SkyWest Airlines 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

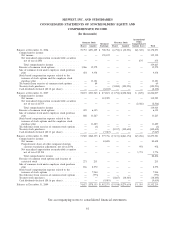

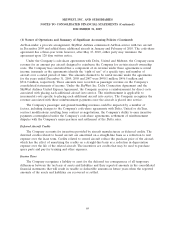

SKYWEST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2009 2008 2007

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income ........................................... $ 83,658 $ 112,929 $ 159,192

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization ............................. 221,548 220,195 208,944

Stock based compensation expense .......................... 7,944 11,489 13,121

Loss (gain) on sale of property and equipment .................. (77) 68 (467)

Undistributed earnings of other companies .................... (1,785) — —

Impairment on marketable securities ........................ 7,115 — —

Net increase in deferred income taxes ........................ 59,350 55,541 106,112

Changes in operating assets and liabilities:

Decrease (increase) in restricted cash ...................... (2) 3,977 1,704

Decrease (increase) in receivables ......................... (56,444) 25,758 (51,785)

Decrease (increase) in income tax receivable ................. 2,260 8,246 (21,295)

Decrease (increase) in inventories ......................... 14,507 1,355 (20,578)

Decrease (increase) in other current assets and prepaid aircraft rents . 10,608 4,437 (145)

Increase (decrease) in deferred aircraft credits ................ (3,658) (5,140) 21,163

Increase (decrease) in accounts payable and accrued aircraft rents . . . 46,908 (23,666) (20,660)

Increase (decrease) in other current liabilities ................. (2,432) 354 710

NET CASH PROVIDED BY OPERATING ACTIVITIES ........... 389,500 415,543 396,016

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of marketable securities .......................... (854,715) (1,305,015) (1,370,189)

Sales of marketable securities ............................. 772,616 1,254,574 1,067,815

Issuance of United Air Lines note receivable ................... (80,000) — —

Payments received on note receivable from United Air Lines ........ 667 — —

Proceeds from the sale of property and equipment ............... 18,662 4,580 11,290

Acquisition of property and equipment:

Aircraft and rotable spare parts .......................... (419,028) (194,189) (298,519)

Deposits on aircraft .................................. — — (32,326)

Buildings and ground equipment .......................... (2,556) (37,627) (37,547)

Increase in other assets ................................ (25,458) (6,559) (2,783)

NET CASH USED IN INVESTING ACTIVITIES ................ (589,812) (284,236) (662,259)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from issuance of long-term debt ..................... 300,716 80,361 177,792

Principal payments on long-term debt ........................ (147,315) (119,823) (110,973)

Return of deposits on aircraft and rotable spare parts ............. 16,143 3,458 11,697

Tax benefit from exercise of common stock options ............... — 9 177

Net proceeds from issuance of common stock .................. 8,787 17,361 28,950

Purchase of treasury stock ................................ (18,445) (102,632) (125,991)

Payment of cash dividends ............................... (9,052) (6,951) (8,061)

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES . . 150,834 (128,217) (26,409)

Increase (decrease) in cash and cash equivalents .................. (49,478) 3,090 (292,652)

Cash and cash equivalents at beginning of year ................... 125,892 122,802 415,454

CASH AND CASH EQUIVALENTS AT END OF YEAR ........... $ 76,414 $ 125,892 $ 122,802

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

Cash paid during the year for:

Interest, net of capitalized amounts ........................ $ 90,572 $ 111,717 $ 112,547

Income taxes ....................................... $ 2,896 $ 23,876 $ 1,420

See accompanying notes to consolidated financial statements.

62