Sears 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

ÈAnnual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended January 30, 2010

or

‘Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission file number 000-51217

SEARS HOLDINGS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Delaware 20-1920798

(State of Incorporation) (I.R.S. Employer Identification No.)

3333 Beverly Road, Hoffman Estates, Illinois 60179

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (847) 286-2500

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of Each Exchange on Which Registered

Common Shares, par value $0.01 per share The NASDAQ Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ÈNo ‘

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘No È

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past

90 days. Yes ÈNo ‘

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit and post such files). Yes ‘No ‘

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained

herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. ‘

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

Large accelerated filer ÈAccelerated filer ‘Non-accelerated filer ‘Smaller reporting company ‘

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ‘No È

On February 27, 2010, the Registrant had 114,834,071 common shares outstanding. The aggregate market value (based on the closing price

of the Registrant’s common shares for stocks quoted on the NASDAQ Global Select Market) of the Registrant’s common shares owned by

non-affiliates (which are assumed, solely for the purpose of this calculation, to be stockholders other than (i) directors and executive

officers of the Registrant and (ii) any person known by the Registrant to beneficially own five percent or more of the Registrant’s common

shares), as of August 1, 2009, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately

$1.8 billion.

Documents Incorporated By Reference

Part III of this Form 10-K incorporates by reference certain information from the Registrant’s definitive proxy statement relating to our

Annual Meeting of Stockholders to be held on May 4, 2010 (the “2010 Proxy Statement”), which will be filed with the Securities and

Exchange Commission within 120 days after the end of the fiscal year to which this Form 10-K relates.

Table of contents

-

Page 1

... file number 000-51217 SEARS HOLDINGS CORPORATION (Exact Name of Registrant as Specified in Its Charter) Delaware (State of Incorporation) 20-1920798 (I.R.S. Employer Identification No.) 3333 Beverly Road, Hoffman Estates, Illinois (Address of principal executive offices) 60179 (Zip Code... -

Page 2

...and Puerto Rico, and which are primarily mall-based locations averaging 133,000 square feet. Full-line stores offer a wide array of products across many merchandise categories, including home appliances, consumer electronics, tools, fitness, lawn and garden equipment, certain automotive services and... -

Page 3

...-business Sears Commercial Sales and Appliance Builder/Distributor businesses. • Sears Commercial Sales provides appliances and services to commercial customers in the singlefamily residential construction/remodel, property management, multi-family new construction, and government/military sectors... -

Page 4

...the traditional mall setting. By merging, the combined company achieved the scale and capabilities to compete more effectively against many of its more profitable rivals, without the capital required for building new stores. After the Merger, we initially worked to improve our operations by focusing... -

Page 5

...accounting rules in place at that time. The acquisition of the additional interest in Sears Canada during fiscal 2008 was not material to our operations or financial position. Real Estate Transactions In the normal course of business, we consider opportunities to purchase leased operating properties... -

Page 6

... availability of retail-related services such as access to credit, product delivery, repair and installation. Additionally, we are influenced by a number of factors including, but not limited to, the cost of goods, consumer debt availability and buying patterns, economic conditions, customer... -

Page 7

...the Investor Information section of our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission ("SEC"). The Corporate Governance Guidelines of our Board of Directors, the charters of the Audit, Compensation, Finance... -

Page 8

...assortment of available merchandise and superior customer service. We must also successfully respond to our customers' changing tastes. The performance of our competitors, as well as changes in their pricing policies, marketing activities, new store openings and other business strategies, could have... -

Page 9

... any other quarter, and comparable store sales for any particular future period may increase or decrease. For more information on our results of operations, see "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report on Form 10-K. We rely on... -

Page 10

... injury, death, or property damage caused by such products, and may require us to take actions such as product recalls. We also provide various services, which could also give rise to such claims. Although we maintain liability insurance, we cannot be certain that our coverage will be adequate for... -

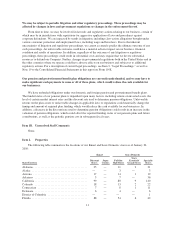

Page 11

...pension cost in subsequent fiscal years. Item 1B. Unresolved Staff Comments None. Item 2. Properties The following table summarizes the locations of our Kmart and Sears Domestic stores as of January 30, 2010: Kmart Discount Stores Super Centers Sears Domestic Sears Full-line Essentials/ Mall Stores... -

