Redbox 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS –(Continued)

YEARS ENDED DECEMBER 31, 2004, 2003, AND 2002

47

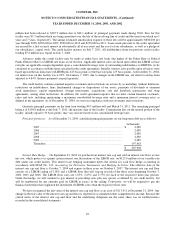

NOTE 7: EARLY RETIREMENT OF DEBT

In connection with our December 20, 2004 stock issuance of 3,450,000 shares, we used some of the net proceeds to

retire a portion of our outstanding principal balance on our term debt. On December 21, 2004, we retired $41.0 million of our

term debt facility with JPMorgan Chase Bank. We wrote off approximately $0.7 million of deferred financing fees associated

with this retirement of debt.

Previous to July 7, 2004, we were a party to a credit agreement entered into on April 18, 2002, with Bank of America,

N.A., for itself and as agent for US Bank National Association, Silicon Valley Bank, KeyBank National Association and

Comerica Bank-California. The credit agreement provided for a senior secured credit facility of $90.0 million, consisting of a

revolving loan commitment of $50.0 million and a term loan commitment of $40.0 million. Loans made pursuant to the credit

agreement were secured by a first priority security interest in substantially all of our assets and the assets of our subsidiaries,

including the pledge of the subsidiaries’ capital stock we own. On July 7, 2004, all outstanding debt on this facility was paid

in full resulting in a charge totaling $0.2 million for the write-off of deferred financing fees.

On March 2, 2004 we terminated an interest rate swap. We originally entered into this swap on July 26, 2002, in order

to manage our exposure to interest rate and cash flow changes related to our floating interest rate debt. The notional principal

amount of the swap was $10.0 million. We recognized approximately $67,000 as interest expense on our income statement to

terminate this interest rate swap.

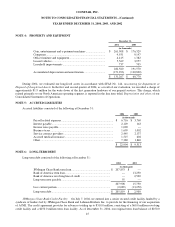

NOTE 8: COMMITMENTS

Lease commitments: Our corporate administrative, marketing and product development facility is located in a 46,070

square foot facility in Bellevue, Washington, under a lease that expires December 1, 2009. The future minimum payments of

this new lease are at a lower monthly rate than under the prior lease terms. The new lease requires us to pay a portion of

operating costs as minimum monthly payments. In connection with our acquisition of ACMI, we assumed the lease for

ACMI’s corporate headquarters. See discussion in Note 18, Related Party Transactions.

In addition, we have entered into capital lease agreements to finance the acquisition of certain automobiles. We retain

title to such assets. These capital leases have terms of 36 to 60 months at imputed interest rates that range from 3.0% to

16.0%. Assets under capital lease obligations aggregated $5.2 million and $4.0 million, net of $2.1 million and $1.8 million

of accumulated amortization, at December 31, 2004 and 2003, respectively.

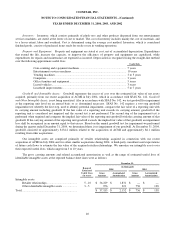

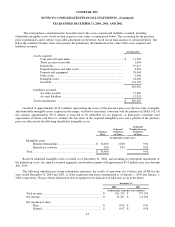

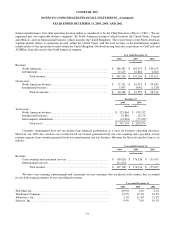

A summary of our minimum lease obligations at December 31, 2004 is as follows:

Capital

Leases

Operating

Leases*

(in thousands)

2005 .................................................................................................

$ 1,438

$ 7,801

2006 .................................................................................................

1,043

6,565

2007 .................................................................................................

544

4,676

2008 .................................................................................................

331

2,134

2009 .................................................................................................

58

1,625

Thereafter.........................................................................................

—

1,243

Total minimum lease commitments.................................................

3,414

$ 24,044

Less amounts representing interest..................................................

(403)

Present value of lease obligation......................................................

3,011

Less current portion.........................................................................

(1,261)

Long-term portion............................................................................

$ 1,750

* One of our leas agreements is a triple net operating lease. Accordingly, we are responsible for other obligations including, but not limited to, taxes, insurance,

utilities and maintenance as incurred.

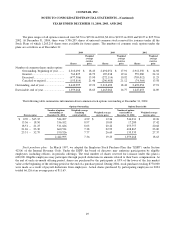

Rental expense was $4.9 million in the year ended December 31, 2004 and $1.4 million for each of the years ended

December 31, 2003 and 2002, respectively.