Redbox 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

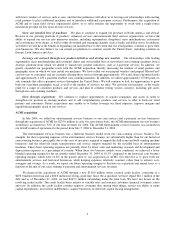

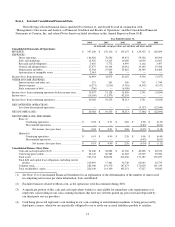

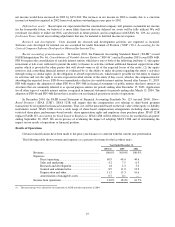

Item 6. Selected Consolidated Financial Data.

The following selected financial data is qualified by reference to, and should be read in conjunction with,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial

Statements of Coinstar, Inc. and related Notes thereto included elsewhere in this Annual Report on Form 10-K.

Year Ended December 31,

2004

2003

2002

2001

2000

(in thousands, except per share, per unit data and where noted)

Consolidated Statements of Operations:

REVENUE $ 307,100

$ 176,136

$ 155,675

$ 129,352

$ 102,609

EXPENSES:

Direct operating................................................................

.....

186,926

78,586

69,451

59,326

49,294

Sales and marketing................................

...............................

12,925

13,215

10,689

11,039

12,867

Research and development ................................

....................

5,465

5,772

4,997

4,162

3,497

General and administrative................................

....................

27,475

19,344

19,061

19,140

15,568

Depreciation and other................................

...........................

35,302

27,006

25,810

26,349

24,460

Amortization of intangible assets ................................

..........

2,014

138

—

—

—

Income (loss) from operations................................

..........................

36,993

32,075

25,667

9,336

(3,077)

OTHER INCOME (EXPENSE):

Interest income and other, net................................

................

521

263

309

707

1,740

Interest expense ................................................................

.....

(6,271)

(1,210)

(3,710)

(8,302)

(8,517)

Early retirement of debt................................

.........................

(706)

—

(6,308)

—

—

Income (loss) from continuing operations before income taxes

.......

30,537

31,128

15,958

1,741

(9,854)

Income taxes ................................................................

....................

(10,169)

(11,573)

42,555

—

—

Income (loss) from continuing operations................................

........

20,368

19,555

58,513

1,741

(9,854)

DISCONTINUED OPERATIONS:

Loss from discontinued operations................................

........

—

—

—

(9,127)

(12,840)

NET INCOME (LOSS) $ 20,368

$ 19,555

$ 58,513

$ (7,386)

$ (22,694)

NET INCOME (LOSS) PER SHARE:

Basic:(1)

Continuing operations................................

.................

$ 0.94

$ 0.91

$ 2.68

$ 0.08

$ (0.49)

Discontinued operations................................

..............

—

—

—

(0.43)

(0.63)

Net income (loss) per share

..............................

$ 0.94

$ 0.91

$ 2.68

$ (0.35)

$ (1.12)

Diluted:(1)

Continuing operations................................

.................

$ 0.93

$ 0.90

$ 2.58

$ 0.08

$ (0.49)

Discontinued operations................................

..............

—

—

—

(0.42)

(0.63)

Net income (loss) per share

..............................

$ 0.93

$ 0.90

$ 2.58

$ (0.34)

$ (1.12)

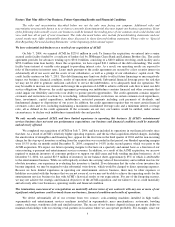

Consolidated Balance Sheet Data:

Cash and cash equivalents(2)(3)................................

............

$ 94,640

$ 38,882

$ 41,560

$ 40,428

$ 20,102

Cash being processed(4)................................

........................

62,147

60,782

61,283

65,507

50,582

Total assets ................................................................

............

547,134

204,074

216,636

171,187

156,037

Total debt and capital lease obligations, including current

portion................................................................

..............

210,919

17,461

36,746

62,643

62,735

Common stock................................................................

.......

282,046

191,370

187,473

171,059

161,339

Total stockholders’ equity ................................

.....................

226,146

114,190

105,251

37,227

34,842

(1) See Note 13 to Consolidated Financial Statements for an explanation of the determination of the number of shares used

in computing net income per share information, basic and diluted.

(2) Excludes balances related to Meals.com, as the operations were discontinued during 2001.

(3) A significant portion of this cash and cash equivalents balance is unavailable for immediate cash requirements as it

represents coin residing in our coin-counting machines that have not yet been picked up, processed and deposited by

our third-party service providers.

(4) Cash being processed represents coin residing in our coin-counting or entertainment machines or being processed by

third-party carriers, which we are specifically obligated to use to settle our accrued liabilities payable to retailers.