SkyWest Airlines 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

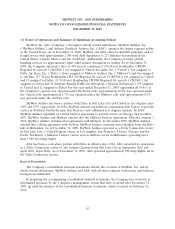

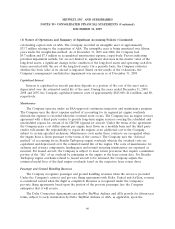

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

them as ‘‘Other assets’’ in the Company’s consolidated balance sheet as of December 31, 2009 (see

Note 6).

Inventories

Inventories include expendable parts, fuel and supplies and are valued at cost (FIFO basis) less an

allowance for obsolescence based on historical results and management’s expectations of future

operations. Expendable inventory parts are charged to expense as used. An obsolescence allowance for

flight equipment expendable parts is accrued based on estimated lives of the corresponding fleet types

and salvage values. The inventory allowance as of December 31, 2009 and 2008 was $6.6 million and

$5.5 million, respectively. These allowances are based on management estimates, which are subject to

change.

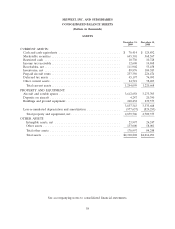

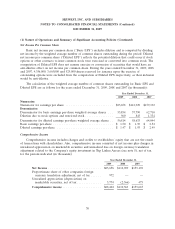

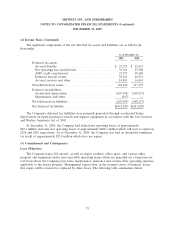

Property and Equipment

Property and equipment are stated at cost and depreciated over their useful lives to their

estimated residual values using the straight-line method as follows:

Depreciable Residual

Assets Life Value

Aircraft and rotable spares ....................... 10 - 18 years 0 - 30%

Ground equipment ............................. 5 - 10 years 0%

Office equipment .............................. 5 - 7 years 0%

Leasehold improvements ......................... 15 years 0%

or life of

the lease

Buildings .................................... 20 - 39.5 years 0%

Change in Accounting Estimates

During the first quarter of 2009, the Company changed its estimate of depreciable lives on ground

equipment from five to seven years to five to ten years and maintained the residual value of zero

percent. The impact of this change increased the Company’s pre-tax income for the year ended

December, 31 2009 by $4.0 million ($.07 per share Basic EPS and Diluted EPS), respectively. The

impact of this change, net of tax, increased the Company’s net income for the year ended

December 31, 2009 by $2.5 million ($.05 per share Basic EPS and $.04 per share Diluted EPS),

respectively.

Impairment of Long Lived and Intangible Assets

As of December 31, 2009, the Company had approximately $2.9 billion of property and equipment

and related assets. Additionally, as of December 31, 2009, the Company had approximately

$24.0 million in intangible assets. In accounting for these long-lived and intangible assets, the Company

makes estimates about the expected useful lives of the assets, the expected residual values of certain of

these assets, and the potential for impairment based on the fair value of the assets and the cash flows

they generate. On September 7, 2005, the Company completed the acquisition of all of the issued and

65