Sears 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

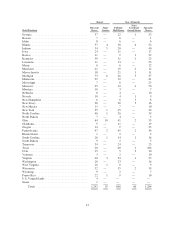

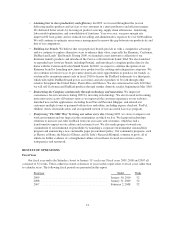

Holdings’ Consolidated Results

Holdings’ consolidated results of operations for fiscal 2009, 2008, and 2007 are summarized as follows:

millions, except per share data 2009 2008 2007(1)

REVENUES

Merchandise sales and services ........................................ $44,043 $46,770 $50,703

COSTS AND EXPENSES

Cost of sales, buying and occupancy .................................... 31,824 34,118 36,638

Gross margin dollars ................................................ 12,219 12,652 14,065

Gross margin rate .................................................. 27.7% 27.1% 27.7%

Selling and administrative ............................................ 10,654 11,060 11,468

Selling and administrative expense as a percentage of total revenues .......... 24.2% 23.6% 22.6%

Depreciation and amortization ......................................... 926 981 1,049

Impairment charges ................................................. — 360 —

Gain on sales of assets ............................................... (74) (51) (38)

Total costs and expenses ......................................... 43,330 46,468 49,117

Operating income ................................................... 713 302 1,586

Interest expense .................................................... (265) (272) (286)

Interest and investment income ........................................ 33 46 135

Other income (loss) ................................................. (61) 108 17

Income before income taxes ........................................... 420 184 1,452

Income taxes ....................................................... (123) (85) (550)

Net income ........................................................ 297 99 902

Income attributable to noncontrolling interests ............................ (62) (46) (76)

NET INCOME ATTRIBUTABLE TO HOLDINGS’ SHAREHOLDERS . . . $ 235 $ 53 $ 826

EARNINGS PER COMMON SHARE ATTRIBUTABLE TO HOLDINGS’

SHAREHOLDERS

Diluted earnings per share ............................................ $ 1.99 $ 0.42 $ 5.70

Diluted weighted average common shares outstanding ...................... 117.9 127.0 144.8

(1) During the fourth quarter of 2007, Sears Canada changed its fiscal year end from the Saturday nearest

December 31st to the Saturday nearest January 31st.

References to comparable store sales amounts within the following discussion include sales for all stores

operating for a period of at least 12 full months, including remodeled and expanded stores, but excluding store

relocations and stores that have undergone format changes. Comparable store sales results for fiscal 2009 were

calculated based on the 52-week period ended January 30, 2010.

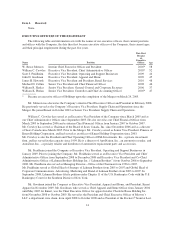

Fiscal 2009 Compared to Fiscal 2008

Net Income Attributable to Holdings’ Shareholders

We recorded net income attributable to Holdings’ shareholders of $235 million ($1.99 per diluted share) for

fiscal 2009 and $53 million ($0.42 per diluted share) in fiscal 2008. Our results for fiscal 2009 and 2008 were

affected by a number of significant items. Our net income, as adjusted for these significant items was $376

million ($3.19 per diluted share) for fiscal 2009 and $215 million ($1.69 per diluted share) for fiscal 2008. The

increase in net income for the year reflects an increase in operating income of $411 million, primarily due to a

decline in selling and administrative expenses and the below noted significant items, partially offset by a decline

in gross margin dollars.

22