SkyWest Airlines 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

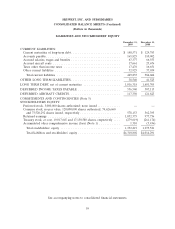

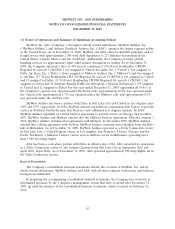

At December 31, 2009, our total capital mix was 42.7% equity and 57.3% debt, compared to 43.1%

equity and 56.9% debt at December 31, 2008.

As of December 31, 2009, SkyWest Airlines had a $25 million line of credit. As of December 31,

2009 and 2008, SkyWest Airlines had no amount outstanding under the facility. The facility expires on

March 31, 2010 and has a fixed interest rate of 4.96%.

As of December 31, 2009, we had $49.7 million in letters of credit and surety bonds outstanding

with various banks and surety institutions.

As of December 31, 2009 and 2008, we classified $10.7 million as restricted cash, related to our

workers compensation policies.

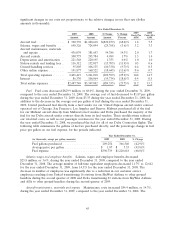

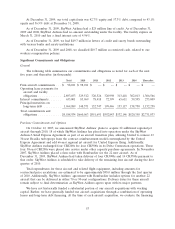

Significant Commitments and Obligations

General

The following table summarizes our commitments and obligations as noted for each of the next

five years and thereafter (in thousands):

Total 2010 2011 2012 2013 2014 Thereafter

Firm aircraft commitments . . . $ 98,011 $ 98,011 $ — $ — $ — $ — $ —

Operating lease payments for

aircraft and facility

obligations ............. 2,893,033 329,512 320,526 320,998 313,418 302,013 1,306,566

Interest commitments ....... 633,001 83,969 78,418 72,399 65,611 59,595 273,009

Principal maturities on

long-term debt .......... 1,964,889 148,571 152,747 199,446 153,117 158,750 1,152,258

Total commitments and

obligations ............. $5,588,934 $660,063 $551,691 $592,843 $532,146 $520,358 $2,731,833

Purchase Commitments and Options

On October 12, 2007, we announced SkyWest Airlines’ plans to acquire 22 additional regional jet

aircraft through 2010, 18 of which SkyWest Airlines has placed into operation under the SkyWest

Airlines United Express Agreement as part of an aircraft transition plan, allowing United to remove 23

30-seat Brasilia turboprops from the contract reimbursement model contemplated by the United

Express Agreement and add 66-seat regional jet aircraft for United Express flying. Additionally,

SkyWest Airlines exchanged four CRJ200s for four CRJ900s in its Delta Connection operations. These

four 50-seat CRJ200s were placed into service under other capacity purchase agreements. In November

2007, SkyWest Airlines placed a firm order with Bombardier for the 22 new aircraft. As of

December 31, 2009, SkyWest Airlines had taken delivery of four CRJ900s and 14 CRJ700s pursuant to

that order. SkyWest Airlines is scheduled to take delivery of the remaining four aircraft during the first

quarter of 2010.

Total expenditures for these aircraft and related flight equipment, including amounts for

contractual price escalations, are estimated to be approximately $98.0 million through the first quarter

of 2010. Additionally, SkyWest Airlines’ agreement with Bombardier includes options for another 22

aircraft that can be delivered in either 70 or 90-seat configurations. Delivery dates for these aircraft

remain subject to final determination as SkyWest Airlines agrees upon with its major partners.

We have not historically funded a substantial portion of our aircraft acquisitions with working

capital. Rather, we have generally funded our aircraft acquisitions through a combination of operating

leases and long-term debt financing. At the time of each aircraft acquisition, we evaluate the financing

53