SkyWest Airlines 2009 Annual Report Download - page 73

Download and view the complete annual report

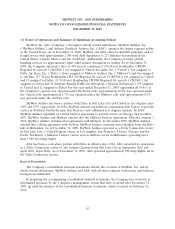

Please find page 73 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

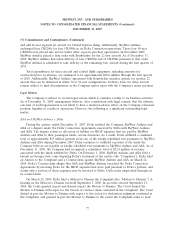

AirTran under a pro-rate arrangement. SkyWest Airlines commenced AirTran service with two aircraft

in December 2009 and added three additional aircraft in January and February of 2010. The code-share

agreement has a three-year term; however, after May 15, 2010, either party may terminate the

agreement upon 120 days written notice.

Under the Company’s code-share agreements with Delta, United and Midwest, the Company earns

revenue for an amount per aircraft designed to reimburse the Company for certain aircraft ownership

costs. The Company has concluded that a component of its revenue under these agreements is rental

income, inasmuch as the agreements identify the ‘‘right of use’’ of a specific type and number of

aircraft over a stated period of time. The amounts deemed to be rental income under the agreements

for the years ended December 31, 2009, 2008 and 2007 were $490.1 million, $496.5 million and

$516.9 million, respectively. These amounts were recorded as passenger revenue on the Company’s

consolidated statements of income. Under the SkyWest Inc. Delta Connection Agreement and the

SkyWest Airlines United Express Agreement, the Company receives a reimbursement for direct costs

associated with placing each additional aircraft into service. The reimbursement is applicable to

incremental costs specific to placing each additional aircraft into service. The Company recognizes the

revenue associated with these reimbursement payments once the aircraft is placed into service.

The Company’s passenger and ground handling revenues could be impacted by a number of

factors, including changes to the Company’s code-share agreements with Delta, United or AirTran,

contract modifications resulting from contract re-negotiations, the Company’s ability to earn incentive

payments contemplated under the Company’s code-share agreements, settlement of reimbursement

disputes with the Company’s major partners and settlement of the Delta rates.

Deferred Aircraft Credits

The Company accounts for incentives provided by aircraft manufacturers as deferred credits. The

deferred credits related to leased aircraft are amortized on a straight-line basis as a reduction to rent

expense over the lease term. Credits related to owned aircraft reduce the purchase price of the aircraft,

which has the effect of amortizing the credits on a straight-line basis as a reduction in depreciation

expense over the life of the related aircraft. The incentives are credits that may be used to purchase

spare parts and pay for training and other expenses.

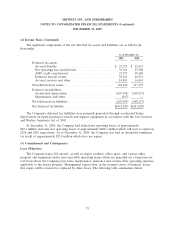

Income Taxes

The Company recognizes a liability or asset for the deferred tax consequences of all temporary

differences between the tax basis of assets and liabilities and their reported amounts in the consolidated

financial statements that will result in taxable or deductible amounts in future years when the reported

amounts of the assets and liabilities are recovered or settled.

69