SkyWest Airlines 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

(5) Commitments and Contingencies (Continued)

As of December 31, 2009, ASA employed approximately 3,604 full-time equivalent employees

consisting of 2,227 pilots and flight attendants, 240 customer service personnel, 901 mechanics and

other maintenance personnel, and 236 administration and support personnel. Three of ASA’s employee

groups are represented by unions. ASA’s pilots are represented by the Air Line Pilots Association

International (‘‘ALPA’’), ASA’s flight attendants are represented by the Association of Flight

Attendants—CWA, and ASA’s flight controllers are represented by the Professional Airline Flight

Control Association. ASA’s collective bargaining agreement with its pilots will become amendable on

November 20, 2010. ASA’s collective bargaining agreement with its flight attendants will become

amendable in July 20, 2011.The collective bargaining agreements between ASA and its flight controllers

became amendable in April 2006 and ASA is currently engaged in negotiations with its flight

controllers.

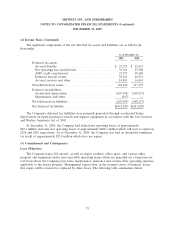

(6) Fair Value Measurements

The Company holds certain assets that are required to be measured at fair value in accordance

with United States GAAP. The Company determined fair value of these assets based on the following

three levels of inputs:

Level 1 — Quoted prices in active markets for identical assets or liabilities.

Level 2 — Observable inputs other than Level 1 prices such as quoted prices for

similar assets or liabilities; quoted prices in markets that are not active;

or other inputs that are observable or can be corroborated by observable

market data for substantially the full term of the assets or liabilities.

Some of the Company’s marketable securities primarily utilize broker

quotes in a non-active market for valuation of these securities.

Level 3 — Unobservable inputs that are supported by little or no market activity

and that are significant to the fair value of the assets or liabilities,

therefore requiring an entity to develop its own assumptions.

As of December 31, 2009, the Company held certain assets that are required to be measured at

fair value on a recurring basis. The Company has invested in auction rate security instruments, which

are classified as available for sale securities and reflected at fair value. However, due primarily to credit

market events beginning during the first quarter of 2008, the auction events for most of these

instruments failed. Therefore, quoted prices in active markets are no longer available and the Company

has estimated the fair values of these securities utilizing a discounted cash flow analysis as of

December 31, 2009. These analyses consider, among other items, the collateralization underlying the

security investments, the creditworthiness of the counterparty, the timing of expected future cash flows,

and the expectation of the next time the security is expected to have a successful auction.

As of December 31, 2009, the Company owned $4.3 million of auction rate security instruments.

The auction rate security instruments held by the Company at December 31, 2009 were tax-exempt

municipal bond investments, for which the market has experienced some successful auctions. The

Company has classified the investments as non-current and has identified them as ‘‘Other assets’’ in its

Consolidated Balance Sheet as of December 31, 2009. The Company has classified these securities as

non current due to the Company’s belief that the market for these securities may take in excess of

twelve months to fully recover. As of December 31, 2009, the Company continued to record interest on

79