Redbox 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

well as other relevant factors. We will continue to evaluate the useful life of our coin-counting and entertainment services

machines, as well as our other property and equipment as necessary, and will determine the need to make changes when and

if appropriate. Any changes to the estimated lives of our machines may cause actual results to differ based on different

assumptions or conditions.

Purchase price allocations: In connection with our acquisitions of our e-payment subsidiaries and ACMI, we have

allocated the respective purchase prices plus transaction costs to the estimated fair values of assets acquired and liabilities

assumed. These purchase price allocation estimates were based on our estimates of fair values and estimates from third-party

consultants.

Goodwill and intangible assets: Goodwill represents the excess of cost over the estimated fair value of net assets

acquired, primarily from our recent acquisition of ACMI in July 2004, which in accordance with SFAS No. 142, Goodwill

and Other Intangible Assets, is not being amortized. Also in accordance with SFAS No. 142, we test goodwill for impairment

at the reporting unit level on an annual basis or as determined necessary. SFAS No. 142 requires a two-step goodwill

impairment test whereby the first step, used to identify potential impairment, compares the fair value of a reporting unit with

its carrying amount including goodwill. If the fair value of a reporting unit exceeds its carrying amount, goodwill of the

reporting unit is considered not impaired and the second test is not performed. The second step of the impairment test is

performed when required and compares the implied fair value of the reporting unit goodwill with the carrying amount of that

goodwill. If the carrying amount of the reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment

loss shall be recognized in an amount equal to that excess. Based on the annual goodwill test for impairment we performed

during the quarter ended December 31, 2004, we determined there is no impairment of our goodwill.

Our intangible assets are comprised primarily of retailer relationships acquired in connection with our recent

acquisition of ACMI in July 2004 and two other smaller acquisitions during 2004. A third-party consultant used expectations

of future cash flows to estimate the fair value of the acquired retailer relationships. We amortize our intangible assets over

their expected useful lives, which range from 3 to 10 years.

Impairment of long-lived assets: Long-lived assets, such as property and equipment and purchased intangibles subject

to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount

of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying

amount of an asset group to the estimated undiscounted future cash flows expected to be generated by the asset group. If the

carrying amount of an asset group exceeds its estimated future cash flows, an impairment charge is recognized in the amount

by which the carrying amount of the asset group exceeds the fair value of the asset group.

Fees paid to retailers: Fees paid to retailers relate to the amount we pay our retail partners for the benefit of placing

our machines in their stores and their agreement to provide certain services on our behalf to our customers. The fee is

calculated as a percentage of each coin-counting transaction or as a percentage of our entertainment and vending revenue and

is recorded in our income statement under the caption “direct operating expenses.” The fee arrangements are based on our

evaluation of certain factors with the retailers such as total revenue, e-payment capabilities, long-term non-cancelable

contracts, installation of our machines in high traffic and/or urban or rural locations, new product commitments, co-op

marketing incentive or other criteria. We recognize this expense at the time we recognize the associated revenue from each of

our customer transactions. This expense is recorded on a straight-line basis as a percentage of revenue based on estimated

annual volumes.

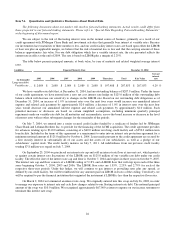

Fair value of financial instruments: The carrying amounts for cash and cash equivalents approximate fair value,

which is the amount for which the instrument could be exchanged in a current transaction between willing parties. The fair

value of our term and revolving loans approximates their carrying amounts. Our interest rate derivative is carried at fair

value.

Foreign currency translation: The functional currency of our International subsidiary is the British Pound Sterling.

We translate assets and liabilities related to these operations to U.S. dollars at the exchange rate in effect at the date of the

consolidated balance sheet; we convert revenues and expenses into U.S. dollars using the average monthly exchange rates.

Translation gains and losses are reported as a separate component of accumulated other comprehensive income.

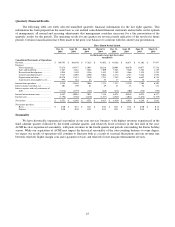

Stock-based compensation: We have several stock-based compensation programs which are described more fully in

the Notes to our Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K. We account for

stock-based awards to employees using the intrinsic value method in accordance with Accounting Principles Board (“APB”)

Opinion No. 25, Accounting for Stock Issued to Employees. If we had determined compensation cost for our stock-based

compensation consistent with the method prescribed in SFAS No. 123, Accounting for Stock-Based Compensation, our net

income would have decreased by $4.8 million in 2004, our net income would have decreased by $5.0 million in 2003 and our