Qantas 2016 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

For the year ended 30 June 2016

REMUNERATION REPORT (AUDITED) CONTINUED

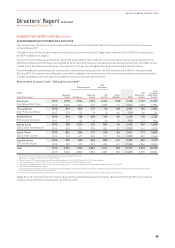

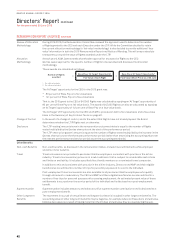

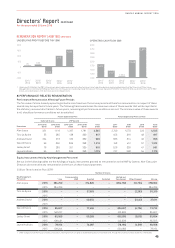

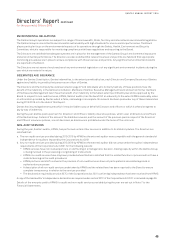

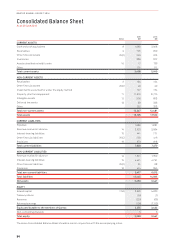

UNDERLYING PROFIT BEFORE TAX1 ($M)

-

1000

-500

0

500

1000

1500

2000

2011/

2012 2012/

2013 2013/

2014 2014/

2015

2015/

2016

95 186

(646)

975

1,532

OPERATING CASH FLOW ($M)

1

,000

1

,250

1,500

1

,750

2

,000

2

,250

2

,500

2

,750

3

,000

2011/

2012

2012/

2013

2013/

2014

2014/

2015

2015/

2016

1,810

1,417 1,069

2,048

2,819

1 Underlying Profit Before Tax (PBT) is the primary reporting measure used by the Qantas Group’s chief operating decision-making bodies, being the Chief Executive Officer, Group

Management Committee and the Board of Directors, for the purpose of assessing the performance of the Group. Statutory Profit After Tax for 2015/2016 was $1,029 million (2015: $560

million, 2014: ($2.8) billion, 2013: $2 million and 2012: ($244) million).

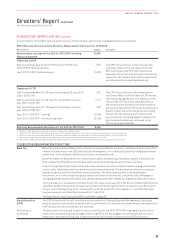

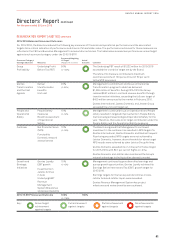

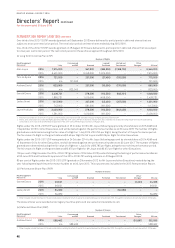

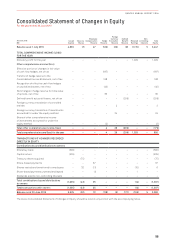

8) PERFORMANCE-RELATED REMUNERATION

Performance Remuneration Affecting Future Periods

The fair value of share-based payments granted is amortised over the service period and therefore remuneration in respect of these

awards may be reported in future years. The following table summarises the maximum value of these awards that will be reported in

the statutory remuneration tables in future years, assuming all performance conditions are met. The minimum value of these awards

is nil, should performance conditions not be satisfied.

