Sears 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

under the program. The share repurchase program has no stated expiration date and share repurchases may be

implemented using a variety of methods, which may include open market purchases, privately negotiated

transactions, block trades, accelerated share repurchase transactions, the purchase of call options, the sale of put

options or otherwise, or by any combination of such methods.

Repayments of debt, when netted with new borrowings during 2009, were $452 million. Total short-term

borrowings at January 30, 2010 of $325 million were $117 million lower than our level of borrowings at

January 31, 2009. The decrease in outstanding long-term debt includes a reduction in domestic long-term debt

and capital lease obligations of $333 million. Long-term debt of the parent at January 30, 2010 (which excludes

the debt of our Sears Canada ($281 million) and Orchard Supply Hardware ($296 million) subsidiaries, which is

non-recourse to the parent) is less than $1 billion, with no significant required repayments until 2011. Payments

on our debt, when netted with new borrowings during 2008, were nominal. Fiscal 2007 financing cash flows

included debt payments of $601 million, net of new borrowings.

While we decreased our total amount of short-term borrowings in fiscal 2009, we also altered the mix of our

funding to include more borrowings in the commercial paper market, increasing our borrowings from this source

by $199 million, while decreasing borrowings under our amended credit agreement by $316 million. The

increased level of funding from commercial paper reduced our total borrowing costs and contributed to lower

usage of our revolving credit facility during 2009.

In August 2007, Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario for

proceeds of $81 million Canadian, net of closing costs. Sears Canada leased back the property under a leaseback

agreement through March 2009, at which time it finished its relocation of all head office operations to previously

underutilized space in the Toronto Eaton Centre, Ontario. The carrying value of the property was approximately

$35 million as of February 2, 2008. Given the terms of the leaseback, for accounting purposes, the excess of

proceeds received over the carrying value of the associated property was deferred, and the resulting $44 million

gain was recognized in fiscal 2009 when Sears Canada no longer occupied the associated property.

Uses and Sources of Liquidity

Our primary need for liquidity is to fund working capital requirements of our retail businesses, capital

expenditures and for general corporate purposes, including debt repayment, pension plan contributions and

common share repurchases. We believe that these needs will be adequately funded by our operating cash flows,

credit terms received from vendors and borrowings under our amended credit agreement (described below). At

January 30, 2010, $3.3 billion was available under this facility. The facility will decrease in size by $1.7 billion

(to $2.4 billion) on March 24, 2010. While we expect to use the Credit Agreement as our primary funding source,

we may also access the public debt markets on an opportunistic basis. Additionally, we may from time to time

consider selective strategic transactions to create value and improve performance, which may include

acquisitions, dispositions, restructurings, joint ventures and partnerships. Transactions of these types may result

in material proceeds or cash outlays.

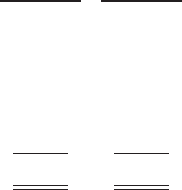

Our year end fiscal 2009 and 2008 outstanding borrowings were as follows:

millions

January 30,

2010

January 31,

2009

Short-term borrowings:

Unsecured commercial paper ........................................... $ 206 $ 7

Secured borrowings .................................................. 119 435

Long-term debt, including current portion:

Notes and debentures outstanding ....................................... 1,545 1,813

Capitalized lease obligations ........................................... 635 664

Total borrowings ......................................................... $2,505 $2,919

40