Sears 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impairment test involves a two-step process as described in the “Summary of Significant Accounting Policies” in

Note 1 below. The first step is a comparison of each reporting unit’s fair value to its carrying value. If the

carrying value of the reporting unit is higher than its fair value, there is an indication that impairment may exist

and the second step must be performed to measure the amount of impairment loss. As a result of impairment

analysis, we determined that the entire amount of goodwill recorded at Sears Domestic’s subsidiary, OSH, was

impaired and recorded a charge of $262 million. See Note 14 to the Consolidated Financial Statements for further

information regarding impairment charges.

Operating Income (Loss)

Sears Domestic recorded an operating loss of $237 million in fiscal 2008 and operating income of $784

million in fiscal 2007, a decline of $1.0 billion. In addition to the significant items noted above, the decline in

operating income primarily reflects lower total gross margin dollars generated as a result of lower overall sales

levels and a decline in gross margin rate, partially offset by a reduction in selling and administrative expenses.

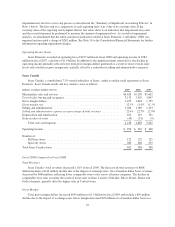

Sears Canada

Sears Canada, a consolidated, 73%-owned subsidiary of Sears, conducts similar retail operations as Sears

Domestic. Sears Canada results and key statistics were as follows:

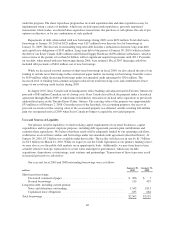

millions, except for number of stores 2009 2008 2007

Merchandise sales and services ........................................... $4,628 $5,236 $5,602

Cost of sales, buying and occupancy ....................................... 3,133 3,592 3,847

Gross margin dollars ................................................... 1,495 1,644 1,755

Gross margin rate ..................................................... 32.3% 31.4% 31.3%

Selling and administrative ............................................... 1,048 1,189 1,233

Selling and administrative expense as a percentage of total revenues ............. 22.6% 22.7% 22.0%

Depreciation and amortization ............................................ 102 119 131

Gain on sales of assets .................................................. (45) (31) (9)

Total costs and expenses ............................................ 4,238 4,869 5,202

Operating income ...................................................... $ 390 $ 367 $ 400

Number of:

Full-line stores .................................................... 122 122 121

Specialty stores .................................................... 280 266 259

Total Sears Canada stores ............................................... 402 388 380

Fiscal 2009 Compared to Fiscal 2008

Total Revenues

Sears Canada’s total revenues decreased 11.6% in fiscal 2009. The decrease in total revenues of $608

million includes a $142 million decline due to the impact of exchange rates. On a Canadian dollar basis, revenues

decreased by $466 million, reflecting lower comparable stores sales across all major categories. The decline in

comparable store sales is mainly the result of lower sales in Sears Canada’s Full-line, Direct, Home, Dealer and

Outlet channels, partially offset by higher sales in Corbeil stores.

Gross Margin

Total gross margin dollars decreased $149 million to $1.5 billion for fiscal 2009 and include a $50 million

decline due to the impact of exchange rates. Gross margin decreased $99 million on a Canadian dollar basis as a

35