Sears 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our culture is owner-oriented, because we have owners who serve on the board that governs our Company.

Because of this ownership, we are able to take a long-term perspective when evaluating strategic, operational and

financial decisions.

Consistent with our approach since the Merger, we have chosen to invest primarily in areas of our business

that we believe will yield long-term growth and attractive returns. These areas include our online businesses, our

service businesses, our Kenmore, Craftsman, DieHard and Lands’ End brands, and some of our alternative

formats like Hometown Stores and Outlet Stores. We will continue to experiment and explore ways to materially

improve our Kmart and Sears Full-Line store experience and competitiveness. As we look ahead to fiscal 2010,

we expect our strategy to deliver improved customer experiences and better financial performance by focusing

on innovation in our products and services, increasing the strength of our customer relationships and developing

our many talented associates and leaders.

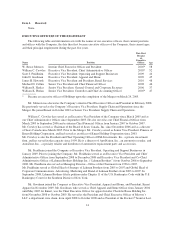

Bankruptcy of Kmart Corporation

Kmart Corporation (the “Predecessor Company”) is a predecessor operating company of Kmart (the

“Successor Company”). In January 2002, the Predecessor Company and 37 of its U.S. subsidiaries (collectively,

the “Debtors”) filed voluntary petitions for reorganization under Chapter 11 of the federal bankruptcy laws

(“Chapter 11”). On May 6, 2003, the Predecessor Company emerged from reorganization proceedings under

Chapter 11 pursuant to the terms of an Amended Joint Plan of Reorganization (the “Plan of Reorganization”) and

related amended Disclosure Statement. This Plan received formal endorsement of the statutory creditors’

committee and, as modified, was confirmed by the U.S. Bankruptcy Court in April 2003. The Predecessor

Company is presently an indirect wholly owned subsidiary of Holdings. During the third quarter of 2008, we

completed the settlement of substantially all of the claims associated with the discharge of the Predecessor

Company’s liabilities subject to compromise pursuant to the Plan of Reorganization. See Note 10 of Notes to

Consolidated Financial Statements for further explanation of the bankruptcy and claims resolution process.

Acquisition of Noncontrolling Interest in Sears Canada

During fiscal 2009, we increased our controlling interest in Sears Canada by acquiring approximately

0.5 million common shares in open market transactions. The Company paid a total of $7 million for the

additional shares and accounted for the acquisition of additional interest in Sears Canada as an equity transaction

in accordance with a newly issued accounting standard on noncontrolling interests (see Note 1 to the

consolidated financial statements for further information on this new standard). Acquisition of the additional

interest in Sears Canada was not material to our financial position. Our majority interest in Sears Canada remains

at 73%.

During fiscal 2008, the Company increased its majority interest in Sears Canada from 70% to 73% by

acquiring approximately 2.6 million common shares in open market transactions. The Company paid a total of

$37 million for the additional shares acquired and accounted for the acquisition of additional interest in Sears

Canada as a purchase business combination under accounting rules in place at that time. The acquisition of the

additional interest in Sears Canada during fiscal 2008 was not material to our operations or financial position.

Real Estate Transactions

In the normal course of business, we consider opportunities to purchase leased operating properties, as well

as offers to sell owned, or assign leased, operating and non-operating properties. These transactions may,

individually or in the aggregate, result in material proceeds or outlays of cash. In addition, we review leases that

will expire in the short term in order to determine the appropriate action to take with respect to them.

Further information concerning our real estate transactions is contained in Note 12 of Notes to Consolidated

Financial Statements.

5