SkyWest Airlines 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.alternatives available to us, and select one or more of these methods to fund the acquisition. In the

event that alternative financing cannot be arranged at the time of delivery, Bombardier has typically

financed our aircraft acquisitions until more permanent arrangements can be made. Subsequent to this

initial acquisition of an aircraft, we may also refinance the aircraft or convert one form of financing to

another (e.g., replacing debt financing with leveraged lease financing).

At present, we intend to satisfy our 2009 firm aircraft purchase commitment, as well as our

acquisition of any additional aircraft, through a combination of operating leases and debt financing,

consistent with our historical practices. Based on current market conditions and discussions with

prospective leasing organizations and financial institutions, we currently believe that we will be able to

obtain financing for our committed acquisitions, as well as additional aircraft, without materially

reducing the amount of working capital available for our operating activities. Nonetheless, recent

disruptions in the credit markets have resulted in greater volatility, decreased liquidity and limited

availability of capital, and there is no assurance that we will be able to obtain necessary funding or that,

if we are able to obtain necessary capital, the corresponding terms will be favorable or acceptable to us.

Aircraft Lease and Facility Obligations

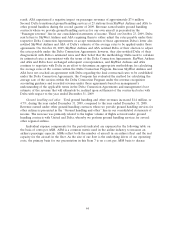

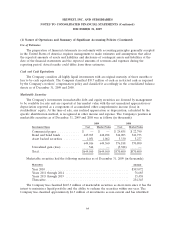

We also have significant long-term lease obligations primarily relating to our aircraft fleet. At

December 31, 2009, we had 284 aircraft under lease with remaining terms ranging from one to

17 years. Future minimum lease payments due under all long-term operating leases were approximately

$2.9 billion at December 31, 2009. Assuming a 5.8% discount rate, which is the average rate used to

approximate the implicit rates within the applicable aircraft leases, the present value of these lease

obligations would have been equal to approximately $2.1 billion at December 31, 2009.

Long-term Debt Obligations

As of December 31, 2009, we had $1,964.9 million of long term debt obligations related to the

acquisition of Brasilia turboprop, CRJ200, CRJ700 and CRJ900 aircraft. The average effective interest

rate on the debt related to the Brasilia turboprop and CRJ aircraft was approximately 4.3% at

December 31, 2009.

Guarantees

We have guaranteed the obligations of SkyWest Airlines under the SkyWest Airlines Delta

Connection Agreement and the obligations of ASA under the ASA Delta Connection Agreement.

New Accounting Standards

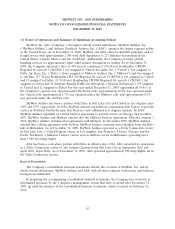

In June 2009, the Financial Accounting Standards Board (‘‘FASB’’) issued Accounting Standards

Codification (‘‘ASC’’) ASC 810 (originally issued as Statement of Financial Accounting Standards

(‘‘SFAS’’) No. 167, Amendments to FASB Interpretation No. 46(R). Among other items, ASC 810

responds to concerns about the application of certain key provisions of FIN 46(R), including those

regarding the transparency of the involvement with variable interest entities. ASC 810 is effective for

calendar year companies beginning on January 1, 2010. We do not believe the adoption of ASC 810 will

have a significant impact on our financial position, results of operations or cash flows.

On September 23, 2009, the FASB ratified Emerging Issues Task Force Issue No. 08-1, Revenue

Arrangements with Multiple Deliverables (‘‘EITF 08-1’’). EITF 08-1 updates the current guidance

pertaining to multiple-element revenue arrangements included in ASC Subtopic 605-25, which

originated primarily from EITF 00-21, also titled Revenue Arrangements with Multiple Deliverables.

EITF 08-1 will be effective for annual reporting periods beginning January 1, 2011 for calendar-year

entities. We are currently evaluating the impact of EITF 08-1 on our financial position, results of

operations and cash flows.

54