Samsung 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

To the Board of Directors and Shareholders of Samsung Electronics Co., Ltd.

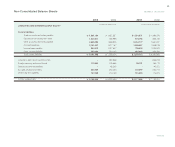

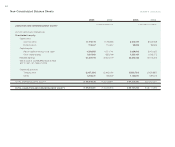

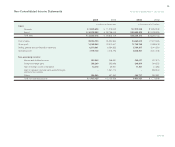

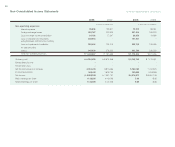

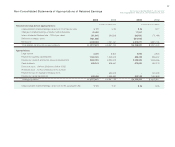

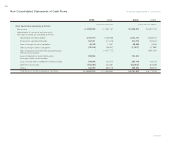

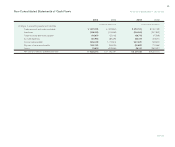

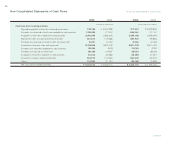

We have audited the accompanying non-consolidated balance sheets of

Samsung Electronics Co., Ltd. (the “Company”) as of December 31, 2003 and

2002, and the related non-consolidated statements of income, appropriations

of retained earnings and cash flows for the years then ended, expressed in

Korean Won. These financial statements are the responsibility of the

Company’s management. Our responsibility is to express an opinion on these

financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally

accepted in the Republic of Korea. Those standards require that we plan and

perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement. An audit includes examining, on

a test basis, evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting principles used

and significant estimates made by management, as well as evaluating the over-

all financial statement presentation. We believe that our audits provide a rea-

sonable basis for our opinion.

In our opinion, the non-consolidated financial statements referred to above

present fairly, in all material respects, the financial position of Samsung

Electronics Co., Ltd. as of December 31, 2003 and 2002, and the results of its

operations, the changes in its retained earnings and its cash flows for the years

then ended, in conformity with accounting principles generally accepted in the

Republic of Korea.

Without qualifying our opinion, we draw your attention to the following matters.

As discussed in Note 16 to the accompanying non-consolidated financial

statements, in June 1999, Samsung Motors Inc. (“SMI”), an affiliate of the

Company, filed a petition for court receivership. In connection with this peti-

tion, the Company and 30 other Samsung Group affiliates (the “Affiliates”)

entered into an agreement with the institutional creditors (the “Creditors”) of

SMI in September 1999. In accordance with this agreement, the Company and

the Affiliates agreed to sell 3,500,000 shares of Samsung Life Insurance Co.,

Ltd., which were previously transferred to the Creditors in connection with the

petition for court receivership of SMI by December 31, 2000. In the event that

the sales proceeds fall short of ₩2,450,000 million, the Company and the

Affiliates have agreed to compensate the Creditors for the shortfall by other

means, including the participation in any equity offering or subordinated

debentures issued by the Creditors. Any excess proceeds over ₩2,450,000

Independent Auditor’s Report