Qantas 2016 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

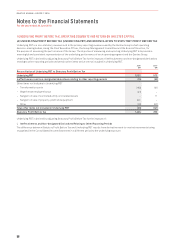

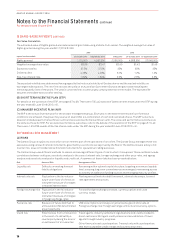

Notes to the Financial Statements continued

For the year ended 30 June 2016

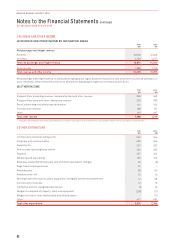

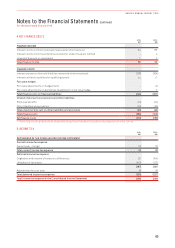

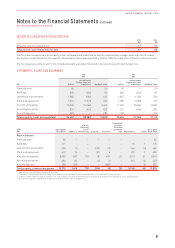

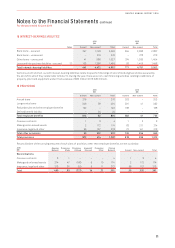

6 DIVIDENDS AND OTHER SHAREHOLDER DISTRIBUTIONS

(A) DIVIDENDS DECLARED AND PAID

The Directors have declared a fully franked final dividend of seven cents per ordinary share for the current year, totalling

$134million (2015: nil). Dividends are paid from the retained earnings and profits of Qantas Airways Limited, as the parent

oftheGroup (refer to note 28).

For the year ended 30 June 2016, no dividends (2015:$4 million) were declared and paid to non-controlling interest shareholders

bynon-wholly owned controlled entities.

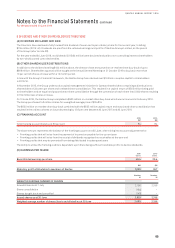

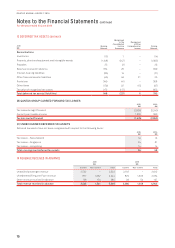

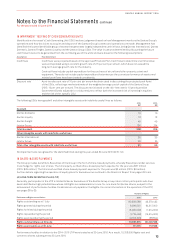

(B) OTHER SHAREHOLDER DISTRIBUTIONS

In addition to the dividend totalling $134 million above, the directors have announced an on-market share buy-back of up to

$366million. Shareholder approval will be sought at the Annual General Meeting on 21 October 2016 to buy back more than

10percent of shares on issue within a 12 month period.

In line with the Group’s Financial Framework, the Qantas Group has returned over $1 billion in surplus capital to shareholders

in2015/16.

In November 2015, the Group undertook a capital management initiative for Qantas shareholders comprising a distribution to

shareholders of 23 cents per share and a related share consolidation. This resulted in a capital return of $505 million being paid

toshareholders and an equal and proportionate share consolidation through the conversion of each share into 0.939 shares resulting

in134 million less shares on issue.

On 10 June 2016, the Qantas Group completed a $500 million on-market share buy-back which was announced in February 2016.

TheGroup purchased 143 million shares for a weighted average price of $3.4819.

The $500 million on-market share buy-back combined with the $505 million capital return and associated share consolidation has

resulted in the ordinary shares on issue decreasing by 12.6 per cent between 30 June 2015 and 30 June 2016.

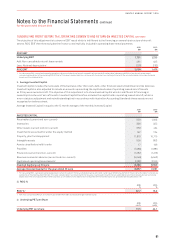

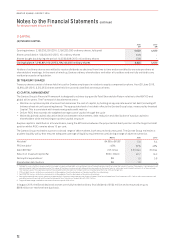

(C) FRANKING ACCOUNT

2016

$M

2015

$M

Total franking account balance at 30 per cent 84 84

The above amount represents the balance of the franking account as at 30 June, after taking into account adjustments for:

–Franking credits that will arise from the payment of income tax payable for the current year

–Franking credits that will arise from the receipt of dividends recognised as receivables at the year end

–Franking credits that may be prevented from being distributed in subsequent years

The ability to utilise the franking credits is dependent upon there being sufficient available profits to declare dividends.

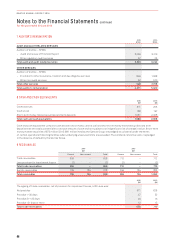

(D) EARNINGS PER SHARE

2016

Cents

2015

Cents

Basic/diluted earnings per share 49.4 25.4

$M $M

Statutory profit attributable to members of Qantas 1,029 557

Number

M

Number

M

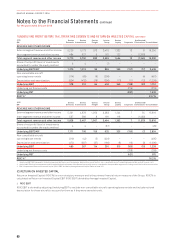

WEIGHTED AVERAGE NUMBER OF SHARES

Issued shares as at 1 July 2,196 2,196

Share consolidation (134) –

Shares bought back and cancelled (143) –

Issued shares as at 30 June 1,919 2,196

Weighted average number of shares (basic and diluted) as at 30 June 2,083 2,196

65

QANTAS ANNUAL REPORT 2016