Sears 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Impairment Charges

Kmart recorded an impairment charge of $20 million during the third quarter of fiscal 2008 in connection

with impairment testing performed in accordance with accounting standards governing the impairment or

disposal of long-lived assets. We recorded an additional impairment of $1 million during the fourth quarter of

2008 related to our decision to close additional Kmart stores in January 2009. See Note 14 to the Consolidated

Financial Statements for further information regarding impairment charges.

Operating Income

Operating income was $172 million in fiscal year 2008 and $402 million in fiscal 2007, a decline of $230

million. As discussed above, declines primarily reflect the negative gross margin impact of lower sales levels, as

well as a slight decline in Kmart’s gross margin rate in 2008. In addition to the above-noted decline in gross

margin, the decline in operating income reflects, to a lesser degree, the impact of $48 million of charges recorded

in connection with fixed asset impairments, store closings and severance in 2008.

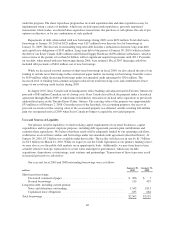

Sears Domestic

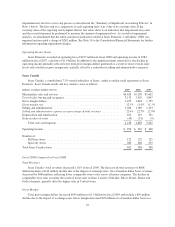

Sears Domestic results and key statistics were as follows:

millions, except for number of stores 2009 2008 2007

Merchandise sales and services ........................................ $23,672 $25,315 $27,845

Cost of sales, buying and occupancy .................................... 16,653 18,084 19,589

Gross margin dollars ................................................ 7,019 7,231 8,256

Gross margin rate .................................................. 29.7% 28.6% 29.6%

Selling and administrative ............................................ 6,220 6,415 6,698

Selling and administrative expense as a percentage of total revenues .......... 26.3% 25.3% 24.1%

Depreciation and amortization ......................................... 672 724 802

Impairment charges ................................................. — 339 —

Gain on sales of assets ............................................... (6) (10) (28)

Total costs and expenses ......................................... 23,539 25,552 27,061

Operating income (loss) .............................................. $ 133 $ (237) $ 784

Number of:

Full-line stores(1) ................................................ 908 929 935

Specialty stores ................................................. 1,284 1,233 1,150

Total Domestic Sears stores ........................................... 2,192 2,162 2,085

(1) Fiscal 2009 includes 848 full-line stores and 60 Sears Essentials/Grand stores; Fiscal 2008 includes 856 full-

line stores and 73 Sears Essentials/Grand stores; Fiscal 2007 includes 860 full-line stores and 75 Sears

Essentials/Grand stores

Fiscal 2009 Compared to Fiscal 2008

Total Revenues and Comparable Store Sales

Sears Domestic’s comparable store sales and total sales declined 8.7% and 6.5%, respectively, during fiscal

2009. The decline in total revenues primarily reflects the impact of lower comparable store sales and includes the

impact of having 21 fewer full-line stores in operation. Comparable store sales declines were driven by decreases

in the home appliance, lawn & garden, and home electronics categories.

32