Page 12

Kmart Discount Stores Super Centers State/Territory Sears Domestic Sears Full-line Essentials/ Mall Stores Grand Stores Specialty Stores...Utah ...Vermont ...Virginia ...Washington ...West Virginia ...Wisconsin ...Wyoming ...Puerto Rico ...U.S. Virgin Islands ...Guam ...Totals ... 37 7 8 57 34 24 11... -

Page 13

... stores), 22 floor covering stores, 1,853 catalog pick-up locations and 108 travel offices. In August 2007, Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario. Sears Canada leased back the property under a leaseback agreement through March 2009, at which time... -

Page 14

... 2006 and as a director of Sears Canada since March 2005. Prior to the Merger, Mr. Crowley served as Senior Vice President, Finance of Kmart Holding Corporation, and had served as an officer of Kmart Holding Corporation since 2003. Mr. Crowley is also the President and Chief Operating Officer of ESL... -

Page 15

...President and Chief Financial Officer. Prior to joining the Company, Mr. Collins served as Senior Vice President, Planning and Analysis, at General Electric Company's NBC Universal Division from March 2004 to October 2008. Mr. Collins worked in a variety of finance positions in his 18-year career at... -

Page 16

..., the first trading day after the consummation of the Merger. Prior to that date, Kmart's common stock was quoted on The NASDAQ Stock Market, under the ticker symbol KMRT. The quarterly high and low sales prices for Holdings' common stock are set forth below. Fiscal Year 2009 Sears Holdings Second... -

Page 17

... March 28, 2005, the first day of trading of our common stock after the Merger, through January 29, 2010, the last trading day before the end of our 2009 fiscal year, with the return on the S&P 500 Stock Index, the S&P 500 Retailing Index and the S&P 500 Department Stores Index for the same period... -

Page 18

... of Equity Securities The following table provides information about shares of common stock we acquired during the fourth quarter of fiscal 2009, including shares assigned to us as part of settlement agreements resolving claims arising from the Chapter 11 reorganization of Kmart Corporation. During... -

Page 19

... gain on the sale of Kmart's former headquarters building, and a charge of $74 million related to an unfavorable verdict in connection with a legal settlement. Fiscal year 2005 included a $90 million charge, net of taxes, due to the cumulative effect of a change in accounting principle pertaining to... -

Page 20

... customers by empowering them to manage their lives. From our Kenmore appliances, to our home and auto services; from our Lands' End apparel, to our Sears and Kmart stores and online experiences, we interact with millions of customers every day. This gives us the foundation to strengthen and extend... -

Page 21

... and services to our customers in a more productive and efficient manner. We delivered better results by focusing on product sourcing, supply chain efficiencies, franchising, labor model optimization, and consolidation of functions. Year over year, our gross margin rate improved 60 basis points and... -

Page 22

..., Sears Canada changed its fiscal year end from the Saturday nearest December 31st to the Saturday nearest January 31st. References to comparable store sales amounts within the following discussion include sales for all stores operating for a period of at least 12 full months, including remodeled... -

Page 23

...2007. Fiscal 2009 (Year ended January 30, 2010) Gain on Sale Domestic Mark-to- Closed Store of Sears Visa / Pension Market Reserve and Canada MasterCard Tax As Expense Gains Severance Headquarters Settlement Matters Adjusted millions, except per share data GAAP Cost of sales, buying and occupancy... -

Page 24

... past service performed by Kmart and Sears, Roebuck and Co. associates. The annual pension expense included in our financial statements related to these legacy domestic pension plans was relatively minimal in years prior to fiscal 2009. However, due to the severe decline in the capital markets that... -

Page 25

... for Kmart stores closed during the year. Gains on sales of assets in fiscal 2008 included a $32 million gain on the sale of Sears Canada's Calgary downtown full-line store. Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario in August 2007. Sears Canada leased... -

Page 26

... dollars given lower overall sales. Operating income for fiscal 2009 includes expenses of $301 million related to domestic pension plans, store closings and severance, a $44 million gain recognized by Sears Canada on the sale of its former headquarters, and a $32 million gain recorded in connection... -

Page 27

... in connection with store closings announced during the third and fourth quarters of the year. Our gross margin rate was 27.1% in fiscal 2008 and 27.7% in fiscal 2007. The 60 basis point decline consisted of a 100 basis point decline at Sears Domestic and a 20 basis point decline at Kmart, partially... -

