Redbox 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

Under the terms of our new credit agreement entered into on July 7, 2004, we are permitted and our Board has

authorized us to repurchase up to $3.0 million of our common stock plus proceeds from the issuance of new shares of capital

stock under our employee equity compensation plans. (This authorization is in addition to the 1,233,214 shares repurchased

previous to July 7, 2004 for $22.8 million.) As of December 31, 2004, the cumulative proceeds received from option

exercises or other equity purchases under our equity compensation plans subsequent to July 7, 2004, totaled approximately

$5.0 million bringing the total authorized for purchase under our credit agreement to $8.0 million. We have not made further

share repurchases since entering into our new credit facility on July 7, 2004.

As of December 31, 2004, our deferred income tax assets totaled $34.7 million. In the year ended December 31, 2004,

we recorded $10.2 million in income tax expense, which, as a result of our NOL carryforwards, will not result in cash

payments for income taxes other than those required by some states and alternative minimum taxes.

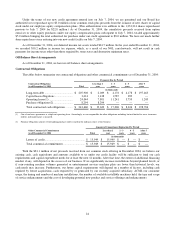

Off-Balance Sheet Arrangements

As of December 31, 2004, we have no off-balance sheet arrangements.

Contractual Obligations

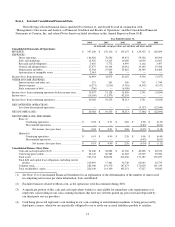

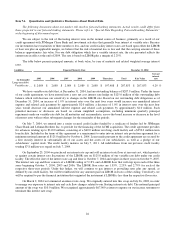

The tables below summarize our contractual obligations and other commercial commitments as of December 31, 2004:

Payments Due by Period

Contractual Obligations

As of December 31, 2004

Total

Less than 1

year

1 - 3

years

4 - 5

years

After 5

years

(in thousands)

Long-term debt ................................

........

$ 207,908 $ 2,089 $ 4,178 $ 4,178 $ 197,463

Capital lease obligations

..........................

3,414 1,438 1,587 389 —

Operating leases(1) ................................

..

24,044 7,801 11,241 3,759 1,243

Purchase obligations(2)

............................

8,294 8,294 — — —

Total contractual cash obligations

...........

$ 243,660 $ 19,622 $ 17,006 $ 8,326 $ 198,706

(1) One of our lease agreements is a triple net operating lease. Accordingly, we are responsible for other obligations including, but not limited to, taxes, insurance,

utilities and maintenance as incurred.

(2) Purchase obligations consist of outstanding purchase orders issued in the ordinary course of our business.

Amount of Commitment Expiration Per Period

Other Commercial Commitments

As of December 31, 2004

Total

Less than 1

year

1 - 3

years

4 - 5

years

After 5

years

(in thousands)

Letters of credit................................

........................

$ 15,949

$ 15,949 $ — $ — $ —

Total commercial commitments

..............................

$ 15,949

$ 15,949 $ — $ — $ —

With the $81.1 million of net proceeds received from our common stock offering in December 2004, we believe our

existing cash, cash equivalents and amounts available to us under our credit facility will be sufficient to fund our cash

requirements and capital expenditure needs for at least the next 12 months. After that time, the extent of additional financing

needed, if any, will depend on the success of our business. If we significantly increase installations beyond planned levels, or

if coin-counting machine volumes generated or entertainment services machine plays are lower than historical levels, our

cash needs may increase. Furthermore, our future capital requirements will depend on a number of factors, including cash

required by future acquisitions, cash required by or generated by our recently acquired subsidiary, ACMI, our consumer

usage, the timing and number of machine installations, the number of available installable machines held, the type and scope

of service enhancements and the cost of developing potential new product and service offerings and enhancements.