Redbox 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

net income would have increased in 2002 by $451,000. The increase in net income in 2002 is mainly due to a one-time

income tax benefit recognized in 2002 from stock options outstanding in years prior to 2002.

Deferred tax assets: Based upon our expectation that the consolidated company will generate sustainable net income

for the foreseeable future, we believe it is more likely than not that our deferred tax assets will be fully utilized. We will

reevaluate our ability to utilize our NOL carryforwards in future periods, and in compliance with SFAS No. 109, Accounting

for Income Taxes, record any resulting adjustments that may be material to deferred income tax expense.

Research and development: Costs incurred for research and development activities are expensed as incurred.

Software costs developed for internal use are accounted for under Statement of Position (“SOP”) 98-1, Accounting for the

Costs of Computer Software Developed or Obtained for Internal Use.

Recent accounting pronouncements: In January 2003, the Financial Accounting Standards Board (“FASB”) issued

FASB Interpretation No. 46, Consolidation of Variable Interest Entities (“FIN 46”) and in December 2003 issued FIN 46R.

FIN 46 requires the consolidation of variable interest entities which have one or both of the following attributes (1) the equity

investment at risk is not sufficient to permit the entity to finance its activities without additional financial support from other

parties which is provided by other parties that will absorb some or all of the expected losses of the entity, (2) the equity

investors lack controlling financial interest as evidenced by (i) the ability to make decisions regarding the entity’s activities

through voting or similar rights (ii) the obligation to absorb expected losses, which make it possible for the entity to finance

its activities and (iii) the right to receive expected residual returns of the entity if they occur, which is the compensation for

absorbing the expected losses. FIN 46 was immediately effective for variable interest entities formed after January 31, 2003.

FIN 46R requires the adoption of either FIN 46 or FIN 46R in financial statements of public entities that have interests in

structures that are commonly referred to as special purpose entities for periods ending after December 15, 2003. Application

for all other types of variable interest entities is required in financial statements for periods ending after March 15, 2004. The

adoption of FIN 46 and FIN 46R did not have an effect on our financial position or results of operations.

In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123 (revised 2004), Share-

Based Payment (“SFAS 123R”). SFAS 123R will require that the compensation cost relating to share-based payment

transactions be recognized in financial statements. That cost will be measured based on the fair value of the equity or liability

instruments issued. SFAS 123R covers a wide range of share-based compensation arrangements including share options,

restricted share plans, performance-based awards, share appreciation rights and employee share purchase plans. SFAS 123R

replaces FASB 123, Accounting for Stock Issued to Employees. SFAS 123R will be effective for us for our third fiscal quarter

ending September 30, 2005. We are in process of evaluating the impact of adopting SFAS 123R and of determining the

impact on our results of operations or financial position.

Results of Operations

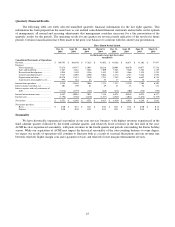

Certain reclassifications have been made to the prior year balances to conform with the current year presentation.

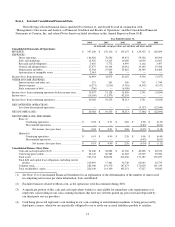

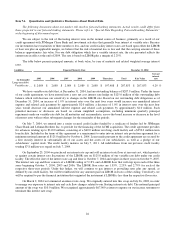

The following table shows revenue and expenses as a percent of revenue for the last three years:

Year Ended December 31,

2004 (1)

2003

2002

Revenue ................................................................

..............

100.0%

100.0% 100.0%

Expenses:

Direct operating................................

.........................

60.9

44.6

44.6

Sales and marketing ................................

..................

4.2

7.5

6.9

Research and development................................

........

1.8

3.3

3.2

General and administrative................................

........

8.9

11.0

12.2

Depreciation and other ................................

..............

11.5

15.3

16.6

Amortization of intangible assets

..............................

0.7

0.1

—

Income from operations................................

......................

12.0%

18.2% 16.5%

(1) These percentages were affected by our acquisition of ACMI and other acquisitions in 2004.