Future Expense by Plan Future Expense by Financial Year

Deferred Shares LTIP Awards

Executives

2014/2015

$’000

2015/2016

$’000

2015–2017

$’000

2016–2018

$’000

Total

$’000

2017

$’000

2018

$’000

2019

$’000

Total

$’000

Alan Joyce 351 1,116 1,297 1,781 4,545 2,749 1,573 223 4,545

Tino La Spina 55 285 138 339 817 453 316 48 817

Andrew David 224 273 160 339 996 636 314 46 996

Gareth Evans 99 350 365 398 1,212 74 3 412 57 1,212

Lesley Grant 76 285 201 339 901 526 328 47 901

Jayne Hrdlicka 95 321 365 398 1,179 727 398 54 1,179

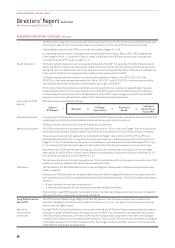

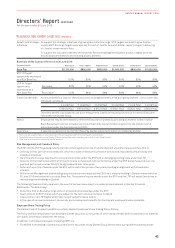

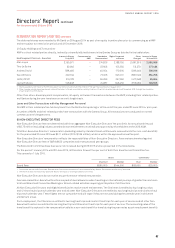

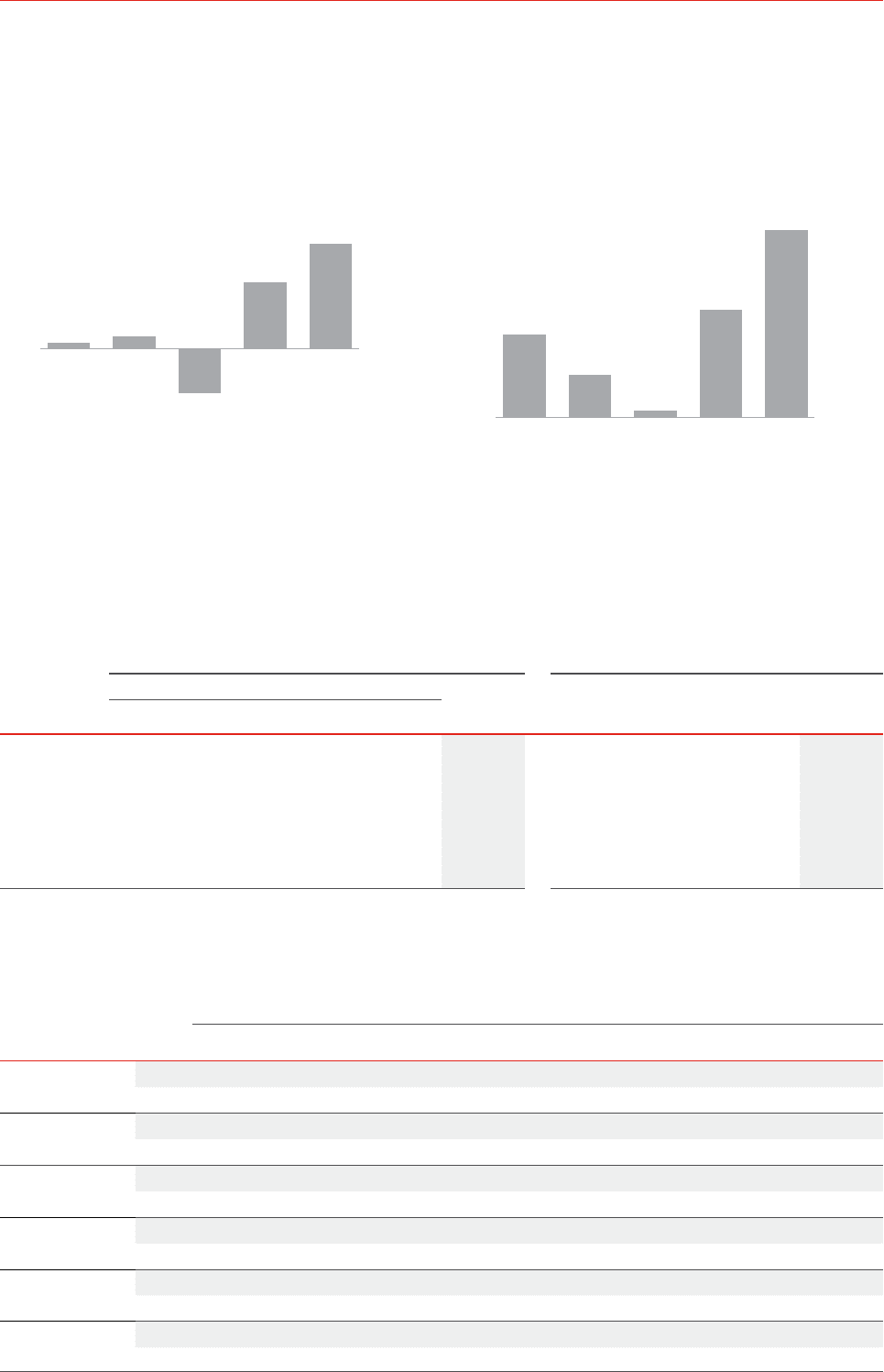

Equity Instruments Held by Key Management Personnel

Set out in the following tables are the holdings of equity instruments granted as remuneration to the KMP by Qantas. Non-Executive

Directors do not receive any remuneration in the form of share-based payments.

(i) Short Term Incentive Plan (STIP)

Number of Shares

Key Management

Personnel 1 July

Commenced as

KMP Granted Forfeited

Vested and

Transferred Other Changes130 June

Alan Joyce 2016 284,769 –274,826 –(284,769) (16,764) 258,062

2015 284,769 – – – – – 284,769

Tino La Spina 2016 – – 37,6 0 3 – – (2,293) 35,310

2015 –––––––

Andrew David 2016 – – 40,054 – – (2,443) 37,611

2015 –––––––

Gareth Evans 2016 85,607 –7 7,4 5 6 –(85,607) (4,724) 72,732

2015 148,227 – – – (62,620) –85,607

Lesley Grant 2016 65,505 –59,269 –(65,505) (3,615) 55,654

2015 108,431 – – – (42,926) –65,505

Jayne Hrdlicka 2016 78,16 4 –74,087 –(78,164) (4,519) 69,568

2015 128,244 – – – (50,080) –78,164

1 Other changes include the impact of share consolidation, relating to return of capital to shareholders paid on 6 November 2015, through the conversion of each share into 0.939 shares.

45

QANTAS ANNUAL REPORT 2016