Redbox 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS –(Continued)

YEARS ENDED DECEMBER 31, 2004, 2003, AND 2002

50

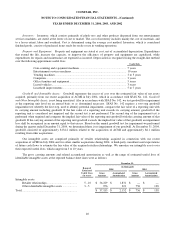

NOTE 12: INCOME TAXES

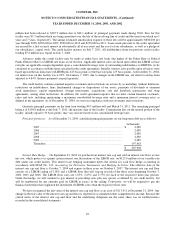

The components of income (loss) before income taxes were as follows:

December 31,

2004

2003

2002

(in thousands)

U.S. operations..................................................................................

$ 27,480

$ 28,087 $ 17,087

Foreign operations ............................................................................

3,057

3,041 (1,129)

Total income (loss) before income taxes.................................

$ 30,537

$ 31,128 $ 15,958

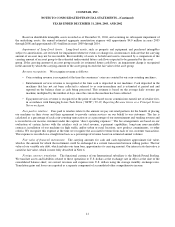

The components of income tax expense (benefit) were as follows:

December 31,

2004

2003

2002

(in thousands)

Current:

U.S. Federal............................................................................. $ 382

$ 600 $ —

State and local ......................................................................... 170

400 —

Foreign .................................................................................... 1,020

15 —

Total current .................................................................. 1,572

1,015 —

Deferred:

U.S. Federal............................................................................. 7,817

9,883 (36,654)

State and local ......................................................................... 1,360

675 (5,901)

Foreign .................................................................................... (580

)

— —

Total deferred ................................................................ 8,597

10,558 (42,555)

Total tax expense .............................................................................. $ 10,169

$ 11,573 $ (42,555)

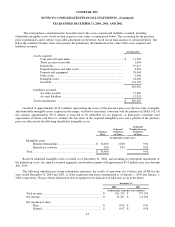

The income tax expense (benefit) differs from the amount that would result by applying the U.S. statutory rate to

income (loss) before income taxes. A reconciliation of the difference follows:

December 31,

2004

2003

2002

U.S. federal tax expense at the statutory rate.............................

35.0%

35.0%

34.0%

State income taxes, net of federal benefit ..................................

3.4%

3.6%

3.9%

Research and development credits.............................................

—

—

(1.3)%

Non-deductible foreign expenses...............................................

—

0.5%

1.3%

Other..........................................................................................

0.2%

0.9%

1.6%

Change in valuation allowance for deferred tax asset................

(1.9)%

(1.8)%

(306.2)%

Recognition of net deferred tax assets at an adjusted rate .........

(3.4)%

(1.0)%

—

33.3%

37.2%

(266.7)%