Redbox 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS –(Continued)

YEARS ENDED DECEMBER 31, 2004, 2003, AND 2002

44

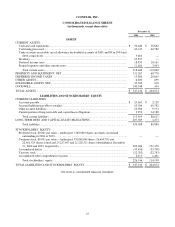

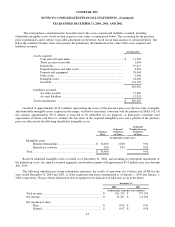

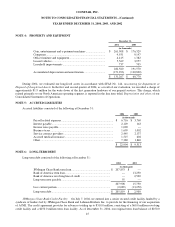

The total purchase consideration has been allocated to the assets acquired and liabilities assumed, including

identifiable intangible assets, based on their respective fair values as summarized below. The accounting for the purchase

price is preliminary and is subject to possible adjustments in the future, based on our final analysis of certain liabilities. The

following condensed balance sheet data presents the preliminary determination of fair value of the assets acquired and

liabilities assumed.

(in thousands)

Assets acquired:

Cash and cash equivalents................................................................

.........

$ 11,505

Trade accounts receivable ................................................................

.........

1,004

Inventories................................................................

................................

19,617

Prepaid expenses and other assets................................

.............................

4,022

Property and equipment ................................................................

............

58,404

Other assets ................................................................

...............................

2,906

Intangible assets ................................................................

........................

34,400

Goodwill................................................................................................

....

134,158

266,016

Liabilities assumed:

Accounts payable ................................................................

......................

13,869

Accrued liabilities ................................................................

.....................

12,852

Total consideration ................................................................

.............................

$ 239,295

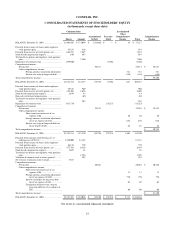

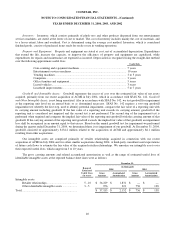

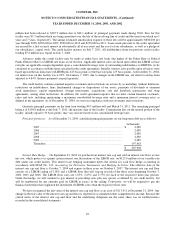

Goodwill of approximately $134.2 million, representing the excess of the purchase price over the fair value of tangible

and identifiable intangible assets acquired in the merger, will not be amortized, consistent with the guidance in SFAS 142. Of

this amount, approximately $37.0 million is expected to be deductible for tax purposes. A third-party consultant used

expectations of future cash flows to estimate the fair value of the acquired intangible assets and a portion of the purchase

price was allocated to the following identifiable intangible assets:

Purchase

Price

Estimated

Useful lives

in Years

Estimated

Weighted Average

Useful lives

in Years

(In thousands, except years)

Intangible assets:

Retailer relationships................................

....................

$ 34,200

10.00 9.94

Internal use software ................................

....................

200

3.00 0.02

Total................................................................

.......................

$ 34,400

9.96

Based on identified intangible assets recorded as of December 31, 2004, and assuming no subsequent impairment of

the underlying assets, the annual estimated aggregate amortization expense will approximate $3.4 million each year through

July, 2014.

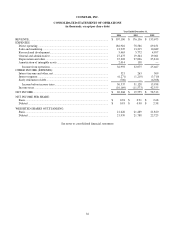

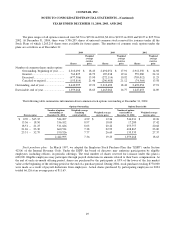

The following unaudited pro forma information represents the results of operations for Coinstar and ACMI for the

years ended December 31, 2004 and 2003, as if the acquisition had been consummated as of January 1, 2004 and January 1,

2003, respectively. This pro forma information does not purport to be indicative of what may occur in the future:

December 31,

2004

2003

(in thousands, except per share amounts)

Total revenue ................................................................

...................

$ 421,713

$ 377,554

Net income................................................................

.......................

$ 21,321

$ 21,381

Net income per share:

Basic................................................................

.......................

$ 0.99

$ 0.99

Diluted................................................................

....................

$ 0.97

$ 0.98