Page 28

...$27 million curtailment gain recorded in connection with changes made to Sears Canada's benefit plans and a $19 million gain related to insurance recoveries for certain Sears Domestic properties damaged by hurricanes during fiscal 2005. Our selling and administrative expense rate was 23.6% in fiscal... -

Page 29

... reserve because of a favorable verdict in connection with a pre-merger legal matter. Our operating income for fiscal 2007 includes gains of $46 million recorded in connection with changes made to Sears Canada's benefit plans, as well as insurance recoveries. Interest and Investment Income We earned... -

Page 30

...related expenses taken in connection with store closings in 2009. Gross margin for 2008 included a charge of $15 million recorded in cost of sales for margin related expenses taken in connection with store closings announced during that year. Kmart's gross margin rate increased 20 basis points to 23... -

Page 31

... reflects the negative gross margin impact of lower overall sales, as well as a decline in Kmart's gross margin rate and includes a charge of $15 million recorded in cost of sales for margin related expenses taken in connection with store closings announced during the third and fourth quarters of... -

Page 32

...connection with fixed asset impairments, store closings and severance in 2008. Sears Domestic Sears Domestic results and key statistics were as follows: millions, except for number of stores 2009 2008 2007 Merchandise sales and services ...Cost of sales, buying and occupancy ...Gross margin dollars... -

Page 33

... charge recorded in cost of sales for margin related expenses taken in connection with store closings. Sears Domestic's gross margin for 2008 included a $21 million charge for markdowns recorded in connection with store closings. Sears Domestic's gross margin rate was 29.7% in fiscal 2009 and 28... -

Page 34

... sales levels, accounted for approximately 10 basis points of the total decline in fiscal 2008, with the remaining 90 basis point decline attributable to gross margin rate declines across a number of merchandise categories, most notably home appliances and apparel. While we tightly managed inventory... -

Page 35

...of Sears, conducts similar retail operations as Sears Domestic. Sears Canada results and key statistics were as follows: millions, except for number of stores 2009 2008 2007 Merchandise sales and services ...Cost of sales, buying and occupancy ...Gross margin dollars ...Gross margin rate ...Selling... -

Page 36

... exchange rates. On an equivalent Canadian dollar basis, revenues decreased by $270 million, primarily reflecting a decrease in Sears Canada's sales at their Full-line, Home, Outlet, and Direct formats. These declines were partially offset by an increase in revenues from services and credit programs... -

Page 37

... outstanding derivative contracts, as well as funds held in trust in accordance with regulatory requirements governing advance ticket sales related to Sears Canada's travel business. Our January 31, 2009 cash balance excluded $38 million on deposit with The Reserve Primary Fund, a money market fund... -

Page 38

...31, 2009. Inventory levels at Sears Canada increased $13 million due to the impact of foreign currency exchange rates. Merchandise payables were $3.3 billion at January 30, 2010 and $3.0 billion as of January 31, 2009. The increase in merchandise payables is reflective of improved cash management in... -

Page 39

... fiscal 2007 included multiple real estate acquisitions of space used for Holdings' retail locations or distribution centers and for continued investments in our information technology. We anticipate fiscal 2010 capital expenditure levels to increase, as compared to 2009 levels, due to investment in... -

Page 40

... credit facility during 2009. In August 2007, Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario for proceeds of $81 million Canadian, net of closing costs. Sears Canada leased back the property under a leaseback agreement through March 2009, at which time... -

Page 41

... in the upcoming 2010 fiscal year are primarily for Sears Canada and Orchard Supply Hardware ("OSH") borrowings as follows: Issue Due in Fiscal 2010 Sears Canada debentures and medium-term notes ...OSH collateralized mortgage-backed loan ...Principal payments on capital lease obligations ...Other... -

Page 42

...of our cash on an annual basis. While Sears Holdings' pension plan is frozen, and thus associates do not currently earn pension benefits, the company has a legacy pension obligation for past service performed by Kmart and Sears, Roebuck and Co. associates. During 2009, we contributed $170 million to... -

Page 43

...' compensation, product and general liability, automobile, warranty, and asbestos and environmental claims. Also, as discussed in Note 1, we sell extended service contracts to our customers. The associated risks are managed through our wholly owned insurance subsidiary. In accordance with applicable... -

