Redbox 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

continue evaluating new marketing and promotional programs to increase consumer utilization of our services. We also

intend to continue to engage in systems and product research and development.

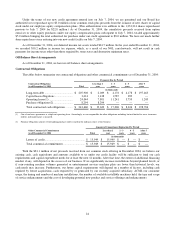

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated

financial statements, which have been prepared in accordance with accounting principles generally accepted in the United

States of America (“GAAP”). The preparation of these financial statements requires us to make estimates and judgments that

affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and

liabilities. On an ongoing basis, we evaluate our estimates, including those related to coin-in-machine and accrued expenses,

property and equipment, stock-based compensation, income taxes and contingencies. We base our estimates on historical

experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which

form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other

sources. Actual results may differ from these estimates under different assumptions or conditions.

Revenue recognition: We recognize revenue as follows:

• Coin counting revenue is recognized at the time the consumers’ coins are counted by our coin-counting machines;

• Entertainment services revenue is recognized at the time cash is deposited in our machines. Cash deposited in the

machines that has not yet been collected is referred to as coin-in-machine and is estimated at period end and

reported on the balance sheet as cash being processed. This estimate is based on the average daily revenue per

machine, multiplied by the number of days since the coin in the machine has been collected;

• E-payment revenue is recognized at the point of sale based on our commissions earned, net of retailer fees, in

accordance with Emerging Issues Task Force (“EITF”) 99-19, Reporting Revenue Gross as a Principal Versus Net

as an Agent.

Cash, cash equivalents and cash being processed: We consider all highly liquid securities purchased with a maturity

at purchase of three months or less to be cash equivalents.

Cash being processed represents coin residing in our coin-counting or entertainment machines or being processed by

third-party carriers, which we are specifically obligated to use to settle our accrued liabilities payable to retailers. We have

the contractual right and obligation to pick up and process all coins in our machines, although in certain circumstances, we

may not be able to immediately access the coins until they have been deposited into one of our regional bank accounts.

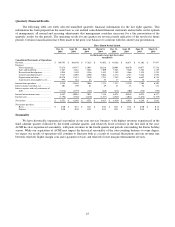

We have estimated the value of our entertainment services coin-in-machine at December 31, 2004 which is

approximately $4.4 million. Coin-in-machine represents the cash deposited into our entertainment services machines at

period end which has not yet been collected. Based on our estimate of coin-in-machine, we have recognized the related

revenue, the corresponding reduction to inventory and increase to accrued liabilities which represents the direct operating

expenses associated with the coin-in-machine estimate.

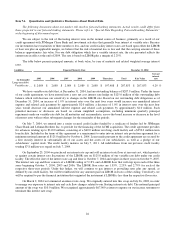

Securities available-for-sale: Our investments are classified as available-for-sale and are stated at fair value in

accordance with Statement of Financial Accounting Standards (“SFAS”) No. 115, Accounting for Certain Investments in

Debt and Equity Securities. Our available-for-sale securities have maturities of one year or less and are reported at fair value

based on quoted market prices and are included in the balance sheet caption, “prepaid expenses and other current assets.”

Changes in unrealized gains and losses are reported as a separate component of accumulated other comprehensive income.

Trade accounts receivable: Trade accounts receivable represents trade receivables, net of allowances for doubtful

accounts. The allowance for doubtful accounts reflects our best estimate of probable losses inherent in the accounts

receivable balance. We determine the allowance based on known troubled accounts, historical experience and other currently

available evidence. When a specific account is deemed uncollectible, the account is written off against the allowance.

Inventory: Inventory, which consists primarily of plush toys and other products dispensed from our entertainment

services machines, are stated at the lower of cost or market. The cost of inventory includes mainly the cost of materials, and

to a lesser extent, labor and overhead. Cost is determined using the average cost method. Inventory, which is considered

finished goods, consists of purchased items ready for resale or use in vending operations.

Property and equipment: Property and equipment are depreciated in accordance with the methods disclosed in the

Notes to our Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K. We are

depreciating the cost of our coin-counting and entertainment services machines over periods that range from 3 to 10 years and

have determined that these lives are appropriate based on our analysis that included a review of historical data and trends, as