Qantas 2016 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

For the year ended 30 June 2016

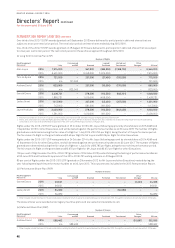

The current performance measures have also resulted in appropriate remuneration outcomes over recent

years with vesting levels strongly aligned with the Qantas Group’s financial performance.

Performance

Conditions

The performance measures for each of the 2014–2016 LTIP (tested at 30 June 2016), 2015–2017 LTIP (to be

tested as at 30 June 2017) and 2016–2018 LTIP (to be tested as at 30 June 2018) are:

–The relative TSR of Qantas compared to companies with ordinary shares included in the ASX100

–The relative TSR of Qantas compared to Global Listed Airlines

These Rights will only vest in full if Qantas’ TSR performance ranks at or above the 75th percentile compared

to both the ASX100 and the Global Listed Airlines peer groups. At the end of the performance period, the

TSR performance of Qantas and each comparator company will be determined based on the average closing

shares price over the final six months of the performance period.

Qantas’ Financial Framework also targets top quartile TSR performance relative to ASX100 companies and

global airline peers and therefore relative TSR performance against these peer groups has been chosen

as the performance measures for the LTIP. The peer groups selected provide a comparison of relative

shareholder returns relevant to most Qantas investors:

–The ASX100 peer group was chosen for relevance to investors with a primary interest in the equity market

for major Australian listed companies, of which Qantas is one

–The Global Listed Airlines peer group was chosen for relevance to investors, including investors based

outside Australia, whose focus is on the aviation industry sector and measuring returns from listed

companies impacted by comparable external factors

The vesting scale for each measure is:

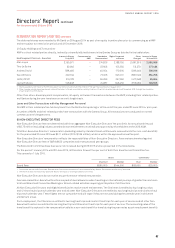

Companies with Ordinary Shares included in the ASX100

Up to one-half of the total number of Rights granted may vest based on the relative TSR performance of

Qantas in comparison to the ASX100 as follows:

Qantas TSR Performance compared to the ASX100 Vesting Scale

Below 50th percentile Nil vesting

Between 50th and 75th percentile Linear scale: 50% to 99% vesting

At or above 75th percentile 100% vesting

Global Listed Airlines Peer Group

Up to one-half of the total number of Rights granted may vest based on the relative TSR performance of

Qantas in comparison to the Global Listed Airlines peer group selected by the Board as follows:

Qantas TSR Performance compared to the Global Listed Airlines Peer Group Vesting Scale

Below 50th percentile Nil vesting

Between 50th and 75th percentile Linear scale: 50% to 99% vesting

At or above 75th percentile 100% vesting

The Global Listed Airlines peer group has been selected with regard to its representation of Qantas’ key

markets, full-service and value-based airlines and the level of government involvement. For the 2014–2016

LTIP and 2015–2017 LTIP, the Global Listed Airlines peer group includes: Air Asia, Air France/KLM, Air New

Zealand, All Nippon Airways, International Airlines Group, Cathay Pacific, Delta Airlines, easyJet, Japan

Airlines, LATAM Airlines Group, Lufthansa, Ryanair, Singapore Airlines, Southwest Airlines, Tiger Airways

and Virgin Australia. The 2016–2018 LTIP also includes American Airlines and United Continental.

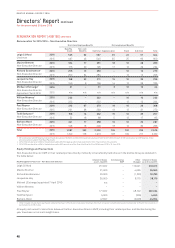

Cessation of

Employment

In general, any Rights which have not vested will be forfeited if the relevant Executive ceases employment

with the Qantas Group.

In limited circumstances approved by the Board (for example, retirement, employer-initiated terminations

(with no record of poor performance), death or total and permanent disablement), a deferred cash payment

may be made at the end of the performance period. This payment is determined with regard to the value of

the LTIP Rights which would have vested had they not lapsed, and:

–The portion of the performance period that the Executive served prior to termination

–The actual level of vesting that is ultimately achieved at the end of the performance period

The Board retains discretion to determine otherwise in appropriate circumstances, which may include

retaining some or all of the LTIP Rights.

REMUNERATION REPORT (AUDITED) CONTINUED

39

QANTAS ANNUAL REPORT 2016