Page 44

... for each grouping of merchandise. Cost factors represent the average cost-to-retail ratio for each merchandise group based upon the fiscal year purchasing activity for each store location. Accordingly, a significant assumption under the retail method is that inventory in each group is similar in... -

Page 45

... number of risks including workers' compensation, asbestos and environmental, automobile, warranty, product and general liability claims. General liability costs relate primarily to litigation that arises from store operations. Self-insurance reserves include actuarial estimates of both claims filed... -

Page 46

... Kmart's acquisition of Sears, Roebuck and Co. in March 2005. We allocated goodwill, which is defined as the total purchase price less the fair value of all assets and liabilities acquired, to reporting units as of the acquisition date. As required by accounting standards, we perform annual goodwill... -

Page 47

... discounted using a weighted-average cost of capital that reflects current market conditions. The projection uses management's best estimates of economic and market conditions over the projected period, including growth rates in sales, costs, estimates of future expected changes in operating margins... -

Page 48

... brand products; our ability to successfully implement initiatives to improve inventory management and other capabilities; competitive conditions in the retail and related services industries; worldwide economic conditions and business uncertainty, the availability of consumer and commercial credit... -

Page 49

...-trading. As of January 30, 2010, 25% of our debt portfolio was variable rate. Based on the size of this variable rate debt portfolio at January 30, 2010, which totaled approximately $621 million, an immediate 100 basis point change in interest rates would have affected annual pretax funding costs... -

Page 50

... on credit ratings, value at risk and maturities. The counterparties to these instruments are major financial institutions with credit ratings of single-A or better. In certain cases, counterparty risk is also managed through the use of collateral in the form of cash or U.S. government securities... -

Page 51

... of Equity for the years ended January 30, 2010, January 31, 2009 and February 2, 2008 ...Notes to Consolidated Financial Statements ...Schedule II-Valuation and Qualifying Accounts ...Management's Annual Report on Internal Control over Financial Reporting ...Report of Independent Registered Public... -

Page 52

SEARS HOLDINGS CORPORATION Consolidated Statements of Income millions, except per share data 2009 2008 2007 REVENUES Merchandise sales and services ...COSTS AND EXPENSES Cost of sales, buying and occupancy ...Selling and administrative ...Depreciation and amortization ...Impairment charges ...Gain ... -

Page 53

...Other taxes ...Total current liabilities ...Long-term debt and capitalized lease obligations ...Pension and postretirement benefits ...Other long-term liabilities ...Total Liabilities ...EQUITY Sears Holdings Corporation equity Preferred stock, 20 shares authorized; no shares outstanding ...Common... -

Page 54

...) Purchases of property and equipment ...(361) (497) (570) Cash settlements and change in collateral on total return swaps, net ...- - 68 Net cash used in investing activities ...(172) (637) (437) CASH FLOWS FROM FINANCING ACTIVITIES Stock issued under executive compensation plans ...13 - - Proceeds... -

Page 55

... Accumulated Capital in Other Number of Common Treasury Excess of Retained Comprehensive Noncontrolling Shares Stock Stock Par Value Earnings Income (Loss) Interests dollars and shares in millions Total Balance at February 3, 2007-as reported ...Effects of adoption of new accounting standard... -

Page 56

... OF SIGNIFICANT ACCOUNTING POLICIES Nature of Operations, Consolidation and Basis of Presentation Sears Holdings Corporation ("Holdings," "we," "us," "our" or the "Company") is the parent company of Kmart Holding Corporation ("Kmart") and Sears, Roebuck and Co. ("Sears"). Holdings was formed as... -

Page 57

... and customer-related accounts receivable, including receivables related to our pharmacy operations. Merchandise Inventories Merchandise inventories are valued at the lower of cost or market. For Kmart and Sears Domestic, cost is primarily determined using the retail inventory method ("RIM"). Kmart... -

Page 58

...lease term or the estimated useful life of the asset. Impairment of Long-Lived Assets and Costs Associated with Exit Activities In accordance with accounting standards governing the impairment or disposal of long-lived assets, the carrying value of long-lived assets, including property and equipment... -

Page 59

... discounted using a weighted-average cost of capital that reflects current market conditions. The projection uses management's best estimates of economic and market conditions over the projected period, including growth rates in sales, costs, estimates of future expected changes in operating margins... -

