SkyWest Airlines 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

(4) Income Taxes (Continued)

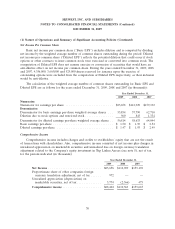

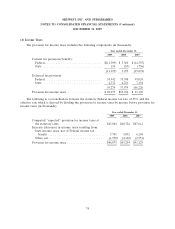

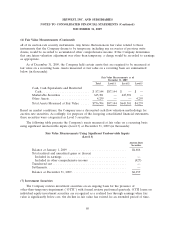

The significant components of the net deferred tax assets and liabilities are as follows (in

thousands):

As of December 31,

2009 2008

Deferred tax assets:

Accrued benefits ............................... $ 22,729 $ 22,423

Net operating loss carryforward .................... 39,368 23,300

AMT credit carryforward ......................... 23,379 30,180

Deferred aircraft credits ......................... 38,283 46,831

Accrued reserves and other ....................... 14,881 14,463

Total deferred tax assets ........................... 138,640 137,197

Deferred tax liabilities:

Accelerated depreciation ......................... (629,586) (568,217)

Maintenance and other .......................... (397) —

Total deferred tax liabilities ......................... (629,983) (568,217)

Net deferred tax liability ........................... $(491,343) $(431,020)

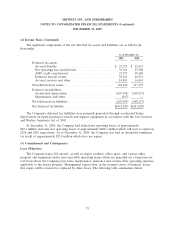

The Company’s deferred tax liabilities were primarily generated through accelerated bonus

depreciation on newly purchased aircraft and support equipment in accordance with the Job Creation

and Worker Assistance Act of 2002.

At December 31, 2009, the Company had federal net operating losses of approximately

$82.1 million and state net operating losses of approximately $408.1 million which will start to expire in

2026 and 2010 respectively. As of December 31, 2009, the Company also had an alternative minimum

tax credit of approximately $23.4 million which does not expire.

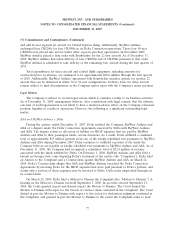

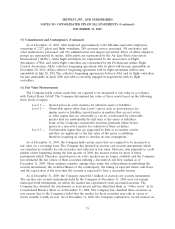

(5) Commitments and Contingencies

Lease Obligations

The Company leases 284 aircraft, as well as airport facilities, office space, and various other

property and equipment under non-cancelable operating leases which are generally on a long-term net

rent basis where the Company pays taxes, maintenance, insurance and certain other operating expenses

applicable to the leased property. Management expects that, in the normal course of business, leases

that expire will be renewed or replaced by other leases. The following table summarizes future

75