Redbox 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS –(Continued)

YEARS ENDED DECEMBER 31, 2004, 2003, AND 2002

48

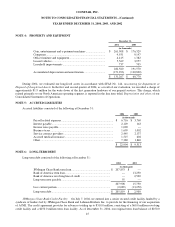

Purchase commitments: We have entered into certain purchase agreements with suppliers of our machines, which

result in total purchase commitments of $8.3 million for 2005.

Letters of credit: As of December 31, 2004, we had nine irrevocable letters of credit that totaled $15.9 million. These

letters of credit, which expire at various times through December 31, 2005, are available to collateralize certain obligations to

third parties. We expect to renew these letters of credit and have an agreement with Bank of America to automatically renew

one of the letters of credit, in three-month increments, through December 31, 2005. As of December 31, 2004, no amounts

were outstanding under these letters of credit agreements.

NOTE 9: STOCKHOLDERS’ EQUITY

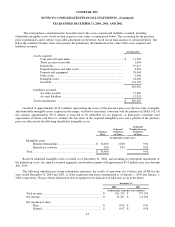

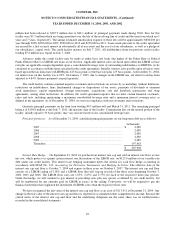

Treasury stock: Under the terms of our new credit agreement entered into on July 7, 2004, our board of directors

approved a stock repurchase program authorizing purchases of up to $3.0 million of common stock, plus additional amounts

equal to proceeds received subsequent to July 7, 2004 from option exercises or other equity purchases under our equity

compensation plans, in open market or private transactions. As of December 31, 2004, the additional amounts equal to the

proceeds received from option exercises or other equity purchases under our current board approval totaled approximately

$5.0 million. We have not repurchased any shares under our current authority from the board. Under our previous credit

facility, we had the authority to repurchase up to $30.0 million, plus the proceeds from option exercises or other equity

purchases. No repurchases of shares were made in 2004. In 2003, we repurchased 933,714 shares of our common stock for

$15.3 million, and in December 2002, we repurchased 299,500 shares of common stock at a cost of approximately $7.5

million.

NOTE 10: PUBLIC OFFERING OF COMMON STOCK

On December 20, 2004, we issued 3,450,000 shares of our common stock (including 450,000 shares issued upon the

exercise of the underwriters’ over-allotment option) at an offering price of $25.00 per share. The net proceeds from the

offering, net of offering costs and expense totaling $5.1 million, were approximately $81.1 million.

Underwriting commissions and costs incurred in connection with this offering are reflected as a reduction of

stockholders’ equity.

NOTE 11: STOCK-BASED COMPENSATION PLANS

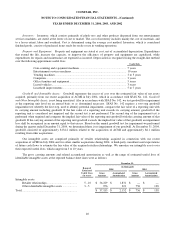

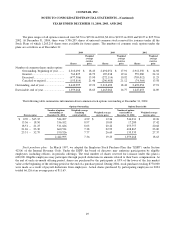

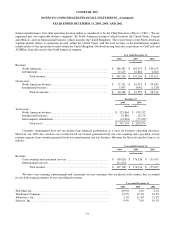

Stock options: During 2004, we granted options to employees under the 2000 Amended and Restated Equity

Incentive Plan (the “2000 Plan”) and the 1997 Amended and Restated Equity Incentive Plan (the “1997 Plan”), which

generally vest over 4 years and expire after 10 years. We have reserved a total of 770,000 shares of common stock for

issuance under the 2000 Plan and 5,380,000 shares of common stock for issuance under the 1997 Plan. Stock options have

been granted to officers and employees to purchase common stock at prices ranging from $0.25 to $32.79 per share, which

represented fair market value at the date of grants and our best estimate of fair market value for grants issued prior to our

initial public offering. We did not recognize any compensation expense related to the options issued under either the 2000

Plan or the 1997 Plan.

Under the terms of our Amended and Restated 1997 Non-Employee Directors’ Stock Option Plan, the board of

directors has provided for the automatic grant of options to purchase shares of common stock to non-employee directors. We

have reserved a total of 400,000 shares of common stock for issuance under the Non-Employee Directors’ Stock Option Plan.

Stock options have been granted to non-employee directors to purchase our common stock at prices of $7.75 to $30.00 per

share, which represented the fair market value at the date of grant.