Qantas 2016 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

For the year ended 30 June 2016

REMUNERATION REPORT (AUDITED) CONTINUED

The deferred shares were awarded to Mr David on 28 August 2014 as part of an equity incentive plan prior to commencing as a KMP

and are subject to a restriction period until 31 December 2016.

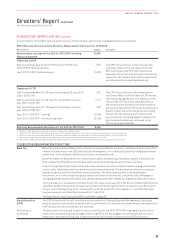

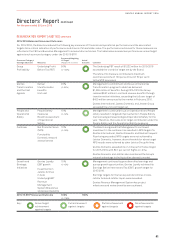

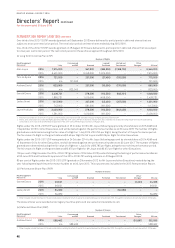

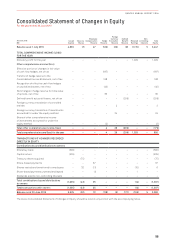

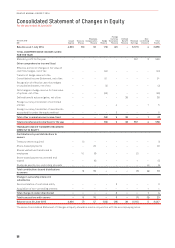

(v) Equity Holdings and Transactions

KMPs or their related parties directly, indirectly or beneficially held shares in the Qantas Group as detailed in the table below:

Key Management Personnel – Executives

Interest in Shares

1 July 2015

Commenced as

KMP

Awarded as

Remuneration1

Rights Converted

to Shares

Other

Changes2

Interest in Shares

30 June 2016

Alan Joyce 3,190,971 –274,826 2,188,750 (2 ,667,5 61) 2,986,986

Tino La Spina 30,992 –37,6 0 3 155,550 53,279 277,424

Andrew David 588,482 –40,054 170,000 (208,340) 590,196

Gareth Evans 202,749 –77,456 6 45,101 (660,540) 264,766

Lesley Grant 216,183 –59,269 257,550 (477,348) 55,654

Jayne Hrdlicka 196,948 –74,087 643,450 (813,930) 100,555

1 Shares awarded under the 2014/15 STIP are subject to a restriction period until the 2016/2017 full year financial results, in August 2017.

2 Other changes include shares purchased, sold and the impact of share consolidation, relating to return of capital to shareholders paid on 6 November 2015, through the conversion

of each share into 0.939 shares.

Other than share-based payment compensation, all equity instrument transactions between the KMP, including their related parties,

and Qantas during the year have been on an arm’s length basis.

Loans and Other Transactions with Key Management Personnel

No KMP or their related parties held any loans from the Qantas Group during or at the end of the year ended 30 June 2016 or prior year.

A number of KMPs and their related parties have transactions with the Qantas Group. All transactions are conducted on normal

commercial arm’s length terms.

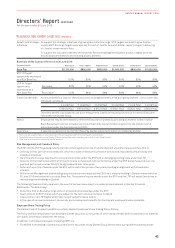

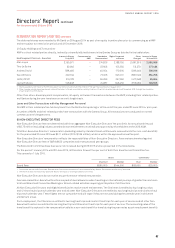

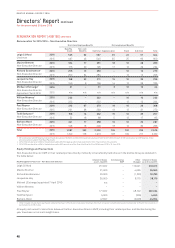

9) NON-EXECUTIVE DIRECTOR FEES

Non-Executive Director fees are determined within an aggregate Non-Executive Directors’ fee pool limit. An annual total fee pool

of $2.75 million (excluding industry standard travel entitlements received) was approved by shareholders at the 2013 AGM.

Total Non-Executive Directors’ remuneration (excluding industry standard travel entitlements received and other non-cash benefits)

for the year ended 30 June 2016 was $2.11 million (2015: $1.99 million), which is within the approved annual fee pool.

Non-Executive Directors’ remuneration reflects the responsibilities of Non-Executive Directors. Fees are benchmarked against

Non-Executive Director fees of S&P/ASX50 companies and revenue based peer groups.

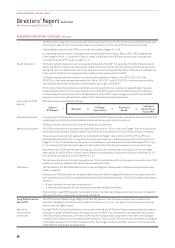

The Board and Committee base fees were not increased during 2015/2016 and are presented in the table below.

For the period 1 January 2014 until 30 June 2015, all Directors forwent five per cent of both their base fee and Committee fee.

This ceased on 1 July 2015.

Board Committees1

Chairman2Member Chair Member

Board Fees $560,000 $144,000 $58,000 $29,000

1 Committees are the Audit Committee, Remuneration Committee, Nominations Committee and Safety, Health, Environment and Security Committee.

2 The Chairman does not receive any additional fees for serving on or chairing any Board Committee.

Non-Executive Directors do not receive any performance-related remuneration.

Overseas-based Non-Executive Directors are paid a travel allowance when travelling on international journeys of greater than six hours

to attend Board and Committee Meetings or Board-related activities requiring participation of all Directors.

All Non-Executive Directors and eligible beneficiaries receive travel entitlements. The Chairman is entitled to four long haul trips

and 12 short haul trips each calendar year and all other Non-Executive Directors are entitled to two long haul trips and six short haul

trips each calendar year. These flights are not cumulative and will lapse if they are not used during the calendar year in which the

entitlement arises.

Post-employment, the Chairman is entitled to two long haul trips and six short haul trips for each year of service and all other Non-

Executive Directors are entitled to one long haul trip and three short haul trips for each year of service. The accounting value of the

travel benefit is captured in the remuneration table (as a non-cash benefit for travel during the year and as a post-employment

benefit).

47

QANTAS ANNUAL REPORT 2016