Page 60

... Canada. Further, Sears Canada is exposed to fluctuations in foreign currency exchange rates due to inventory purchase contracts denominated in U.S. dollars. As a result, we primarily use derivatives as a risk management tool to decrease our exposure to fluctuations in the foreign currency market... -

Page 61

... in our consolidated statements of income as they occur. We had no investments in total return swaps as of January 30, 2010 or January 31, 2009. Counterparty Credit Risk We actively manage the risk of nonpayment by our derivative counterparties by limiting our exposure to individual counterparties... -

Page 62

..., services and extended service contracts, net commissions earned from leased departments in retail stores, delivery and handling revenues related to merchandise sold, and fees earned from co-branded credit card programs. We recognize revenues from retail operations at the later of the point of sale... -

Page 63

... includes stock options) and to classify excess tax benefits associated with share-based compensation deductions as cash from financing activities rather than cash from operating activities. We recognize compensation expense as awards vest on a straight-line basis over the requisite service period... -

Page 64

... nature, terms and size of the acquisitions we consummate after the effective date. As of January 30, 2010, we have recorded $38 million of unrecognized tax benefits and related interest, net of federal tax benefit, for tax positions of the Predecessor Company and tax positions of acquired entities... -

Page 65

... is effective for the first reporting period beginning after December 15, 2009, except for the requirement to provide the Level 3 activity of purchases, sales, issuances, and settlements on a gross basis, which will be effective for fiscal years beginning after December 15, 2010. As this update only... -

Page 66

...ORCHARD SUPPLY HARDWARE STORES CORPORATION Commercial Mortgage-Backed Loan, variable interest rate above LIBOR, due 2010(1) ...Senior Secured Term Loan, variable rate of interest above LIBOR, due 2013(2) ...SEARS CANADA INC. 7.05% to 7.45% Medium-Term Notes, due 2010 ...CAPITALIZED LEASE OBLIGATIONS... -

Page 67

..., our Finance Committee of the Board of Directors authorized the repurchase, subject to market conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately negotiated transactions. Our wholly owned finance subsidiary, Sears Roebuck Acceptance Corp... -

Page 68

... is available for OSH LLC's general corporate purposes and is secured by a first lien on substantially all of OSH LLC's non-real estate assets. Availability under the OSH LLC Facility is determined pursuant to a borrowing base formula based on inventory and account and credit card receivables... -

Page 69

...' compensation, product and general liability, automobile, warranty, and asbestos and environmental claims. Also, as discussed in Note 1, we sell extended service contracts to our customers. The associated risks are managed through our wholly owned insurance subsidiary. In accordance with applicable... -

Page 70

...for the fiscal year ending January 31, 2009. See Note 5 for further information regarding fair value of these option and merchandise purchase contracts and the respective balance sheet classifications as of January 30, 2010 and January 31, 2009. Hedges of Net Investment in Sears Canada As of January... -

Page 71

... Included within Other current liabilities on the consolidated balance sheets. Short-term investments are typically valued at the closing price in the principal active market as of the last business day of the year. Short-term investments at January 31, 2009 included $38 million on deposit with The... -

Page 72

... municipal government securities, floating-rate notes, repurchase agreements and money market funds. All invested cash amounts are readily available to us. Other Investment Income Other investment income primarily includes income generated by (and sales of investments in) certain real estate joint... -

Page 73

... annually. There were no accrued post-retirement benefit costs as of January 30, 2010 and January 31, 2009. Sears' Benefit Plans Certain domestic full-time and part-time employees of Sears are eligible to participate in noncontributory defined benefit plans after meeting age and service requirements... -

Page 74

...medical plans, with Company subsidies for certain eligible retirees. Certain domestic Sears' retirees are also provided life insurance benefits. To the extent we share the cost of the retiree medical benefits with retirees, such cost sharing is based on years of service and year of retirement. Sears... -

Page 75

...Continued) Pension Plans SHC Domestic 2009 Sears Canada SHC Domestic 2008 Sears Canada millions Total Total Change in projected benefit obligation Beginning balance ...Benefits earned during the period ...Interest cost ...Actuarial loss (gain) ...Benefits paid ...Foreign currency exchange impact... -

