Redbox 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS –(Continued)

YEARS ENDED DECEMBER 31, 2004, 2003, AND 2002

45

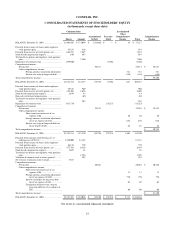

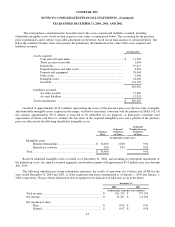

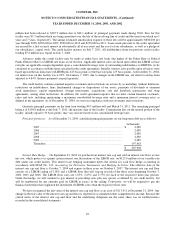

NOTE 4: PROPERTY AND EQUIPMENT

December 31,

2004

2003

(in thousands)

Coin, entertainment and e-payment machines ...........................

$ 261,908

$ 176,329

Computers..................................................................................

9,931

9,197

Office furniture and equipment..................................................

4,415

1,382

Leased vehicles..........................................................................

5,569

3,957

Leasehold improvements ...........................................................

737

705

282,560

191,570

Accumulated depreciation and amortization..............................

(151,293

)

(130,800)

$ 131,267

$ 60,770

During 2004, we evaluated our long-lived assets in accordance with SFAS No. 144, Accounting for Impairment or

Disposal of Long-Lived Assets. In the first and second quarter of 2004, as a result of our evaluation, we recorded a charge of

approximately $1.9 million for the write down of the first generation hardware of our prepaid services. This charge, which

related primarily to our North American operating segment, is reported in the line item titled, Depreciation and other, of our

Consolidated Statements of Operations.

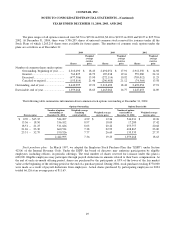

NOTE 5: ACCRUED LIABILITIES

Accrued liabilities consisted of the following at December 31:

2004

2003

(in thousands)

Payroll related expenses........................................................................ $ 6,716 $ 3,769

Interest payable..................................................................................... 2,129 163

Income taxes payable............................................................................ 1,020 —

Business taxes....................................................................................... 1,699 1,002

Service contract providers .................................................................... 2,445 2,137

Accrued medical insurance................................................................... 1,515 602

Other..................................................................................................... 7,380 1,840

$ 22,904 $ 9,513

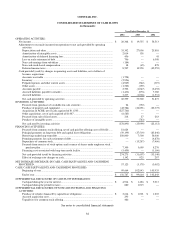

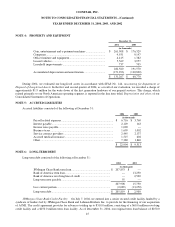

NOTE 6: LONG-TERM DEBT

Long-term debt consisted of the following at December 31:

2004

2003

(in thousands)

JPMorgan Chase Bank term loan................................

......................

$ 207,853

$ —

Bank of America term loan................................

...............................

—

13,250

Bank of America revolving line of credit ................................

.........

—

2,500

Long-term note payable................................................................

....

55

—

207,908

15,750

Less current portion................................................................

..........

(2,089

)

(13,250)

Long-term debt ................................................................

.................

$ 205,819

$ 2,500

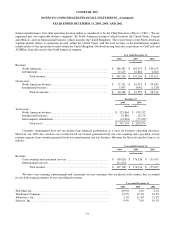

JPMorgan Chase Bank Credit Facility: On July 7, 2004, we entered into a senior secured credit facility funded by a

syndicate of lenders led by JPMorgan Chase Bank and Lehman Brothers Inc. to provide for the financing of our acquisition

of ACMI. The credit agreement provides for advances totaling up to $310.0 million, consisting of a $60.0 million revolving

credit facility and a $250.0 million term loan facility. As of December 31, 2004, our original term loan balance of $250.0