Qantas 2016 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

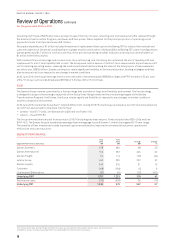

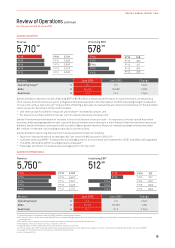

Review of Operations continued

For the year ended 30 June 2016

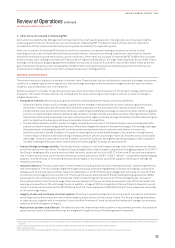

Qantas Freight reported an Underlying EBIT of $64 million, a $50 million decrease from the prior year in line with guidance provided

at the Group’s full year 2014/15 results. The performance reflected challenging global cargo markets, and more in keeping with

historical performance. Key drivers of the result included:

–Revenue performance reflecting flat demand against a six per cent global capacity increase

–Conclusion of favourable Australian air Express legacy agreements in 2014/15

–Continued cost reduction through Qantas Transformation

Qantas Freight retains a leading position in the Australian cargo market with Australia Post and Toll Group, Australia’s largest air

freight customers, under contract. With yields likely remaining under pressure, the segment is focused on delivering on strategic

objectives to ensure sustainable performance in the future:

–Integrated ground to air operations

–Continued cost reduction through Qantas Transformation

–Developing growth opportunities into China through tactical freight deployment to Zhengzhou and Chongqing

–Agile scheduling to adapt to changing markets – for example new freighter stop-off into Dallas

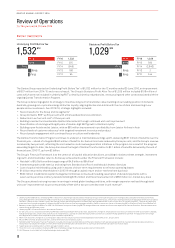

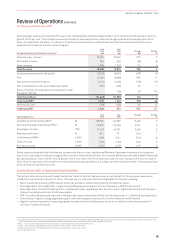

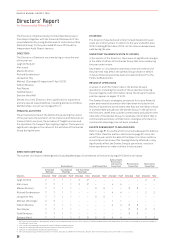

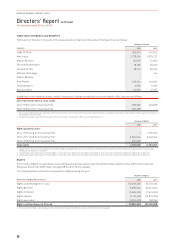

RECONCILIATION OF UNDERLYING PBT TO STATUTORY PROFIT BEFORE TAX

The Statutory Profit Before Tax of $1,424 million for the year ended 30 June 2016 is $635 million higher than the prior year.

Underlying PBT

Underlying PBT is the primary reporting measure used by the Qantas Group’s chief operating decision-making bodies, being the

Chief Executive Officer, Group Management Committee and the Board of Directors, for the purpose of assessing the performance

of the Group. The primary reporting measure of the Qantas International, Qantas Domestic, Jetstar Group, Qantas Loyalty and

Qantas Freight operating segments is Underlying EBIT. The primary reporting measure of the Corporate segment is Underlying PBT

as net finance costs are managed centrally. Underlying PBT is derived by adjusting Statutory Profit Before Tax for the impacts of

ineffectiveness and non-designated derivatives relating to other reporting periods and certain other items which are not included

inUnderlying PBT.

2016

$M

2015

$M

Statutory

Ineffectiveness

relating to

other reporting

periods

Other items

not included

in Underlying

PBT Underlying Statutory

Ineffectiveness

relating to

other reporting

periods

Other items

not included

in Underlying

PBT Underlying

Net passenger revenue 13,961 – – 13,961 13,604 – – 13,604

Net freight revenue 850 – – 850 936 – – 936

Other 1,389 – – 1,389 1,276 – – 1,276

Revenue and other income 16,200 – – 16,200 15,816 – – 15,816

Manpower and staff related 3,849 –(22) 3,827 3,604 –(13) 3,591

Fuel 3,250 (15) –3,235 3,937 (38) –3,899

Aircraft operating variable 3,362 –(5) 3,357 3,206 –(3) 3,203

Depreciation and

amortisation 1,224 – – 1,224 1,096 – – 1,096

Non-cancellable aircraft

operating lease rentals 461 – – 461 495 – – 495

Share of net (profit)/loss of

investments accounted for

under the equity method

–––– 40 –(11) 29

Other 2,411 –(66) 2,345 2,390 –(120) 2,270

Expenses 14,557 (15) (93) 14,449 14,768 (38) (147) 14,583

Earnings Before Interest

and Tax 1,643 15 93 1,751 1,048 38 147 1,233

Net finance costs (219) – – (219) (259) 1 – (258)

PBT 1,424 15 93 1,532 789 39 147 975

Underlying PBT is derived by adjusting Statutory Profit Before Tax for the impacts of:

i. Ineffectiveness and non-designated derivatives relating to other reporting periods

The difference between Statutory Profit Before Tax and Underlying PBT results from derivative mark-to-market movements being

recognised in the Consolidated Income Statement in a different period to the underlying exposure.

22

QANTAS ANNUAL REPORT 2016