Sears 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

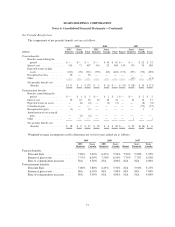

Notes to Consolidated Financial Statements—(Continued)

Wholly owned Insurance Subsidiary and Inter-company Notes

As noted in Note 1, we have numerous types of insurable risks, including workers’ compensation, product

and general liability, automobile, warranty, and asbestos and environmental claims. Also, as discussed in Note 1,

we sell extended service contracts to our customers. The associated risks are managed through our wholly owned

insurance subsidiary. In accordance with applicable insurance regulations, the insurance subsidiary holds

investment grade securities to support the insurance coverage it provides.

We have transferred certain domestic real estate and intellectual property (i.e. trademarks) into separate

wholly owned, bankruptcy remote subsidiaries. These bankruptcy remote subsidiaries lease the real estate

property to Sears and license the use of the trademarks to Sears and Kmart. Further, the bankruptcy remote

subsidiaries have issued asset-backed notes that are collateralized by the aforementioned real estate rental

streams and intellectual property licensing fee streams. Cash flows received from rental streams and licensing fee

streams paid by Sears, Kmart and, potentially in the future, other affiliates or third parties, will be used for the

payment of fees, interest and principal on the asset-backed notes issued. Since the inception of these subsidiaries,

the debt securities have been entirely held by our wholly owned consolidated subsidiaries in support of our

insurance activities. At January 30, 2010 and January 31, 2009, the net book value of the securitized intellectual

property assets was approximately $1.0 billion. The net book value of the securitized real estate assets was

approximately $0.9 billion at January 30, 2010 and January 31, 2009.

NOTE 4—DERIVATIVE FINANCIAL INSTRUMENTS AND FINANCIAL GUARANTEES

Sears Canada Hedges of Merchandise Purchases

Sears Canada had entered into foreign currency option contracts with a total notional value of $299 million

and $457 million as of January 30, 2010 and January 31, 2009, respectively. As discussed previously, these

option contracts are used to hedge Sears Canada’s purchase of inventory under U.S. dollar denominated

contracts. We record mark-to-market adjustments based on the total notional value of these outstanding option

contracts at the end of each period. We recorded mark-to-market assets related to the foreign currency option

contracts of $9 million at January 30, 2010 and $74 million at January 31, 2009.

We record the earnings impact of mark-to-market and settlement adjustments for foreign currency option

contracts in other income (loss) at the end of each period. We recorded mark-to-market and settlement losses on

these contracts of $77 million and mark-to-market gains of $87 million in other income (loss) for fiscal years

ended January 30, 2010 and January 31, 2009, respectively.

Sears Canada’s above noted foreign currency options contracts were entered into as a hedge of merchandise

purchase contracts denominated in U.S. currency. We also record mark-to-market adjustments for the value of

the merchandise purchase contracts (considered to be embedded derivatives under relevant accounting rules) at

the end of each period. These embedded derivates had a zero fair value as of January 30, 2010. We recorded a

liability of $6 million at January 31, 2009 related to the fair value of these embedded derivatives.

We record the earnings impact of mark-to-market and settlement adjustments related to the embedded

derivative in the merchandise purchase contracts in other income (loss) at the end of each period. We recorded

mark-to-market and settlement gains of $10 million for the fiscal year ended January 30, 2010 and

mark-to-market losses of $6 million for the fiscal year ended January 31, 2009.

At January 30, 2010, we had total derivative mark-to-market assets related to the option contracts and

embedded derivatives of $9 million. We recorded total mark-to-market losses and settlements of $67 million in

69