SkyWest Airlines 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

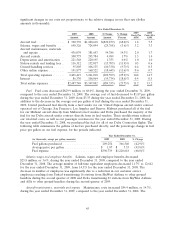

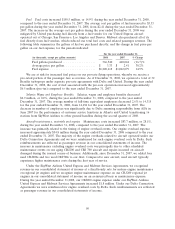

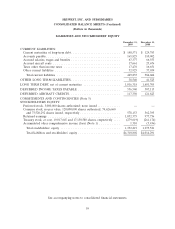

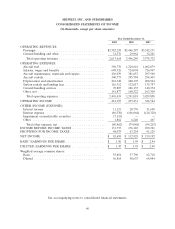

fuel and engine overhaul expenses which are included in our total airline expenses for the periods

indicated (dollar amounts in thousands).

For the year ended December 31,

2008 2007 $ Change % Change

Total airline expense .......................... $3,347,082 $3,156,128 $190,954 6.1%

Less: Fuel expense ........................... 1,220,618 1,062,079 158,539 14.9%

Less: Engine overhaul reimbursement from major

partners ................................. 120,101 67,961 52,140 76.7%

Total airline expense excluding fuel and engine

overhauls ................................ $2,006,363 $2,026,088 $(19,725) (1.0)%

Excluding fuel and engine overhaul costs, our total airline expense decreased $19.7 million, or

1.0%, during the year ended December 31, 2008, compared to the year ended December 31, 2007. The

percentage decrease in total airline expenses excluding fuel and engine overhauls, was less than the

percentage decrease in ASMs, which is primarily due to increases in non-engine overhaul maintenance

expenses attributable to the increased age of our fleet.

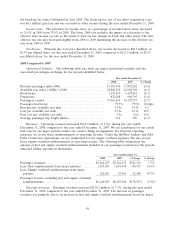

Income taxes. The provision for income taxes, as a percentage of income before taxes, decreased

to 35.9% in 2008 from 36.4% in 2007. The lower 2008 rate includes the impact of a decrease to the

effective state income tax rate as the result of state tax law changes in Utah and other states. The

impact of the decreased effective tax rate was partially offset by the decrease in tax exempt interest

income in 2008 from 2007.

Net Income. Primarily due to the factors described above, net income decreased to $112.9 million,

or $1.93 per diluted share, for the year ended December 31, 2008, compared to $159.2 million, or $2.49

per diluted share, for the year ended December 31, 2007.

Liquidity and Capital Resources

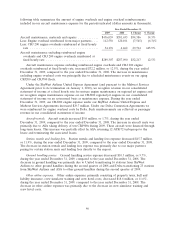

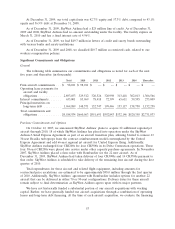

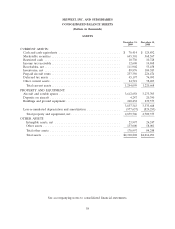

We had working capital of $804.3 million and a current ratio of 2.8:1 at December 31, 2009,

compared to working capital of $834.1 million and a current ratio of 3.2:1 at December 31, 2008. The

decrease was principally attributable to $80.0 million we loaned to United in October 2009. We also

agreed to defer $49.0 million otherwise payable to SkyWest Airlines under the SkyWest Airlines United

Express Agreement, offset by cash generated from operating activities. The principal sources of cash

during the year ended December 31, 2009 were $389.5 million provided by operating activities,

$300.7 million of proceeds from the issuance of long-term debt, $18.7 million from the sale of property

and equipment, $16.1 million from returns on aircraft deposits, $8.8 million from the sale of common

stock in connection with the exercise of stock options under our stock option and employee stock

purchase plans and $0.7 million from repayment of the United note receivable. We invested

$82.1 million in marketable securities, invested $419.0 million in flight equipment, made principal

payments on long-term debt of $147.3 million, repurchased $18.4 million of outstanding shares of our

common stock, invested $2.6 million in buildings and ground equipment, paid $9.1 million in cash

dividends, invested $25.5 million in other assets and issued a note receivable of $80.0 million to United.

These factors resulted in a $49.5 million decrease in cash and cash equivalents during the year ended

December 31, 2009.

Our position in marketable securities, consisting primarily of bonds, bond funds and commercial

paper, increased to $645.3 million at December 31, 2009, compared to $568.6 million at December 31,

2008. The increase in marketable securities was due primarily to cash generated from operations in

2009 that was invested in marketable securities.

52