SkyWest Airlines 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Airlines and ASA. The Chief Executive and the CFO meet the guidelines. The Presidents of the

operating subsidiaries have been in their positions for only two years, and the Compensation

Committee believes they are making progress towards the ownership guideline each year. The holdings

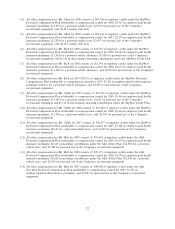

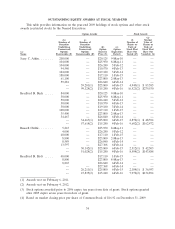

of the Named Executives are summarized in the Security Ownership Table, below.

Deductibility of Executive Compensation

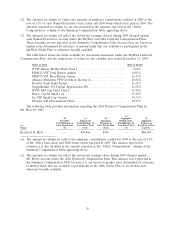

Section 162(m) of the Code imposes a $1 million annual limit on the amount that a publicly-traded

company may deduct for compensation paid to the company’s principal executive officer during a tax

year or to any of the company’s three other most highly compensated executive officers who are still

employed at the end of the tax year (other than the Company’s principal financial officer). The limit

does not apply to compensation that meets the requirements of Section 162(m) of the Code for

‘‘qualified performance-based compensation’’ (i.e., compensation paid only if the executive meets

pre-established, objective goals based upon performance criteria approved by the Company’s

shareholders). The Compensation Committee reviews and considers the deductibility of executive

compensation under Section 162(m) of the Code. In certain situations, the Compensation Committee

may approve compensation that will not meet the requirements of Code Section 162(m) in order to

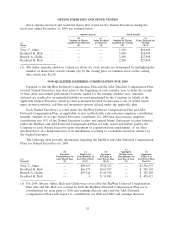

ensure competitive levels of total compensation for its executive officers. Stock option grants and

long-term performance unit awards in 2009 were intended to constitute ‘‘qualified performance-based

compensation’’ under Section 162(m) of the Code. The Company’s 2009 restricted stock grants, and

performance-based and discretionary annual bonuses, however, were not ‘‘qualified performance-based

compensation.’’

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed the foregoing compensation discussion and analysis

and discussed with the Company’s management the information set forth herein. Based on such review

and discussions with management, the Compensation Committee recommended to the Board that the

foregoing compensation discussion and analysis be included in this proxy statement.

The Compensation Committee

Henry J. Eyring, Chair

Margaret S. Billson

Ian M. Cumming

Steven F. Udvar-Hazy

Michael K. Young

30