Redbox 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

with fewer vendors of services such as ours, and that this preference will allow us to leverage our relationships with existing

retail partners to place additional machines and to introduce additional e-payment services. Furthermore, the acquisition of

ACMI and its large field service organization allows us to offer retailers the opportunity to work with a single-source

nationwide provider for key front-of-store services.

Grow our installed base of machines. We plan to continue to expand our presence in North America and abroad.

Because of our growing platform of products, enhanced services and nationwide field services organization, we have the

ability to expand our services into numerous retailers, including supermarkets, drugstores, mass merchandisers, restaurants

and convenience store chains, as well as other diversified and emerging channels such as banks and dollar stores. In addition,

we believe we will have the benefit of expanding our installed base to the extent that our retail partners continue to grow their

own businesses. We also believe we can extend our platform to countries outside the United States, including countries in

Europe, Latin America and Asia.

Leverage our network through new product initiatives and develop new markets. Our relationships with leading

supermarket, mass merchandising and restaurant chains and our installed base of networked coin-counting machines form a

strategic platform from which we intend to launch new product initiatives, such as e-payment services. In addition, we

greatly expanded our geographic reach with the ACMI acquisition, thereby increasing the number of retail partners and

geographic areas in which we may install our machines. We have rolled out our prepaid wireless and prepaid MasterCard

®

card services to consumers and are currently offering these services through approximately 150 stand-alone e-payment kiosks

and approximately 2,450 e-payment enabled coin-counting machines. In addition, we utilize approximately 15,000 point-of-

sale terminals that offer e-payment services throughout the United States. We will continue to look for opportunities to grow

both our e-payment geographic reach as well as the number of services we offer. We envision our machines as the touch-

point for a range of consumer products and services and plan to continue testing various concepts, including gift cards,

through our coin-counting machines.

Grow through acquisitions. We continue to explore opportunities to acquire companies and assets in order to

strengthen our position in existing markets and to add complementary products and services to offer to both our retail

partners and consumers. Future acquisitions may enable us to further leverage our fixed expenses, improve margins and

expand the geographic reach of our services.

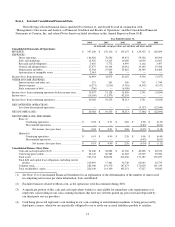

ACMI acquisition

In July 2004, we added our entertainment services business to our coin services and e-payment services businesses

through the acquisition of ACMI for $235.0 million in cash. On a pro forma basis, the ACMI entertainment services business

would have accounted for 54% of our total revenues for 2004. The ACMI entertainment services business was included in

our GAAP results of operations for the period from July 7, 2004 to December 31, 2004.

The entertainment services business has a different business model from our coin-counting services business. For

example, the direct operating expenses of the entertainment services business are substantially higher than for our historical

coin-counting business, principally due to the costs of inventory required to support the skill-crane and bulk vending machine

businesses and the relatively larger transportation and service support required for the installed base of entertainment

machines. These direct operating expenses are partially offset by lower sales and marketing, research and development and

depreciation expenses as a percentage of revenue. When these two business models were combined, we achieved a lower

blended operating margin for the six months ended December 31, 2004 of 10.5% compared to the historical coin business

operating margins which were 14.8% in the quarter prior to our acquisition of ACMI. Our objective is to grow both our

entertainment services and historical businesses while keeping expenses relatively constant, rather than to achieve cost-

synergies and savings. As a result, we expect our future operating margins to fluctuate on a quarterly and annual basis as a

function of the mix of our coin-counting, e-payment and entertainment services revenues.

We financed the acquisition of ACMI through a new $310.0 million senior secured credit facility, consisting of a

$250.0 million term loan and a $60.0 million revolving credit line. Since the acquisition, we have repaid $42.1 million of the

debt and as of December 31, 2004, we had $207.9 million outstanding under the term loan. We have not drawn on the

revolving credit facility. The credit facility bears interest at variable rates and contains customary financial covenants, ratios

and tests. In addition, the credit facility contains negative covenants that, among other things, restrict our ability to make

capital expenditures, incur future indebtedness, acquire businesses or enter into capital leasing arrangements.