Redbox 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The following discussion about our market risk involves forward-looking statements. Actual results could differ from

those projected in our forward-looking statements. Please refer to “Special Note Regarding Forward-Looking Statements”

at the beginning of this annual report.

We are subject to the risk of fluctuating interest rates in the normal course of business, primarily as a result of our

credit agreement with JPMorgan Chase Bank and investment activities that generally bear interest at variable rates. Because

our investments have maturities of three months or less, and our credit facility interest rates are based upon either the LIBOR

or base rate plus an applicable margin, we believe that the risk of material loss is low and that the carrying amount of these

balances approximates fair value. For our debt obligation which has a variable interest rate, the rate presented reflects the

current rate in effect at the end of 2004. The rate is based on LIBOR plus a margin of 2.25%.

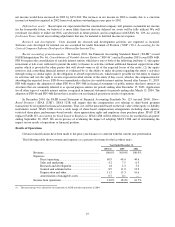

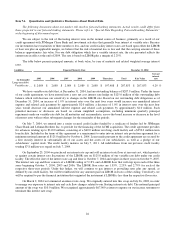

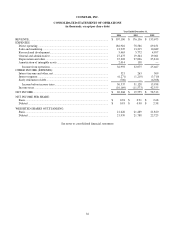

The table below presents principal amounts, at book value, by year of maturity and related weighted average interest

rates.

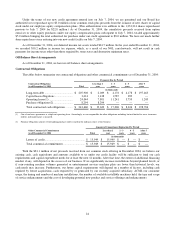

Liabilities

Expected Maturity Date

December 31, 2004

(in thousands)

2005

2006

2007

2008

2009

Thereafter

Total

Fair Value

Average

interest

rate

Long-term debt:

Variable rate

......

$ 2,089

$ 2,089

$ 2,089

$ 2,089

$ 2,089

$ 197,408

$ 207,853

$ 207,853

4.29 %

We have variable-rate debt that, at December 31, 2004, had an outstanding balance of $207.9 million. Under the terms

of our credit agreement, we have entered into a zero net cost interest rate hedge on $125.0 million of this outstanding debt

balance which will decrease our sensitivity to changes in the LIBOR rate. Based on our outstanding debt obligations as of

December 31, 2004, an increase of 1.0% in interest rates over the next four years would increase our annualized interest

expense and related cash payments by approximately $2.0 million; a decrease of 1.0% in interest rates over the next four

years would decrease our annualized interest expense and related cash payments by approximately $2.0 million. Such

potential increases or decreases are based on certain simplified assumptions, including minimum quarterly principal

repayments made on variable-rate debt for all maturities and an immediate, across-the-board increase or decrease in the level

of interest rates with no other subsequent changes for the remainder of the periods.

On July 7, 2004, we entered into a senior secured credit facility funded by a syndicate of lenders led by JPMorgan

Chase Bank and Lehman Brothers Inc. to provide for the financing of the ACMI acquisition. The credit agreement provides

for advances totaling up to $310.0 million, consisting of a $60.0 million revolving credit facility and a $250.0 million term

loan facility. Included in the terms of this agreement is a requirement to enter into an interest rate protection agreement for a

minimum notional amount of $125.0 million by October 6, 2004. Loans made pursuant to the credit agreement are secured by

a first security interest in substantially all of our assets and the assets of our subsidiaries, as well as a pledge of our

subsidiaries’ capital stock. The credit facility matures on July 7, 2011. All indebtedness from our previous credit facility

totaling $7.8 million was repaid on July 7, 2004.

On September 23, 2004 we purchased an interest rate cap and sold an interest rate floor at zero net cost, which protects

us against certain interest rate fluctuations of the LIBOR rate on $125.0 million of our variable rate debt under our credit

facility. The effective date of the interest rate cap and floor is October 7, 2004 and expires in three years on October 9, 2007.

The interest rate cap and floor consists of a LIBOR ceiling of 5.18% and a LIBOR floor that will step up in each of the three

years beginning October 7, 2004, 2005 and 2006. The LIBOR floor rates are 1.85%, 2.25% and 2.75% for each of the

respective three-year periods. Under this hedge, we will continue to pay interest at prevailing rates plus any spread, as

defined by our credit facility, but will be reimbursed for any amounts paid on LIBOR in excess of the ceiling. Conversely, we

will be required to pay the financial institution that originated the instrument if LIBOR is less than the respective floor rates.

On March 2, 2004 we terminated an interest rate swap. We originally entered into this swap on July 26, 2002, in order

to manage our exposure to interest rate and cash flow changes related to our floating interest rate debt. The notional principal

amount of the swap was $10.0 million. We recognized approximately $67,000 as interest expense on our income statement to

terminate this interest rate swap.