Redbox 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

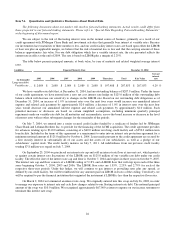

Depreciation and Other

Depreciation and other expense increased to $35.3 million in the year ended December 31, 2004 from $27.0 million in

the comparable prior year period. Depreciation expense increased primarily due to our acquisition of ACMI. Depreciation

and other expense as a percentage of revenue decreased to 11.5% in the year ended December 31, 2004 from 15.3% in the

same period in the prior year.

Amortization of Intangible Assets

Amortization of intangible assets increased to $2.0 million in the year ended December 31, 2004, from $0.1 million in

the comparable period ended 2003. Amortization expense of intangible assets increased due to our acquisition of ACMI;

specifically the amortization of the value assigned to retailer relationships that ACMI has established. Amortization expense

as a percentage of revenue increased to 0.7% in the year ended December 31, 2004, from 0.1% in the same period during

2003.

Other Income and Expense

Interest income and other, net, increased to $521,000 in the year ended December 31, 2004 from $263,000 in the prior

year. The increase in other income was due to a combination of miscellaneous income earned by our e-payment subsidiary, as

well as an increase in interest income in the year ended December 31, 2004.

Interest expense increased to $6.3 million in the year ended December 31, 2004 from $1.2 million in the prior year.

With our acquisition of ACMI on July 7, 2004, we entered into a $310.0 million credit facility of which $250.0 million had

been drawn initially in connection with this acquisition. As a result, the increase in interest expense was attributed to a

significantly larger amount of outstanding debt at year end December 31, 2004 compared to 2003.

Additionally, we used some of the proceeds from a secondary offering of 3,450,000 shares of our common stock to

retire $41.0 million on our term debt earlier than previously scheduled. When we retired this debt we also expensed $0.7

million of deferred financing fees.

Years Ended December 31, 2003 and 2002

Revenue

Revenue increased to $176.1 million in 2003 from $155.7 million in 2002. Revenue grew principally as a result of an

increase in the number of users and frequency of use of our coin-counting machines, the increase in the number of coin-

counting machines in service during 2003 and the volume of coins processed by the machines in service during this period.

The average installed base of coin-counting machines increased to 10,976 in 2003 from 10,147 machines in 2002. The

average number of machines in 2003 takes into consideration approximately 900 coin-counting machines de-installed from a

former customer during the third and fourth quarters of 2003. The total dollar value of coins processed was $2.0 billion

during 2003 compared with $1.8 billion in 2002.

Direct Operating Expenses

Direct operating expenses increased to $78.6 million in 2003 from $69.5 million in 2002. Direct operating expenses

increased due primarily to an increase in the fees paid to our retail partners resulting from a 13.1% increase in coin-counting

revenue, an increase in coin pick-up and processing costs resulting from the increased coin volumes processed during the

year, and increases in field service expenses related to our expansion into new international and domestic regional markets

during 2003. Direct operating expenses as a percentage of revenue remained constant at 44.6% in both 2003 and 2002.

Although direct operating expenses as a percentage of revenue remained the same, efficiencies implemented in our operations

shifted the impact of various direct operating expenses as a percentage of revenue. This includes an increase in expenses

associated with the service fees we pay to our retail partners and the cost of refurbishing and maintaining our coin-counting

machines. These increases were offset by a decrease in per unit field service, coin processing and telecommunication

expenses.

Sales and Marketing

Sales and marketing expenses increased to $13.2 million in 2003 from $10.7 million in 2002. Sales and marketing

expenses increased due to a shift from radio advertising to national cable television advertising in the United States as well as

increased radio advertising in the United Kingdom. During 2003, our usage of national cable television advertising extended

our advertising coverage to less densely populated areas of the country. As we expand our network of coin-counting