Sears 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

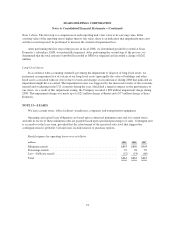

NOTE 11—INCOME TAXES

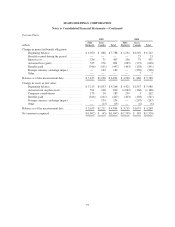

millions 2009 2008 2007

Income (loss) before income taxes

U.S. .................................................................. $ (38) $ (407) $ 953

Foreign ............................................................... 458 591 499

Total ............................................................. $420 $ 184 $1,452

Income tax expense (benefit)

Current:

Federal ........................................................... $(179) $ (70) $ 76

State and local ...................................................... 18 32 43

Foreign ........................................................... 141 199 98

Total ................................................................. (20) 161 217

Deferred:

Federal ........................................................... 124 (60) 253

State and local ...................................................... 21 (11) 2

Foreign ........................................................... (2) (5) 78

143 (76) 333

Total ................................................................. $123 $ 85 $ 550

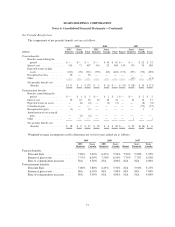

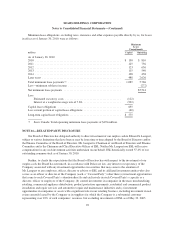

2009 2008 2007

Effective tax rate reconciliation

Federal income tax rate .................................................. 35.0% 35.0% 35.0%

State and local taxes net of federal tax benefit ................................. 6.0 7.2 2.0

Tax credits ............................................................ (3.0) (6.3) (0.4)

Resolution of income tax matters ........................................... (6.2) (6.8) 0.5

Basis difference in domestic subsidiary ...................................... — (30.2) 0.3

Canadian rate differential on noncontrolling interest ............................ (0.9) (2.3) —

Nondeductible goodwill .................................................. — 50.0 —

Other ................................................................. (1.6) (0.4) 0.5

29.3% 46.2% 37.9%

85