Redbox 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS –(Continued)

YEARS ENDED DECEMBER 31, 2004, 2003, AND 2002

53

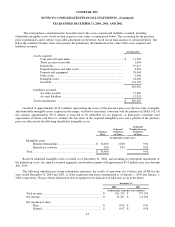

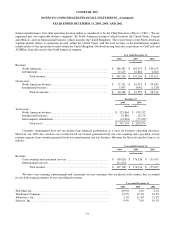

financial performance. Our chief operating decision maker is considered to be the Chief Executive Officer (“CEO”). We are

organized into two reportable business segments: the North American business (which includes the United States, Canada

and Mexico), and our International business (which includes the United Kingdom). The total revenue of the North American

segment mainly relates to operations located within the United States, and the total revenue of the International segment

mainly relates to the operations located within the United Kingdom. Goodwill arising from the acquisitions of CellCards and

ACMI has been allocated to the North American segment.

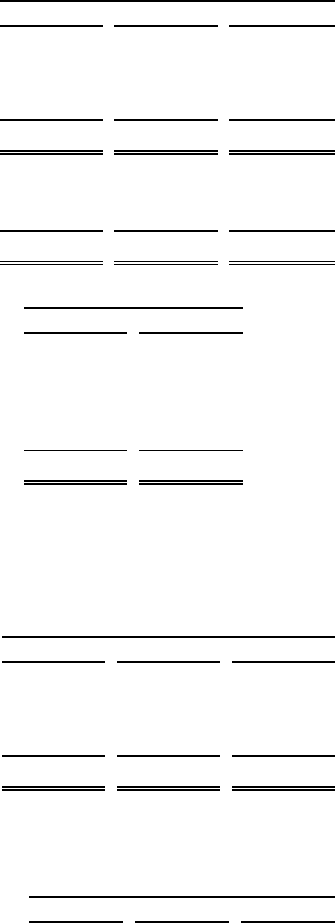

Year ended December 31,

2004

2003

2002

(in thousands)

Revenue:

North American.............................................................................................

$ 289,485

$ 165,274

$ 149,615

International ..................................................................................................

17,615

10,862

6,060

Total revenue .......................................................................................

$ 307,100

$ 176,136

$ 155,675

Net income:

North American business ..............................................................................

$ 17,311

$ 16,513

$ 59,642

International business....................................................................................

3,057

3,042

(1,129)

Total net income..................................................................................

$ 20,368

$ 19,555

$ 58,513

December 31,

2004

2003

(in thousands)

Total assets:

North American business .....................................................................................

$ 535,864

$ 199,132

International business...........................................................................................

25,886

20,174

Intercompany eliminations...................................................................................

(14,616) (15,232)

Total assets .................................................................................................

$ 547,134

$ 204,074

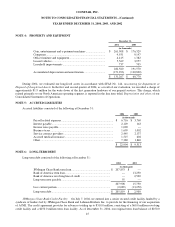

Currently, management does not use product line financial performance as a basis for business operating decisions.

However, our CEO does analyze our revenue based on revenue generated from our coin-counting and e-payment service

revenue separate from revenue generated from our entertainment services business. Revenue for these two product lines is as

follows:

Year ended December 31,

2004

2003

2002

(in thousands)

Revenue:

Coin-counting and e-payment services .........................................................

$ 196,026

$ 176,136

$ 155,675

Entertainment services ..................................................................................

111,074

—

—

Total revenue .......................................................................................

$ 307,100

$ 176,136

$ 155,675

We have coin-counting, entertainment and e-payment services machines that are placed with retailers that accounted

for the following percentages of our consolidated revenue:

Year ended December 31,

2004

2003

2002

Wal-Mart, Inc. ..........................................................................................................

20.9%

3.4%

2.1%

The Kroger Company ...............................................................................................

14.7%

22.3%

23.0%

Albertson’s, Inc.........................................................................................................

9.1%

11.8%

12.2%

Safeway, Inc. ............................................................................................................

0.4%

7.8%

10.1%