Qantas 2016 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

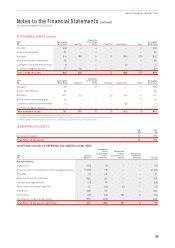

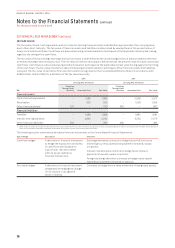

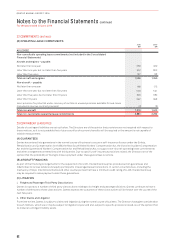

20 FINANCIAL RISK MANAGEMENT CONTINUED

i. Liquidity Risk

Nature of the Risk:

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities.

Liquidity Risk Management:

The Qantas Group manages liquidity risk by targeting a minimum liquidity level, ensuring long-term commitments are managed with

respect to forecast available cash inflows, maintaining access to a variety of additional funding sources, including commercial paper

and standby facilities and managing maturity profiles. Qantas may from time to time seek to purchase and retire outstanding debt

through cash purchases in open market transactions, privately negotiated transactions or otherwise. Any such repurchases would

depend on prevailing market conditions, liquidity requirements and possibly other factors.

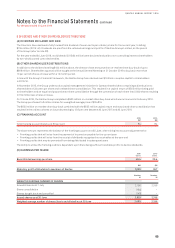

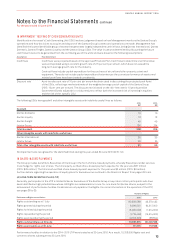

The following table summarises the contractual timing of cash flows, including estimated interest payments, of financial liabilities

and derivative instruments. The contractual amount assumes current interest rates and foreign exchange rates.

2016

$M

Less Than

1 Year 1 to 5 Years

More Than

5 Years Total

FINANCIAL LIABILITIES

Payables 1,986 – – 1,986

Bank loans – secured1367 1,444 560 2,371

Bank loans – unsecured19297 – 306

Other loans – unsecured1118 954 325 1,397

Lease and hire purchase liabilities1147 588 1,034 1,769

Derivatives – inflows (16) (46) (1) (63)

Derivatives – outflows 30 84 2116

Net other financial assets/liabilities – outflows (41) (26) –(67)

Total financial liabilities 2,600 3,295 1,920 7,815

1 Recognised financial liability maturity values are shown pre-hedging.

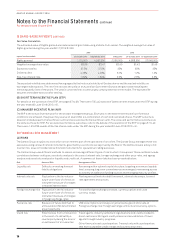

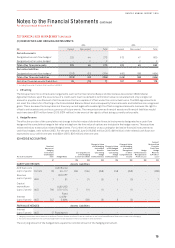

2015

$M

Less Than

1 Year 1 to 5 Years

More Than

5 Years Total

FINANCIAL LIABILITIES

Payables 1,881 – – 1,881

Bank loans – secured1383 1,481 885 2,749

Bank loans – unsecured111 313 –324

Other loans – unsecured1472 613 777 1,862

Lease and hire purchase liabilities1135 553 1,150 1,838

Derivatives – inflows (370) (58) (4) (432)

Derivatives – outflows 334 109 8451

Net other financial assets/liabilities – outflows (152) (22) –(174)

Total financial liabilities 2,694 2,989 2,816 8,499

1 Recognised financial liability maturity values are shown pre-hedging.

75

QANTAS ANNUAL REPORT 2016