Page 76

... 2009 Sears Canada SHC Domestic 2008 Sears Canada millions Total Total Change in projected benefit obligation: Beginning balance ...Benefits earned during the period ...Interest cost ...Plan participants' contributions ...Actuarial loss (gain) ...Benefits paid ...Foreign currency exchange rate... -

Page 77

... net cost for years ended are as follows: 2009 SHC Sears Domestic Canada 2008 SHC Sears Domestic Canada 2007 Sears Domestic Sears Canada Kmart Pension benefits: Discount Rate ...Return of plan assets ...Rate of compensation increases ...Postretirement benefits: Discount Rate ...Return of plan... -

Page 78

... beyond, the domestic weighted-average health care cost trend rates used in measuring the postretirement benefit expense are a 10.0% trend rate in 2010 to an ultimate trend rate of 8.0% in 2014. A one-percentage-point change in the assumed health care cost trend rate would have the following effects... -

Page 79

... investments securities ...Total ... 20% 48 32 100% 16% 50 34 100% The Sears Canada plans' target allocation is determined by taking into consideration the amounts and timing of projected liabilities, our funding policies and expected returns on various asset classes. At January 30, 2010, the plan... -

Page 80

...Fixed income securities Corporate ...U.S. government and agencies ...Mortgage backed and asset backed ...Municipal and foreign government ...Ventures and partnerships ...Total investment assets at fair value ...Cash ...Accounts receivable ...Accounts payable ...Net assets available for plan benefits... -

Page 81

..., Issuances and Settlements $ (21) - $ (21) Net Transfers Into/(Out of) Level 3 $13 49 $62 January 30, 2010 Balance Sears Canada Fixed income securities Pooled equity funds ...Corporate bonds and notes ...Mortgage backed and asset backed ...Total Level 3 investments ... $409 62 4 $475 $38 14... -

Page 82

... the grantee remains employed by us as of the vesting date. The fair value of these awards is equal to the market price of our common stock on the date of grant. We do not currently have a program that provides for restricted stock awards on an annual basis. Changes in restricted stock awards for... -

Page 83

... equity securities of the Predecessor Company, as well as substantially all of its pre-petition liabilities were cancelled. On the day of emergence, 89.7 million shares of Kmart common stock and options to purchase 8.2 million shares of Kmart common stock were issued pursuant to the Plan of... -

Page 84

... connection with their pre-petition claims. In accordance with the terms of the settlement agreements, Kmart assumed responsibility for the future obligations under the bonds issued with respect to the Predecessor Company's workers' compensation insurance program and was assigned the Class 5 claims... -

Page 85

...) 333 $ 123 $ 85 $ 550 2009 2008 2007 Effective tax rate reconciliation Federal income tax rate ...State and local taxes net of federal tax benefit ...Tax credits ...Resolution of income tax matters ...Basis difference in domestic subsidiary ...Canadian rate differential on noncontrolling interest... -

Page 86

... ...Capital leases ...NOL carryforwards ...OPEB ...Pension ...Deferred revenue ...Credit carryforwards ...Other ...Total deferred tax assets ...Valuation allowance ...Net deferred tax assets ...Deferred tax liabilities: Trade names/Intangibles ...Property and equipment ...Inventory ...Other... -

Page 87

... our belief that the underlying tax positions are fully supportable. Unrecognized tax benefits are reviewed on an ongoing basis and are adjusted in light of changing facts and circumstances, including progress of tax audits, developments in case law, and closing of statute of limitations. Such... -

Page 88

... pre-tax gain on the sale of our Sears fashion center in Los Angeles. In August 2007, Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario for proceeds of $81 million Canadian, net of closing costs. Sears Canada leased back the property under a leaseback agreement... -

Page 89

... fair value of the net assets acquired in business combinations accounted for under the purchase method. We recorded $1.7 billion in goodwill in connection with the Merger. We recorded $12 million in connection with our acquisition of an additional 3% interest in Sears Canada during fiscal 2008. 89 -

Page 90

... $7 million during the first half of 2010 related to stores we announced would close in 2009. Goodwill We perform our annual goodwill and intangible impairment test required under accounting standards during the fourth quarter of each fiscal year, or when an indication of potential impairment... -

Page 91

... charge was made up of a $21 million charge at Kmart and a $77 million charge at Sears Domestic. NOTE 15-LEASES We lease certain stores, office facilities, warehouses, computers and transportation equipment. Operating and capital lease obligations are based upon contractual minimum rents and, for... -

