SkyWest Airlines 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

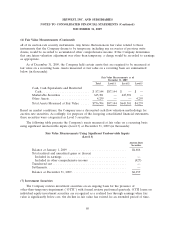

(7) Investment Securities (Continued)

and recovery is not expected in the near term. OTTI losses on individual perpetual preferred securities

are recognized as a realized loss through earnings when a decline in the cash flows has occurred or the

rating of the security has been downgraded below investment grade.

This accounting guidance requires the Company to take into consideration current market

conditions, fair value in relationship to cost, extent and nature of change in fair value, issuer rating

changes and trends, volatility of earnings, current analysts’ evaluations, all available information

relevant to the securities, the Company’s ability and intent to hold investments until a recovery of fair

value, which may be maturity, and other factors when evaluating for the existence of OTTI in the

Company’s securities portfolio.

As a result of an ongoing valuation review of the Company’s marketable securities portfolio, the

Company recognized a pre-tax charge of approximately $7.1 million during the year ended

December 31, 2009 for certain marketable securities deemed to have other-than-temporary impairment.

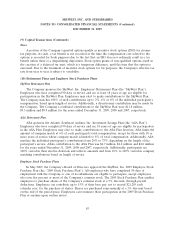

(8) Investment in Other Companies

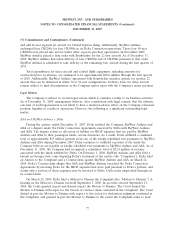

On September 4, 2008, the Company announced its intention to acquire a 20% interest in a

Brazilian regional airline, Trip Linhas Aereas (‘‘Trip’’), for $30 million. As of December 31, 2009, the

Company’s investment balance was $23.4 million for a 16.4% interest in Trip, which is recorded as an

‘‘Other asset’’ on the Company’s consolidated balance sheet. If Trip meets or exceeds certain financial

targets, the Company is scheduled to make another $10 million investment on March 1, 2010. The

Company accounts for its interest in Trip using the equity method of accounting. The Company records

its equity in Trip’s earnings on a one-quarter lag. The Company’s allocated portion of Trip’s earnings

during the year ended December 31, 2009 was $1.8 million.

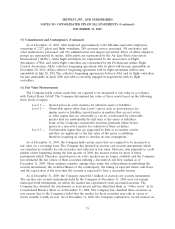

(9) Capital Transactions

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock in one or more series

without shareholder approval. No shares of preferred stock are presently outstanding. The Company’s

Board of Directors is authorized, without any further action by the shareholders of the Company, to

(i) divide the preferred stock into series; (ii) designate each such series; (iii) fix and determine dividend

rights; (iv) determine the price, terms and conditions on which shares of preferred stock may be

redeemed; (v) determine the amount payable to holders of preferred stock in the event of voluntary or

involuntary liquidation; (vi) determine any sinking fund provisions; and (vii) establish any conversion

privileges.

Stock Compensation

Effective January 1, 2001, the Company adopted two stock option plans: the Executive Stock

Incentive Plan (the ‘‘Executive Plan’’) and the 2001 Allshare Stock Option Plan (the ‘‘Allshare Plan’’).

These plans replaced the Company’s Combined Incentive and Non-Statutory Stock Option Plans (the

‘‘Prior Plans’’). There are no additional shares of common stock available for issuance under these

plans. However, as of December 31, 2009, options to purchase approximately 360,000 shares of the

81