Sears 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

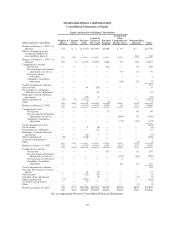

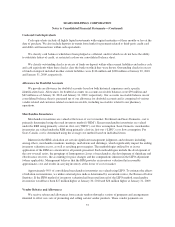

SEARS HOLDINGS CORPORATION

Consolidated Statements of Equity

Equity Attributable to Holdings’ Shareholders

dollars and shares in millions

Number of

Shares

Common

Stock

Treasury

Stock

Capital in

Excess of

Par Value

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Noncontrolling

Interests Total

Balance at February 3, 2007—as

reported .................... 154 $ 2 $(1,437) $10,393 $3,689 $ 59 $— $12,706

Effects of adoption of new

accounting standard for

noncontrolling interests ........ — — — — — — 166 166

Balance at February 3, 2007—as

adjusted .................... 154 2 (1,437) 10,393 3,689 59 166 12,872

Comprehensive income

Net income ............... — — — — 826 — 76 902

Pension and postretirement

adjustments, net of tax ..... — — — — — 53 23 76

Deferred gain on

derivatives .............. — — — — — 1 — 1

Cumulative translation

adjustment .............. — — — — — (44) 42 (2)

Total Comprehensive Income ..... 977

Stock awards .................. — — 54 (30) — — — 24

Pre-petition tax settlements/

valuation reserve adjustments . . . — — — 52 — — — 52

Bankruptcy related settlement

agreements .................. — — (29) 4 — — — (25)

Shares repurchased ............. (22) (1) (2,921) — — — — (2,922)

Other ........................ — — 2 — (6) — 6 2

Balance at February 2, 2008 ...... 132 1 (4,331) 10,419 4,509 69 313 10,980

Comprehensive loss

Net income ............... — — — — 53 — 46 99

Pension and postretirement

adjustments, net of tax ..... — — — — — (604) 59 (545)

Cumulative translation

adjustment .............. — — — — — (77) (95) (172)

Total Comprehensive Loss ....... (618)

Stock awards .................. — — 2 (8) — — — (6)

Pre-petition tax settlements ....... — — — 23 — — — 23

Bankruptcy related settlement

agreements .................. — — (12) 7 — — — (5)

Shares repurchased ............. (10) — (678) — — — — (678)

Associate stock purchase ......... — — 7 — — — — 7

Other ........................ — — — — — — (4) (4)

Balance at January 31, 2009 ...... 122 1 (5,012) 10,441 4,562 (612) 319 9,699

Comprehensive income

Net income ............... — — — — 235 — 62 297

Pension and postretirement

adjustments, net of tax ..... — — — — — (197) (62) (259)

Deferred gain on derivative . . . — — — — — 6 — 6

Cumulative translation

adjustment .............. — — — — — 82 28 110

Total Comprehensive Income .... 154

Proceeds from exercise of stock

options ..................... — — 16 (3) — — — 13

Stock awards .................. — — (32) 29 — — — (3)

Canadian shares purchased ....... — — — (2) — — (5) (7)

Shares repurchased ............. (7) (424) — — — — (424)

Associate stock purchase ......... — — 6 — — — — 6

Other ........................ — — — — — — (3) (3)

Balance at January 30, 2010 ...... 115 $ 1 $(5,446) $10,465 $4,797 $(721) $339 $ 9,435

See accompanying Notes to Consolidated Financial Statements.

55