Redbox 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

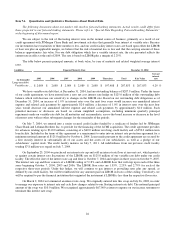

machines, we will continue to analyze and use cost effective ways to reach our growing potential customer base. Sales and

marketing as a percentage of revenue increased to 7.5% in 2003 from 6.9% in 2002.

Research and Development

Research and development expenses increased to $5.8 million in 2003 from $5.0 million in 2002. Research and

development expenses grew primarily as the result of an increase in staffing levels to support research and development to

design complementary new product ideas and continue our ongoing efforts to enhance our existing coin-counting network.

Research and development expenses as a percentage of revenue remained relatively the same at 3.3% and 3.2% for 2003 and

2002, respectively.

General and Administrative

General and administrative expenses increased to $19.3 million in 2003 from $19.1 million in 2002. General and

administrative expenses increased in areas such as professional services (including legal and accounting services), employee

benefits and corporate insurance policies. General and administrative expenses as a percentage of revenue decreased to

11.0% in 2003 from 12.2% in 2002.

Depreciation, Amortization and Other

Depreciation expense increased to $27.0 million in 2003 from $25.8 million in 2002. Depreciation expense increased

mainly due to losses recorded on the disposal of capital assets associated with upgrading the computers in our coin-counting

machines. Depreciation and other as a percentage of revenue decreased to 15.3% in 2003 from 16.6% in 2002. A greater

number of coin-counting machines became fully depreciated between December 31, 2002 and December 31, 2003 than were

newly installed in the same period.

Other Income and Expense

Interest income and other, net, decreased to $263,000 in 2003 from $309,000 in 2002. This decrease, primarily in

interest income, was attributed to both lower amounts of funds invested and lower interest rates earned on investments in the

year ended December 31, 2003 than in the prior year.

Interest expense decreased to $1.2 million in 2003 from $3.7 million in 2002. The decrease is due to a combination of a

decreased amount of outstanding debt and reduced interest rates in the year ended December 31, 2003 compared to the prior

year.

During 2002, we recorded a loss from early retirement of debt totaling $6.3 million related to premiums paid and the

write-off of deferred financing fees to retire our 13% senior subordinated discount notes prior to the October 2006 maturity

date.

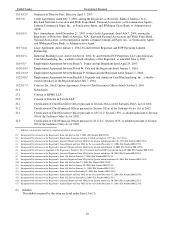

Income Taxes

Income tax expense was $11.6 million in 2003. During the fourth quarter of 2002, we recognized deferred tax assets in

accordance with SFAS No. 109 resulting in an income tax benefit $42.6 million. The deferred tax assets primarily represent

the income tax benefit of net operating losses we have incurred since inception. The related tax impact on diluted earnings

per share for 2003 was $(0.53) compared with $1.87 in 2002 resulting from the income tax benefit.

Liquidity and Capital Resources

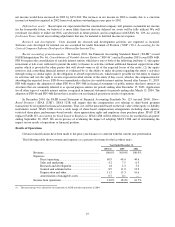

As of December 31, 2004, we had cash, cash equivalents and cash being processed totaling $156.8 million, which

consisted of cash and cash equivalents available to fund our operations of $94.6 million and cash being processed of $62.1

million. Cash being processed represents coin residing in our coin-counting or entertainment services machines or being

processed by third-party carriers, which we are mainly obligated to use to settle our accrued liabilities payable to our retailer

partners. Working capital was $105.0 million at December 31, 2004 compared with $26.3 million at December 31, 2003.

On December 20, 2004, we issued 3,450,000 shares of our common stock (including 450,000 shares issued upon the

exercise of the underwriters’ over-allotment option) at an offering price of $25.00 per share. The net proceeds from the

offering, net of offering costs and expenses were approximately $81.1 million.

Net cash provided by operating activities was $60.6 million for the year ended December 31, 2004, compared to net

cash provided by operating activities of $53.5 million for the year ended December 31, 2003. Cash provided by operating

activities increased primarily as the result of a net increase in non-cash transactions on our income statement of $9.3 million