Page 92

... as a director, officer or employee of the Company, (b) control investments in companies in the mass merchandising, retailing, commercial appliance distribution, product protection agreements, residential and commercial product installation and repair services and automotive repair and maintenance... -

Page 93

... employees of ESL. William C. Crowley is a director and our Executive Vice President, Chief Administrative Officer while continuing his role as President and Chief Operating Officer of ESL. Our Senior Vice President of Real Estate is also employed by ESL. NOTE 17-SUPPLEMENTAL FINANCIAL INFORMATION... -

Page 94

SEARS HOLDINGS CORPORATION Notes to Consolidated Financial Statements-(Continued) 2008 Sears Sears Domestic Canada Sears Holdings millions Kmart Merchandise sales and services ...Costs and expenses Cost of sales, buying and occupancy ...Selling and administrative ...Depreciation and amortization ... -

Page 95

... estate holdings, as evidenced by the prices at which Kmart subsequently sold certain of its stores in June 2004 to Home Depot and Sears. Plaintiffs seek damages for alleged misrepresentations. On December 19, 2006, the Court consolidated the actions and plaintiffs filed their consolidated complaint... -

Page 96

... share), which was recognized as Sears Canada ceased use of the building under the lease-back agreement signed at the time of the sale; domestic pension plan expense of $42 million ($25 million after tax or $0.20 per diluted share); mark-to-market losses on Sears Canada hedge transactions of $14... -

Page 97

... quarter of 2009 includes domestic pension plan expense of $44 million ($28 million after tax or $0.24 per diluted share); a charge for costs associated with store closings and severance of $10 million ($6 million after tax or $0.05 per diluted share); and mark-to-market gains on Sears Canada hedge... -

Page 98

Sears Holdings Corporation Schedule II-Valuation and Qualifying Accounts Fiscal Years 2009, 2008 and 2007 Balance at beginning of period Additions charged to costs and expenses Millions (Deductions) Balance at end of period Allowance for Doubtful Accounts(1): Fiscal 2009 ...Fiscal 2008 ...Fiscal... -

Page 99

... because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Management assessed the effectiveness of the Company's internal control over financial reporting as of January 30, 2010. In making its assessment, management used the criteria... -

Page 100

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Sears Holdings Corporation We have audited the accompanying consolidated balance sheets of Sears Holdings Corporation and subsidiaries (the "Company") as of January 30, 2010 and January 31, 2009, ... -

Page 101

... set forth therein. Also, in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of January 30, 2010, based on the criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations... -

Page 102

... by us in the reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms and (ii) is accumulated and communicated to our management, including our principal executive officer and principal... -

Page 103

... the 2010 Proxy Statement and to Part I of this Report. Holdings has adopted a Code of Conduct, which applies to all employees, including our principal executive officer, principal financial officer and principal accounting officer, and a Code of Conduct for its Board of Directors. Directors who are... -

Page 104

...been omitted because they are not required under the instructions contained in Regulation S-X because the information called for is contained in the financial statements and notes thereto. 3. Exhibits An "Exhibit Index" has been filed as part of this Report beginning on Page E-1 and is incorporated... -

Page 105

... officer) Senior Vice President and Chief Financial Officer (principal financial officer) Senior Vice President and Controller (principal accounting officer) Director and Chairman of the Board of Directors Director, Executive Vice President and Chief Administrative Officer Director March 12, 2010... -

Page 106

... to Sears, Roebuck and Co.'s Annual Report on Form 10-K for the fiscal year ended January 3, 2004 (File No. 1416)). Amended and Restated Credit Agreement, dated as of May 21, 2009, among Sears Holdings Corporation, Sears Roebuck Acceptance Corp., Kmart Corporation, the lenders party thereto, Bank of... -

Page 107

...10.44 to Registrant's Annual Report on Form 10-K for the fiscal year ended February 3, 2007 (the "2006 10-K")) (File No. 000-51217).** Form of Sears Holdings Corporation Restricted Stock Award Agreement** Sears Holdings Corporation 2007 Executive Long-Term Incentive Program Document (incorporated by... -

Page 108

... Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. 10.30 10.31 *10.32 *10.33 10.34 10.35 *10.36 *21 *23 *24 *31.1 *31.2 *32. * ** Filed herewith A management contract or compensatory plan...