Sears 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

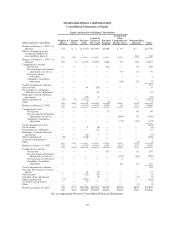

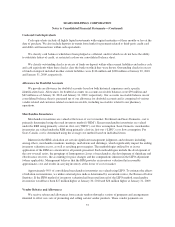

SEARS HOLDINGS CORPORATION

Consolidated Statements of Cash Flows

millions 2009 2008 2007

CASH FLOWS FROM OPERATING ACTIVITIES

Net income .......................................................... $ 297 $ 99 $ 902

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ....................................... 926 981 1,049

Impairment charges ................................................ — 360 —

Curtailment gain on Sears Canada’s post-retirement benefit plans ........... — — (27)

Loss on total return swaps, net ....................................... — — 14

Gain on sales of assets ............................................. (74) (51) (38)

Gain on sale of investments ......................................... — — (2)

Pension and post-retirement plan contributions .......................... (209) (286) (277)

Settlement of Canadian dollar hedges ................................. — (64) (12)

Change in operating assets and liabilities (net of acquisitions and dispositions):

Deferred income taxes ......................................... 90 (385) (84)

Merchandise inventories ........................................ 188 1,003 66

Merchandise payables .......................................... 272 (389) 93

Income and other taxes ......................................... 101 (173) (541)

Mark-to-market asset on Sears Canada U.S. dollar option contracts ...... 65 (74) —

Other operating assets .......................................... 48 207 35

Other operating liabilities ....................................... (197) (236) 369

Net cash provided by operating activities ............................... 1,507 992 1,547

CASH FLOWS FROM INVESTING ACTIVITIES

Acquisitions of businesses, net of cash acquired ......................... — (37) —

Proceeds from sales of property and investments ......................... 23 86 95

Net decrease (increase) in investments and restricted cash ................. 166 (189) (30)

Purchases of property and equipment .................................. (361) (497) (570)

Cash settlements and change in collateral on total return swaps, net .......... — — 68

Net cash used in investing activities ................................... (172) (637) (437)

CASH FLOWS FROM FINANCING ACTIVITIES

Stock issued under executive compensation plans ........................ 13 — —

Proceeds from debt issuances ........................................ — 17 3

Repayments of long-term debt ....................................... (335) (262) (672)

Increase (decrease) in short-term borrowings, primarily 90 days or less ....... (117) 280 68

Proceeds from sale leaseback transaction ............................... — — 88

Debt issuance costs ................................................ (81) — —

Additional purchase of noncontrolling interest .......................... (7) — —

Purchase of treasury stock .......................................... (424) (678) (2,926)

Net cash used in financing activities ................................... (951) (643) (3,439)

Effect of exchange rate changes on cash and cash equivalents .................. 132 (161) 112

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS ........ 516 (449) (2,217)

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR .............. 1,173 1,622 3,839

CASH AND CASH EQUIVALENTS, END OF YEAR ..................... $1,689 $1,173 $ 1,622

SUPPLEMENTAL DISCLOSURE ABOUT NON-CASH INVESTING AND

FINANCING ACTIVITIES:

Bankruptcy related settlements resulting in the receipt of treasury stock .......... $ — $ 12 $ 29

Capital lease obligation incurred ......................................... 7 12 66

Supplemental Cash Flow Data:

Income taxes paid, net of refunds ..................................... (70) 107 372

Cash interest paid ................................................. 185 207 243

See accompanying Notes to Consolidated Financial Statements.

54