SkyWest Airlines 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for the five taxable years preceding the year of the change in control (the ‘‘Base Period Amount’’), the

acceleration would result in an excess parachute payment under Code Section 280G. A Named

Executive would be subject to a 20% excise tax on any such excess parachute payment and the

Company would be unable to deduct the amount of the excess parachute payment for tax purposes.

The Company has not agreed to provide its Named Executives with any gross-up or reimbursement for

excise taxes imposed on excess parachute payments.

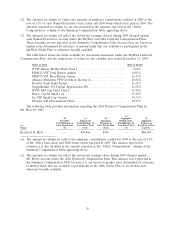

Deferred Compensation. If a Named Executive had terminated employment on December 31,

2009, the Named Executive would have become entitled to receive the balance in his account under the

applicable deferred compensation plan. Distribution would be made in the form of a lump sum or in

installments, and in accordance with the distributions schedule elected by the Named Executive under

the applicable plan. The 2009 year-end account balances under those plans are shown in column (e) in

the applicable Nonqualified Deferred Compensation Tables set forth above. A Named Executive’s

account balance would continue to be credited with notational investment earnings or losses through

the date of actual distribution.

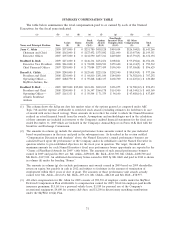

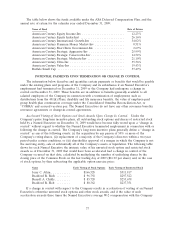

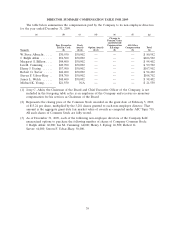

DIRECTOR COMPENSATION

The Company uses a combination of cash and stock based incentive compensation to attract and

retain qualified candidates to serve as directors. In setting director compensation, the Company

considers the significant amount of time that directors expend in fulfilling their duties to the Company,

as well as the skill level required by the Company of its directors. Each director is encouraged to own

at least 5,000 shares of Common Stock.

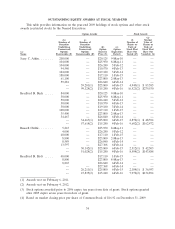

Cash Compensation Paid to Directors

For the year ended December 31, 2009, all directors who were not employees of the Company

received an annual cash retainer of $32,000 and attendance fees of $1,700 for each board meeting,

$1,600 for each Audit & Finance Committee meeting and $1,300 for each Compensation Committee

meeting and each Nominating and Corporate Governance Committee meeting; $850 for each

telephonic board meeting, $800 for each telephonic Audit & Finance Committee meeting and $750 for

each telephonic Compensation Committee meeting and each Nominating and Corporate Governance

Committee meeting. The director serving as the Chairman of the Compensation Committee was paid

an annual fee of $5,000, the Chairman of Nominating and Corporate Governance Committee was paid

an annual fee of $4,000, and the lead director was paid $4,000. The director serving as the Chairman of

the Audit and Finance Committee was paid an annual fee of $15,000. Jerry C. Atkin, Chairman of the

Board and an employee of the Company, received no compensation for his service on the Board.

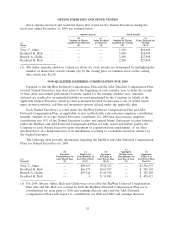

Stock Awards

Each non-employee director receives a stock award annually. On February 5, 2009, each of the

non-employee directors received an award of 3,281 shares of Common Stock. The Company did not

grant stock options to its non-employee directors in 2009.

38