Sears 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

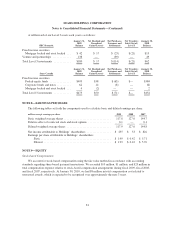

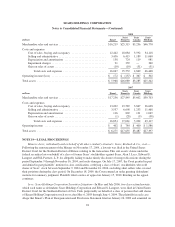

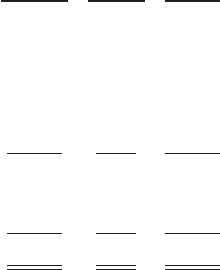

Changes in the carrying amount of goodwill by segment during fiscal years 2008 and 2009 are as follows:

millions

Sears

Domestic

Sears

Canada Total

Balance, February 2, 2008:

Goodwill ....................................................... $1,428 $258 $1,686

Fiscal 2008 changes:

Acquisition of additional interest in Sears Canada ....................... — 12 12

Impairment charges ............................................... (262) — (262)

Tax adjustments affecting Merger-related goodwill ...................... (69) 25 (44)

Balance, January 31, 2009 and January 30, 2010:

Goodwill ....................................................... 1,359 295 1,654

Accumulated impairment charges .................................... (262) — (262)

$1,097 $295 $1,392

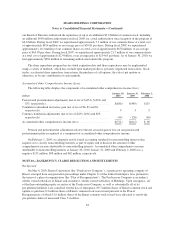

In accordance with accounting standards for goodwill and other intangible assets, goodwill is not amortized

but requires testing for potential impairment, at a minimum on an annual basis, or when indications of potential

impairment exist. The impairment test for goodwill utilizes a fair value approach. The impairment test for

identifiable intangible assets not subject to amortization is also performed annually or when impairment

indications exist, and consist of a comparison of the fair value of the intangible asset with its carrying amount.

Identifiable intangible assets that are subject to amortization are evaluated for impairment using a process similar

to that used to evaluate other long-lived assets. Our annual impairment analysis is performed as of the last day of

our November accounting period each year. See Note 14 for further information regarding our impairment

charges recorded in fiscal 2008.

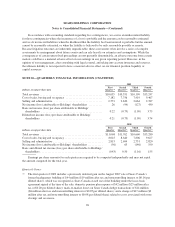

NOTE 14—STORE CLOSINGS AND IMPAIRMENTS

Store Closings and Severance

We made the decision to close 62 underperforming stores during fiscal 2009 and 46 underperforming stores

in fiscal 2008. The store closures included closures within both of our Kmart and Sears Domestic segments. We

recorded charges related to these store closings of $131 million and $77 million in fiscal 2009 and 2008,

respectively. The charges include $37 million and $36 million in 2009 and 2008, respectively, recorded in cost of

sales for margin related expenses, $82 million and $41 million in 2009 and 2008, respectively, recorded in selling

and administrative expenses for store closing and severance costs, and $12 million recorded in 2009 related to

accelerated depreciation on assets in stores we decided to close.

In accordance with accounting standards governing costs associated with exit or disposal activities,

expenses related to future rent payments for which we no longer intend to receive any economic benefit are

accrued for when we cease to use the leased space. We expect to record an additional charge of approximately $7

million during the first half of 2010 related to stores we announced would close in 2009.

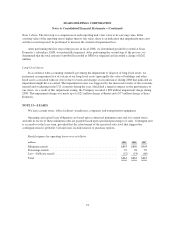

Goodwill

We perform our annual goodwill and intangible impairment test required under accounting standards during

the fourth quarter of each fiscal year, or when an indication of potential impairment exists. The goodwill

impairment test involves a two-step process as described in the “Summary of Significant Accounting Policies” in

90