Qantas 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

Directors’ Report continued

FOR THE YEAR ENDED 30 JUNE 2013

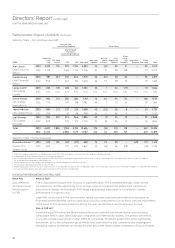

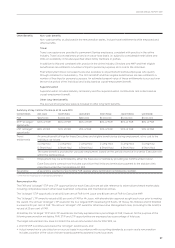

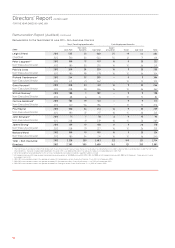

Additional Information – Share-based Payments

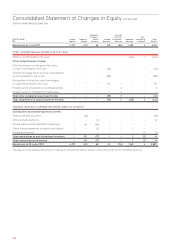

The following table provides a more detailed breakdown of the statutory accounting expense of share-based payments

to disclosed Executives.

$000

STIP LTIP

Total

Cash-settled

Share-based

Payment

Equity-settled

Share-based

Payment

Equity-settled

Share-based

Payment

Alan Joyce

Chief Executive Ofcer

2013 – 375 1,794 2,169

2012 1,201 962 1,134 3,297

Gareth Evans

Chief Financial Ofcer

2013 202 133 366 701

2012 358 185 194 737

Lesley Grant

CEO Qantas Loyalty

2013 139 89 162 390

2012 n/a n/a n/a n/a

Simon Hickey

CEO Qantas International

2013 159 125 280 564

2012 349 225 138 712

Jayne Hrdlicka

CEO Jetstar Group

2013 162 75 224 461

2012 115 26 48 189

Lyell Strambi

CEO Qantas Domestic

2013 193 130 366 689

2012 319 260 215 794

Total 2013 855 927 3,192 4,974

2012 2,342 1,658 1,729 5,729

Former Executive

Bruce Buchanan 2013 146 121 (217) 50

Former CEO Jetstar Group 2012 330 241 202 773

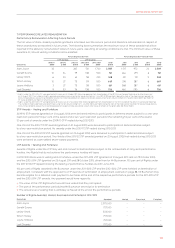

Additional Information – Methodology Used for the Remuneration Outcomes Table (Non-statutory)

Base pay (cash FAR) and other remuneration in the Remuneration Outcomes tables on pages 78 and 81 are the same as those

reported in the statutory remuneration tables on pages 79 and 82.

The STIP amount shown in the Remuneration Outcomes tables is the full value of the STIP awarded for the corresponding year

calculated as a product of FAR, At Target Opportunity, STIP Scorecard Result and Individual Performance Factor (rather than

amortising the accounting value over the relevant performance and service period as per the accounting standards).

The LTIP amount shown in the Remuneration Outcomes tables is equal to the number of Rights vested during the year multiplied

by the fair value of the Right at grant date (rather than amortising the accounting value over the relevant performance and service

period as per the accounting standards).

Risk Management

The STIP and the LTIP have design elements that protect against the risk of unintended and unjustied pay outcomes, that is:

»Diversity in their performance measures, which as a suite of measures cannot be directly and imprudently inuenced by one

individual employee

»Clear maxima dened for scorecard outcomes under the STIP and a challenging vesting scale under the LTIP

»Diversity in the timeframes in which performance is measured, with performance under the STIP being measured over one year

and performance under the LTIP being measured over three years

»Deferral of a portion of awards under the STIP with a restriction period of up to two years. This creates an alignment with

shareholder interests and also provides a claw-back mechanism, in that the Board may forfeit restricted STIP awards if they were

later found to have been awarded as a result of material nancial misstatement

While formal management shareholding requirements are not imposed, the CEO has a material holding in Qantas shares, currently

valued at more than one and a half times FAR. The potential equity awards under the STIP and the LTIP will assist Executives in

maintaining shareholdings in Qantas.

Remuneration Report (Audited)

c

ontinue

d