Qantas 2016 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

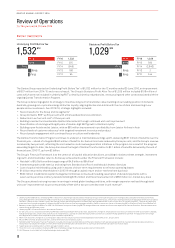

Qantas

Domestic

$578m

Underlying EBIT.

Up 20 per cent

Qantas

International

$512m

Underlying EBIT.

Up 92 per cent

Qantas

Loyalty

$346m

Underlying EBIT.

Up 10 per cent

Jetstar

Group

$452m

Underlying EBIT.

Up 97 per cent

QANTAS

FREIGHT

$64m

Underlying EBIT.

Down 44 per cent

Record underlying profit $1.53 billion

( 57%)

Statutory earnings

per share (EPS) 49.4 cents per share

( 24c)

Return on invested capital 23%

Operating cash flow $2.8 billion

Ex-fuel unit cost 3%

Net debt

$5.6 billion

(within target $4.8-$6b)

Our Performance* in 2015/16

This exceptional performance

reflects the strength of our Qantas

Group strategy, with record results

and increased margins for Qantas

Domestic, Qantas International, the

Jetstar Group and Qantas Loyalty,

and Group-wide return on invested

capital of 23 per cent.

Total underlying earnings before

interest and tax (EBIT) in the

domestic market – across both

Qantas and Jetstar – rose 30 per cent

to $820 million, and total underlying

EBIT from the Group’s international

operations was $722 million, up

107 per cent.

The result also reflects the

continued delivery of the Qantas

Transformation program, which

has now unlocked $1.66 billion in

cost and revenue benefits since

beginning in 2014.

The Group’s disciplined fuel

hedging – which helped secure a

$664 million benefit from lower

global fuel prices – was another

driver.

The Group’s financial position

was strengthened during the year,

with $2.8 billion in operating cash

flow used for capital expenditure,

shareholder distributions and debt

repayments, and excess cash used

for refinancing aircraft. Qantas’

strong balance sheet and more

sustainable outlook was recognised

by ratings agencies during the

financial year, with an investment

grade credit rating restored by

Standard & Poor’s and Moody’s

Investor services.

Group Performance

*Refer to the Review of Operations section in the Qantas Annual Report 2016 for definitions and explanations of non-statutory measures

02

QANTAS ANNUAL REPORT 2016