Redbox 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

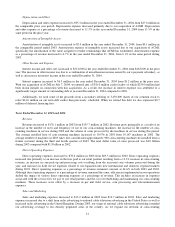

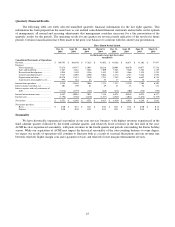

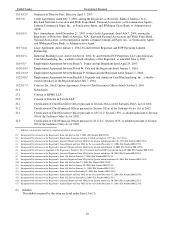

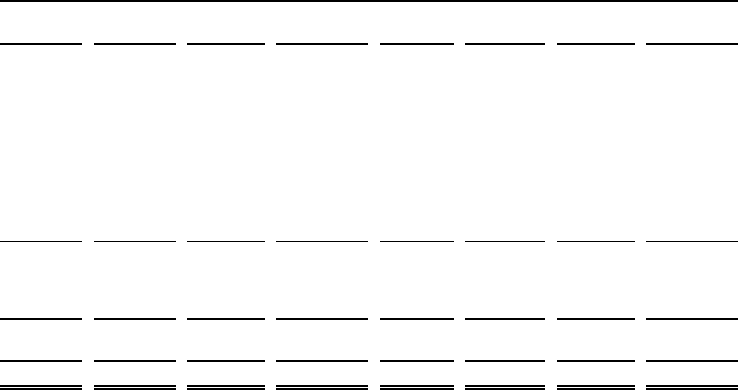

Quarterly Financial Results

The following table sets forth selected unaudited quarterly financial information for the last eight quarters. This

information has been prepared on the same basis as our audited consolidated financial statements and includes, in the opinion

of management, all normal and recurring adjustments that management considers necessary for a fair presentation of the

quarterly results for the periods. The operating results for any quarter are not necessarily indicative of the results for future

periods. Certain reclassifications have been made to the prior year balances to conform with the current year presentation.

Three Month Periods Ended

Dec. 31,

2004

Sept. 30,

2004

June 30,

2004

March 31,

2004

Dec. 31,

2003

Sept. 30,

2003

June 30,

2003

March 31,

2003

(in thousands, except per share data)

(unaudited)

Consolidated Statements of Operations:

Revenue...................................................

$ 109,793

$ 106,430

$ 47,825

$ 43,052

$ 46,366

$ 48,671

$ 43,102

$ 37,997

Expenses:

Direct operating.................................

73,678

69,937

23,093

20,218

20,904

20,870

19,077

17,736

Sales and marketing ..........................

4,567

3,642

3,666

1,050

5,262

3,440

3,384

1,129

Research and development................

1,058

1,410

1,556

1,441

1,389

1,566

1,524

1,293

General and administrative................

9,423

8,098

4,890

5,064

4,376

4,783

5,228

4,956

Depreciation and other ......................

10,116

9,821

7,450

7,915

7,245

6,764

6,642

6,355

Amortization of intangible assets ......

993

884

84

53

37

38

38

25

Income from operations...........................

9,958

12,638

7,086

7,311

7,153

11,210

7,209

6,503

Interest income and other, net..................

201

190

61

69

41

38

52

132

Interest expense and early retirement of

debt ...................................................

(3,812)

(2,793) (126

)

(246) (216) (300) (336

)

(358)

Income before income taxes ....................

6,347

10,035

7,021

7,134

6,978

10,948

6,925

6,277

Income taxes............................................

(1,796)

(3,386) (2,470

)

(2,517) (2,548) (4,014) (2,676

)

(2,335)

Net income ..............................................

$ 4,551

$ 6,649

$ 4,551

$ 4,617

$ 4,430

$ 6,934

$ 4,249

$ 3,942

Net income per share:

Basic .................................................

$ 0.20

$ 0.31

$ 0.21

$ 0.22

$ 0.21

$ 0.32

$ 0.20

$ 0.18

Diluted ..............................................

0.20

0.30

0.21

0.21

0.21

0.32

0.19

0.18

Seasonality

We have historically experienced seasonality in our coin services business, with highest revenues experienced in the

third calendar quarter, followed by the fourth calendar quarter, and relatively lower revenues in the first half of the year.

ACMI has also experienced seasonality, with peak revenues in the fourth quarter and periods surrounding the Easter holiday

season. While our acquisition of ACMI may impact the historical seasonality of the coin-counting business to some degree,

we expect our results of operations will continue to fluctuate both as a result of seasonal fluctuations and our revenue mix

between relatively higher margin coin and e-payment services and relatively lower margin entertainment services.