Qantas 2016 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

Segment Performance Measure Basis of Preparation

Share of net profit/

(loss) of investments

accounted for under the

equity method

Share of net profit/(loss) of investments accounted for under the equity method is reported by the

operating segment which is accountable for the management of the investment. The share of net

profit/(loss) of investments accounted for under the equity method for Qantas Airlines’ investments has

been equally shared between Qantas Domestic and Qantas International.

Underlying EBITDAR The significant expenses impacting Underlying EBITDAR are as follows:

–Manpower and staff related costs are reported by the operating segment that utilises the manpower.

Where manpower supports both Qantas Domestic and Qantas International, costs are reported by

using an appropriate allocation methodology

–Fuel expenditure is reported by the segment that consumes the fuel in its operations

–Aircraft operating variable costs are reported by the segment that incurs these costs

–All other expenditure is reported by the operating segment to which they are directly attributable or, in

the case of Qantas Airlines, between Qantas Domestic and Qantas International using an appropriate

allocation methodology

To apply this accounting policy, where necessary, expenditure is recharged between operating segments

as a cost recovery.

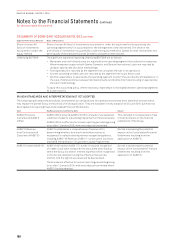

(R) NEW STANDARDS AND INTERPRETATIONS NOT YET ADOPTED

The following table details the standards, amendments to standards and interpretations that have been identified as those which

may impact the Qantas Group in the period of initial application. They are available for early adoption at 30 June 2016, but have not

been applied in preparing these Consolidated Financial Statements.

Topic Key Requirements and Effective Date Impact

AASB 9

Financial

Instruments

(AASB 9

(2014))

AASB 9 (2014) amends AASB 9 (2013) to include a new expected

credit loss model for calculating impairment on financial assets.

AASB 9 (2014) is effective for annual reporting periods beginning

on or after 1 January 2018, with early adoption permitted.

This standard is not expected to have

a material impact on the financial

statements of the Group.

AASB 15

Revenue

from Contracts with

Customers

(AASB 15)

AA

SB 15 establishes a comprehensive framework for

determining whether, how much and when revenue is

recognised. It replaces existing revenue recognition guidance,

including AASB 118

Revenue

, A ASB 111

Construction Contracts

and AASB Interpretation 13

Customer Loyalty Programmes

.

Qantas is assessing the potential

impact on the Consolidated Financial

Statements resulting from the

application of AASB 15.

A

ASB 16

Leases

(A ASB 16)

AASB 16 will replace AASB 117

Leases

. It requires recognition

of a right of use asset along with the associated lease liability

where the Group is a lessee. Interest expense will be recognised

in the income statement using the effective interest rate

method, and the right of use asset will be depreciated.

The standard is effective for annual reporting periods beginning

on or after 1 January 2019, with early adoption permitted where

AASB 15 is also adopted.

Qantas is assessing the potential

impact on the Consolidated Financial

Statements resulting from the

application of AASB 16.

29 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES CONTINUED

100

QANTAS ANNUAL REPORT 2016