SkyWest Airlines 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

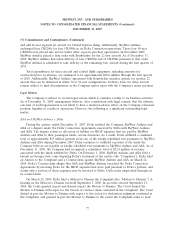

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

Transactions Are Participating Securities) on April 1, 2009. ASC 260 addresses whether instruments

granted in share-based payment transactions are participating securities prior to vesting and, therefore,

need to be included in the earnings allocation in computing earnings per share (EPS) under the

two-class method described. This provision of ASC 260 is effective for financial statements issued for

fiscal years beginning after December 15, 2008, and interim periods within those years. The adoption of

this provision of ASC 260 did not have a material impact on the Company’s consolidated financial

position, results of operations or cash flows.

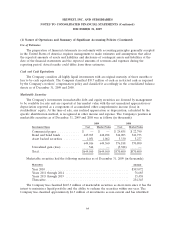

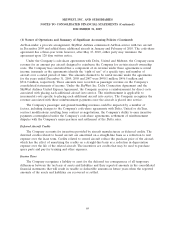

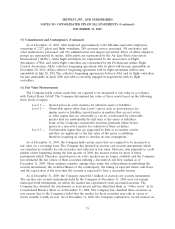

(2) Long-term Debt

Long-term debt consisted of the following as of December 31, 2009 and 2008 (in thousands):

December 31, December 31,

2009 2008

Notes payable to banks, due in semi-annual installments, variable interest

based on LIBOR, or with interest rates ranging from 0.46% to 3.51%

through 2012 to 2020, secured by aircraft ........................ $ 469,663 $ 529,625

Notes payable to a financing company, due in semi-annual installments,

variable interest based on LIBOR, or with interest rates ranging from

0.73% to 7.52% through 2010 to 2021, secured by aircraft ............ 557,293 594,999

Notes payable to banks, due in semi-annual installments plus interest at

6.06% to 7.18% through 2021, secured by aircraft .................. 231,002 248,731

Notes payable to a financing company, due in semi-annual installments plus

interest at 5.78% to 6.23% through 2019, secured by aircraft .......... 67,963 74,455

Notes payable to banks, due in monthly installments plus interest of 3.15%

to 8.18% through 2025, secured by aircraft ....................... 611,829 325,834

Notes payable to banks, due in semi-annual installments, plus interest at

6.05% through 2020, secured by aircraft ......................... 23,939 25,857

Notes payable to banks, due in semi-annual installments, plus interest at

3.72% to 3.86%, net of the benefits of interest rate subsidies through the

Brazilian Export financing program, through 2011, secured by aircraft .... 3,200 5,936

Notes payable to a bank, due in monthly installments interest based on

LIBOR, interest rate at 7.9% secured by building .................. — 6,051

Long-term debt ............................................. $1,964,889 $1,811,488

Less current maturities ....................................... (148,571) (129,783)

Long-term debt, net of current maturities .......................... $1,816,318 $1,681,705

At December 31, 2009, the three-month and six-month LIBOR rates were 0.25% and 0.43%,

respectively.

72