Qantas 2016 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our Financial Framework*

Qantas’ Financial Framework

guides how we create value for our

shareholders. Our overarching goal

is to achieve maintainable earnings-

per-share growth through the cycle,

and in turn deliver total shareholder

returns in the top quartile of global

airlines and the ASX100.

The three core pillars of the

framework are consistent:

> Maintaining an optimal capital

structure that minimises the

Group’s cost of capital;

> Achieving return on invested

capital (ROIC) above 10 per cent

through the cycle; and

> Growing invested capital with

disciplined investment; returning

any surplus to shareholders.

Optimal Capital Structure

The Group maintained an optimal

capital structure throughout

2015/16, with net debt at year-end

of $5.6 billion within our target

range of $4.8 billion to $6 billion.

Credit metrics remain significantly

better than the investment-grade

metrics Qantas targets through the

cycle.

In addition to strong short-term

liquidity of $3 billion – including

cash of $2 billion – the Group’s

unencumbered asset base totals

over US$3.9 billion.

Improving Return on Invested

Capital (ROIC)

The Group’s ROIC of 23 per cent

was up from 16 per cent in 2014/15,

and well above our threshold of

ROIC above 10 per cent through

the cycle. All operating segments

continue to deliver ROIC above the

Group’s cost of capital. Efficient

allocation of capital, increased fleet

utilisation, and ongoing business

transformation all contributed to

achieving greater returns from the

Group’s existing assets.

Qantas Transformation

The Qantas Transformation

program has unlocked total

cost and revenue benefits of

$1.66 billion since 2013/14 –

including $557 million in 2015/16.

A further $450 million in benefits

will be realised in 2016/17, to reach

the Group’s increased target of $2.1

billion by 30 June 2017.

Disciplined Allocation of Capital

The Group used cash in excess of

short-term liquidity requirements

to refinance 29 maturing aircraft

leases, while funds from operations

were directed to debt repayments

($1.1 billion), net capital expenditure

($1 billion), and shareholder

distributions ($1 billion).

Shareholder Returns

The Group has returned more than

$1 billion to shareholders over the

past 12 months, through a $505

million capital return (completed in

November 2015) and $500 million

on-market share buy-back

(completed in June 2016). Combined,

these two capital management

initiatives reduced shares on issue

by 12.6 per cent.

Our strong result in 2015/16

means we can return a further

$500 million via a fully-franked

ordinary dividend of 7 cents per

share – totalling $134 million – and

an on-market share buy-back of up

to $366 million.

Where there is surplus capital in

future, the Group will first distribute

to shareholders via an ordinary

dividend, in conjunction with share

buy-backs, special dividends or

a capital return should additional

surplus exist.

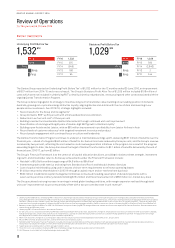

Target

Progress

Metric Timeframe

Accelerated

Transformation

benefits

$2.1b gross benefits

>10% Group ex-fuel

expenditure reduction

FY17 $1.66b benefits realised.

Ex-fuel expenditure reduced by 9%

5,000 FTE reduction FY17 4,605 FTE reduction

Deleverage

Balance Sheet

>$1b debt reduction FY15 Delivered on schedule

Debt / EBITDA <3.5x

FFO / net debt > 45% FY17 Delivered ahead of schedule

Cash Flow Sustainable positive

free cash flow FY15 onwards Delivered on schedule

Fleet

Simplification Eleven fleet types to seven FY16 Eight fleet types

Retaining 2 x non-reconfigured B747

Customer and

Brand

Customer Advocacy (NPS) Ongoing

NPS record achieved at Qantas

Domestic, Qantas International and

Qantas Loyalty

Maintain premium

on-time performance:

Qantas Domestic

Ongoing Premium on-time performance

maintained with increase to 89.7%

Qantas Transformation Scorecard

ACHIEVING OUR TARGETS

*Refer to the Review of Operations section in the Qantas Annual Report 2016 for definitions and explanations of non-statutory measures

OPTIMAL CAPITAL STRUCTURE

Surplus

Capital

No

Surplus

Capital

Increased

distributions,

grow invested

capital

Debt

reduction

focus

4.8 6.0

10% ROIC

ROIC (%)

Net Debt ($b)

03

QANTAS ANNUAL REPORT 2016